I have often written about how the developing world is leap-frogging the developed world. The reason is that the developing world had no infrastructure in place whilst the developed world implemented their infrastructure in the last century. The developed world has become a legacy world. The developing world is a world fit for today.

First thing I should qualify is what I mean by ‘the developing world’. I don’t mean what most economists talk about. I mean countries that at the end of the last century were emerging economies. Those economies were the BRICs, as Goldman Sachs called it. Brazil, Russia, India and China.

Twenty years ago the term ‘BRICs’ was coined by Jim O’Neill at Goldman Sachs, in a paper titled: “Building Better Global Economic BRICs”. Since then, China and India have both transformed into major leading global economies. They are no longer developing but have developed and leap frogged. I wrote about this back in 2006:

In the case of China, I’ve written loads about the impact of Tencent and Alibaba on payments and finance, and continue to do so. Maybe I was more predictive than I imagined when I wrote in 2006:

"China will be teaching us how to deploy bank infrastructures ten years from now"

And see a headline: ICBC, Alibaba and Ant Financial strengthen fintech partnership

We can learn a lot from them.

In the case of India, I wrote back in 2006:

“One of the biggest impacts India will have on world banking will not stem from today's domestic challenges, but from its ability to adapt and develop new services tomorrow.”

And the transformation since 2006 in the country has been a phenomenon. It started with the Aadhaar digital identity program which led to the Unified Payment Interface (UPI) as part of IndiaStack which now leads to IndiaChain, a distributed identity ledger project.

Again, we can learn a lot from them.

Part of the reason why these thoughts come back to me now is because we are not learning a lot from them. We languish in legacy infrastructures and the chains of last century systems in Europe and America, because a refresh is too costly and too difficult. Like banks changing core systems, we are stuck in our own 21st century Catch 22: refresh core country infrastructures at high risk or maintain old infrastructures at high cost. It’s a lose-lose situation.

Nevertheless, a report caught my attention the other day. Written by the Bank for International Settlements (BIS, the guys who do Basel’s), it highlights the massive transformation in India thanks to the IndiaStack:

The design of digital financial infrastructure: lessons from India

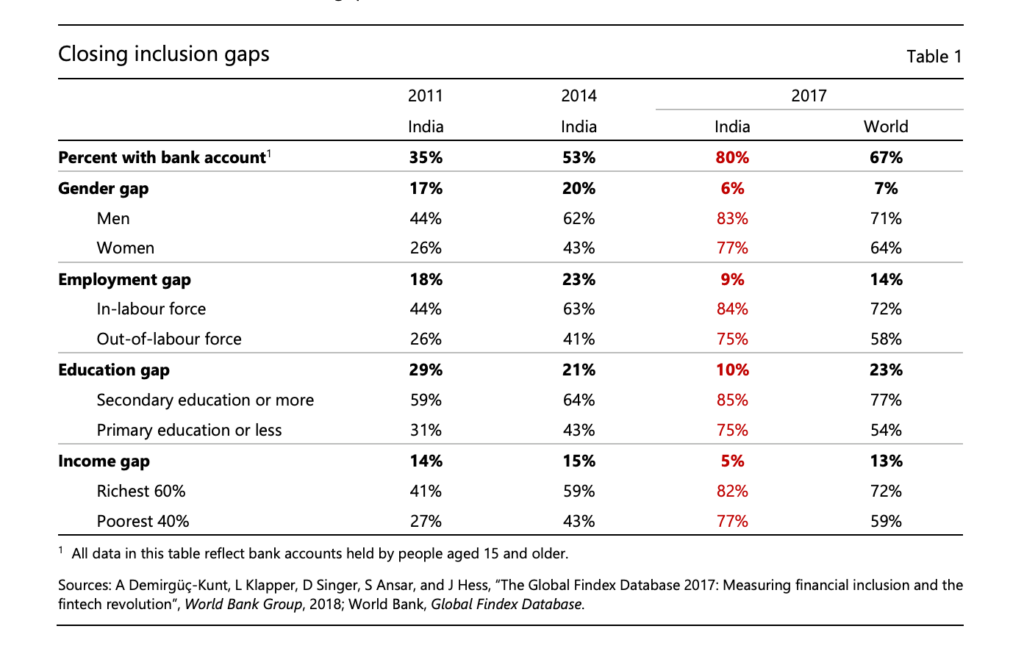

The paper shows a remarkable change in financial inclusion in just a half a decade. In 2011, two thirds of Indian citizens were unbanked; by 2017, only a fifth were. Putting it better, India went from 35% banked to 80% in just six years.

This is due, according to the BIS paper’s author Siddharth Tiwari, to the “visionary” action of the Indian government. The Financial Times writes a decent summation of the report and is well worth a read.

In my own case, I am conflicted when writing about India these days. Whilst UPI, Aadhaar and IndiaStack may be a success, I see regular commentary about it being used to track and trace citizens, act as a Big Brother and being unsafe due to regular hacks. Maybe IndiaChain will solve the hacking issues a bit but, even so, the introduction of facial recognition is possibly unnerving for many, as is the case in China. In other words, it is for the State to track and trace citizens and wipe out any behaviours that don't support government programmes.

NRC is needed so that fascists can selectively exclude Indian citizens with Aadhar/PAN/passports/voter cards and then call them illegal infiltrators before stripping them of rights, robbing, jailing & doing worse to them.

Sanghis have always admired the Nazis. https://t.co/Bdcvc6T9O2— Geet V (@geetv79) December 16, 2019

Nevertheless, both China and India are technologically leap-frogging in financial services and in state monitoring. A positive and negative story but, either way, Europe and America can learn a lot from the developments in these countries. We need to watch them and learn.

And that’s exactly what some are doing, such as Google. Google have grown to be one of the most successful payments firms in India and, in a letter written by Mark Isakowitz, the company said it worked closely with the National Payments Corporation of India (NPCI) and the Reserve Bank of India (RBI) to build 'Google Pay' for the Indian market. The letter was sent to the US Federal Reserve Financial Services Committee on November 9, 2019, and states:

“The approach in India attained amazing results for banks, consumers, other players within the payment ecosystem and India’s central bank. Adoption of the system was rapid, growing from 100,000 monthly transactions, to 77 million, to 480 million, to 1.15 billion monthly transactions in the first four years. After just three years, the annual run rate of transactions flowing through UPI is about 10 percent of India’s GDP, including 800 million transactions valued at approximately $19 billion.”

The letter further added that:

“UPI was thoughtfully planned and critical aspects of its design led to its success. First, UPI is an interbank transfer system (there are now over 140 member banks, after initially launching with 9 participating banks). Second, it is a real time system. Third, it is ‘open’ – meaning technology companies can build applications that help users directly manage transfers into and out of their accounts held at banks.”

I guess we are learning something from India and China. In fact, maybe we should change our terminology and call these economies the developed ones and call Europe and America the legacy world.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...