Just before Christmas I heard of a new European payments initiative called PEPSI, short for Pan European Payment System Initiative. Nice acronym although I prefer Coca-Cola, the Co-ordinated Car Co-operative Association. Or something like that.

Anyways, whichever Cola you prefer, this new initiative is interesting. Backed by over twenty mainly French and German banks, the aim is to create a network to rival Visa and MasterCard, as well as the potential threat of Big Tech giants like Amazon.

Rather than me waffle on about it, I thought it easier to share the full text of the speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the Joint Conference of the ECB and the National Bank of Belgium from the end of November 2019.

---------------------------------------------------------------------------------------------------------------

Towards the retail payments of tomorrow: a European strategy

Brussels, 26 November 2019

Europe has made important progress towards a true banking union in recent years. We now have a single banking supervisor for significant institutions, a single framework for resolving failing institutions, a single fund to finance those resolution activities, and we will soon have a single backstop for that fund. There are also renewed hopes that political negotiations could soon begin on a European deposit insurance scheme.

The European Commission has also launched an ambitious agenda for creating a capital markets union. Although the pace at which co-legislators, and Member States in particular, have progressed on individual Commission initiatives has often been sluggish, the recent establishment of a high-level expert group might help overcome the remaining impediments and reinforce efforts to make European capital markets deeper and more liquid.[1]

Step by step, we are improving our financial structures to support a single market of half a billion consumers, underpin the stability of our single currency and channel savings towards financing sustainable growth.

One area that has received less attention from policymakers in recent years, however, is the European retail payments market, in particular point-of-sale and online payments. It is true that a lot has been achieved at the back-end of European retail payments systems, most notably under the umbrella of the Single Euro Payments Area, or SEPA. SEPA allows payments to be processed across borders at the same cost, and as efficiently and safely, as national payments.

More recently, the Eurosystem has also introduced TARGET Instant Payment Settlement, or TIPS. This service, which was launched a year ago, enables payment service providers to transfer funds to their customers in real time, around the clock, every single day of the year. And it settles the payments in central bank money.

But progress at the back-end has not translated into similar progress at the front-end, which remains fragmented, with no European solution emerging for point-of-sale and online payments.

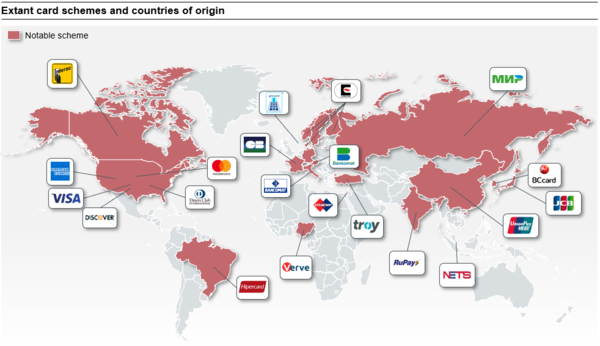

National providers in particular have not been able, or willing, to act in a pan-European manner. 20 years after the introduction of the single currency, we still do not have a European card scheme. Ten European countries currently have national card schemes that do not accept cards from other EU countries.

This has led to a notable rise in the use of non-European cards for non-cash payments. At the end of 2016, the share of transactions made with international card schemes was a little more than two-thirds. It is unfortunate that past harmonisation initiatives have failed to explore the significant economies of scale that the Single Market offers.

In addition, the current situation has attracted new initiatives that aim to overcome shortcomings in cross-border retail payments by building a new separate payments ecosystem.

These initiatives highlight the rapidly rising consumer demand for payment services that work across borders and that are also faster, cheaper and easier to use. Among younger people in particular, there is a willingness and curiosity to use new technologies and try new providers.

Relying exclusively on non-European and new ecosystems presents two risks, however.

The first relates to the untested nature of some initiatives. Global stablecoin arrangements, for example, raise potential risks across a broad range of policy domains, such as legal certainty, investor protection, financial stability and compliance with anti-money laundering requirements. Public authorities have made clear that the bar will be set very high for these stablecoin initiatives to be allowed to operate.[2]

The second risk relates to the autonomy and resilience of European payments systems.

Dependence on non-European global players creates a risk that the European payments market will not be fit to support our Single Market and single currency, making it more susceptible to external disruption such as cyber threats, and that service providers with global market power will not necessarily act in the best interest of European stakeholders.

Strategic autonomy in payments is part and parcel of the European agenda to assert the euro’s international role.[3] The rising challenges to our global governance system have contributed to the belief that the EU may be more exposed to the risk that the monetary power of others is not used in its best interests, or is even used against it.[4]

The Eurosystem’s retail payments strategy: a pan-European vision

The only effective response to these risks is for European stakeholders to step up their collaboration and act together to provide payment solutions that both reflect the demands of consumers and strengthen the Single Market.

With this in mind, earlier this month the ECB’s Governing Council decided to relaunch its retail payments strategy. The aim of our strategy is to inter alia actively foster pan-European market initiatives for retail payments at the location of the purchase or interaction – so-called point-of-interaction, or POI, payments.

In the view of the Governing Council, these market initiatives would have to fulfil five key objectives.

- Pan-European reach and customer experience

Customers should be able to make POI payments throughout the entire European Union just as efficiently and safely as in their home country. To this end, pan-European reach with wide merchant acceptance and a sound and efficient governance (see below) is needed to achieve critical mass, which is necessary for a network industry, and to fully exploit the benefits of the Single Market. Scale will drive consumer adoption and trust, which is pivotal in e-commerce.

- Convenient and cost-efficient

A European retail payments solution will only be accepted if it fully addresses user needs and demands. So the solution needs to enable an easy, flexible, secure and user-friendly payment experience for both consumers and merchants. This requires that payments can be performed using different tools and instruments, such as payment cards, mobile phones, wearables and instant payments, as well through other channels and technologies, such as near-field communication.

Relying on previously unavailable instant payments technology could be the key to designing a solution that is more efficient than existing ones. Subsequent cost savings for merchants will eventually lower consumer prices and benefit every citizen.

- Safety and security

A new European payments solution must comply with all relevant legal and regulatory requirements. It should provide the highest levels of fraud prevention and offer consumer protection with robust complaint and refund procedures.[5]

- European identity and governance

A common brand and logo should be adopted to foster European identity. A European governance structure could enable European payment stakeholders to have a direct influence on the strategic direction and business models. These stakeholders should be incentivised to design a payment solution under their governance that meets the needs of European customers.

- Global acceptance

To fully meet the needs of end users, a new European solution should also be accessible to merchants based outside the EU, which will reinforce economies of scale and domestic adoption. Global acceptance should therefore be a long-term goal.

The need for a pan-European market-led solution

These five key objectives form the heart of the Eurosystem’s retail payments strategy. They provide a conceptual vision that should be fleshed out by the private sector.

The Eurosystem therefore welcomes the strategic initiative of a number of major European banks to create a true pan-European retail payment solution that has the potential to meet the vision of our strategy. The proposed solution would be based on the SEPA credit transfer instant (SCT Inst) scheme, which is in our view the correct approach as it is future-oriented. And it could capitalise from day one on existing powerful and sophisticated infrastructures, such as the Eurosystem’s TIPS.

What is now needed, however, is a strong commitment from the proponents of the new initiative, and a clear roadmap to meet the envisaged objectives, so that we can see tangible actions emerge soon. Proponents should also work closely with the European Commission to ensure that any project will be open and comply with EU competition rules. This also means that if and when other initiatives emerge, they will of course be considered equally.

Public initiatives may be useful and needed from time to time to support industry-led solutions. The European Commission, for example, could propose legislation obliging payment service providers to adopt instant payments within a certain period if a critical mass has not been reached by, say, the end of 2020. Other regulatory changes may be needed in due course.

For its part, the Eurosystem stands ready to provide additional technical assistance where useful and required. For example, we will analyse how we could support the search for solutions that ensure that SCT Inst-compliant clearing mechanisms can be fully integrated. Current private solutions for the clearing of instant payments still have not addressed interoperability issues in a satisfactory manner. This requires further analysis and action.

The ECB will also continue to monitor how new technologies change payment behaviour in the euro area, for example through a reduced demand for cash. We will explore how, and to which extent, central banks would need to adapt their policies and instruments to face challenges to consumer protection and monetary policy transmission that could arise from such changes.

For example, a central bank digital currency could ensure that citizens remain able to use central bank money even if cash is eventually no longer used. A digital currency of this sort could take a variety of forms, the benefits and costs of which the ECB and other central banks are currently investigating, being mindful of their broader consequences on financial intermediation.

But potential central bank initiatives should not discourage or crowd out private market-led solutions for fast and efficient retail payments in the euro area.

Conclusion

Let me conclude.

Global payments markets are undergoing a transformation. Rapid technological progress, regulatory reforms and rising cross-industry initiatives, in particular by large global digital firms, have led to unprecedented dynamics and are putting established banks and payment service providers under considerable pressure.

In this environment, there are clear signs that Europe is at risk of losing its economic edge. Country-specific solutions lack the necessary size and scale, and national fragmentation has paralysed competition and stifled innovation on the pan-European level. In the worst case scenario, this may endanger the autonomy of European payment systems.

The vision of an industry-led, pan-European retail payment solution is therefore at the heart of the Eurosystem’s retail payment strategy that I have outlined this morning. A pan-European strategy that facilitates instant, secure and inexpensive payments – both online and in brick and mortar stores – has the potential to make up lost ground and meet the rising needs of consumers for efficient cross-border payments. Better affordability, quality and choice will also promote financial inclusion.

The Eurosystem therefore welcomes the recent initiative of European banks to join forces and envisage a payment solution for the euro area as a whole.

Thank you.

[1]See also Cœuré, B. (2019), “European capital markets: priorities and challenges”, dinner remarks at the International Swaps and Derivatives Association, Frankfurt am Main, 25 June.

[2]See G7 Working Group on Stablecoins (2019), Investigating the impact of global stablecoins, October.

[3]See Juncker, J.C. (2018), “The Hour of European Sovereignty”, State of the Union Address 2018; European Commission (2018), “Towards a stronger international role of the euro”, European Commission contribution to the European Council and the Euro Summit, 5 December; and European Council (2018), “Statement of the Euro Summit”, 14 December.

[4]See Cœuré, B. (2019), “The euro’s global role in a changing world: a monetary policy perspective”, speech at the Council on Foreign Relations, New York City, 15 February.

[5]In line with strong customer authentication (SCA) under the revised Payment Services Directive (PSD2).

---------------------------------------------------------------------------------------------------------------

It’s fascinating to see yet another attempt within Europe to create an alternative payments scheme. Ten years ago, 24 European banks collaborated in a consortium called Monnet to create an alternative payments scheme for Europe. There was also the Euro Alliance of Payment Schemes (Eaps) and PayFair. These did not succeed and the large card schemes insist that increased competition in payment services would be a costly waste of time.

So far, so true, although there are many schemes out there.

The two largest are in India and China. India has RuPay and China has Union Pay.

Described as Alternative Payment Methods, or APMs, there are many such schemes emerging around the world to try to avoid the foreign exchange and transaction costs of the major card processors. Having said that, the major card processors believe their breadth and depth of coverage globally makes it uneconomic for any local processor to compete with them.

It will therefore be interesting to see how the PEPSI project plays out, bearing in mind that Europe has tried several times in the past to create an alternative card scheme that covers the region … and failed. That is not just because of the lack of a co-ordinated and co-operative approach (the Coca-Cola way), but because there are domestic card schemes around Europe that don’t want a Pan-European replacement.

For example, there may be French banks behind PEPSI but they are also behind Cartes Bancaires, a major domestic scheme co-branded with Visa and MasterCard. This conflicted approach is why Europe has failed to create an alternative to Visa and MasterCard in the past.

Will they succeed this time?

I have my doubts, but then my country voted to leave all these guys to do their own thing so you never know.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...