I recently posted a whine about HSBC charging 40 percent on overdrafts:

The fact I wrote this about HSBC gave the impression it was they who were the target. They are, but so are any banks who treat customers unfairly and the blog was meant to be more about the fact that banks punish the weakest and support the strongest.

I hate free banking.

Free banking is actually subsidised banking where those who can afford to stay in credit get it for nothing, whilst those who struggle with money pay their fees.

It’s something I write about quite often, and now am similarly surprised and incensed again. This is because almost every British bank has come out and said they will charge 39.9 percent interest on overdrafts.

This fee rate was initially announced by the Nationwide Building Society. HSBC followed, and then so did Santander and Lloyds … and Monzo. What’s going on?

Well, what’s going on is that the UK regulator told the UK banks that their overdraft rates were confusing and unfair. Customers could get punished for going overdrawn for a day with daily fees and punitive interest rates that they don’t understand. As a result, the regulator said: you guys need to make overdrafts simple.

That’s not actually what they said. They said:

The FCA “is introducing reforms to fix a dysfunctional overdraft market. These changes will make overdrafts simpler, fairer, and easier to manage and will protect the millions of consumers that use overdrafts, particularly more vulnerable consumers.”

That was back in June 2019. From April therefore, all banks must have better overdraft structures and focus upon supporting the most financially vulnerable. That was the plan anyway. The reality is that the banks have interpreted this as a method of introducing a simple flat fee for all customers who go minus £1 in balance.

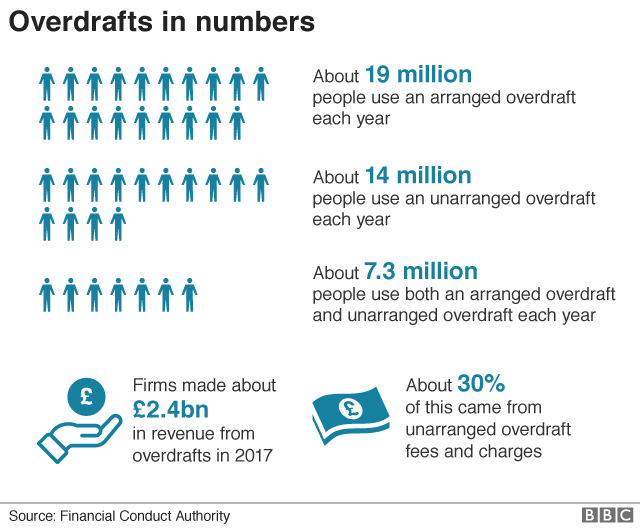

Now, I’m not against charging customers for borrowing from the bank. But what I am against is having customers who are the financially weakest subsidising customers who are the financially strongest. For all those who enjoy free banking, millions of other customers who cannot afford to pay are being charged billions by the banks for the pleasure of not being able to pay.

This is where the heart of the issue lies and the only way to get rid of this is to start charging for banking. However, no bank will charge for banking unless forced to by the regulator. That’s the likely long-term outcome of all of this.

Anyways, the Financial Conduct Authority (FCA), the UK regulator, has now asked the banks how come they’ve all determined that 39.9 percent is the right rate to charge. Where’s the competition here? How come one bank didn’t say it would be 29.9 percent? Is this a cartel?

Here’s the FCA’s letter in full.

28 January 2020

Dear Bank,

We are writing to you to understand more about your new overdraft pricing and the measures you have in place to help customers who may be adversely impacted by the changes you are making to this pricing. This letter asks you to provide more information on both points.

The FCA’s new rules on overdraft pricing, set out in our Policy Statement PS 19/16, come into force on the 6th of April 2020 (and the repeat use rules came into force on 18th December 2019). Our package of remedies will make overdraft pricing simpler, fairer and easier to manage. We expect that the changes will result in a fairer distribution of charges, particularly benefitting vulnerable consumers, who are disproportionately hit by high unarranged overdraft charges.

We wish to underscore that our rules require you to take measures to help and support those customers who are worse off because of these changes. This is important for all customers and particularly those who are or may be vulnerable.

Operationally, you will need to ensure you are able to support all customers with the changes now and once the rules are in place.

We appreciate your constructive engagement throughout the implementation period, we would now be grateful for the following information. Could you please provide:

- A summary of how you arrived at your new overdrafts rate(s). This should include:

- Which internal factors were considered in setting your new overdraft rate(s)

- Which external factors were considered in setting your new overdraft rate(s)

- How these factors were taken into account in setting your new overdraft rates

- A timeline of key decisions, particularly, any points where you substantively revised your rates

- A summary of decision-making executive meetings where setting your new overdrafts rate(s) has been discussed and, where available, minutes of those meetings. This should include attendance lists.

- Any pricing paper proposals that you put to your decision-making committee

A summary of your approach to dealing with customers who will be worse off following your pricing changes and the measures you are taking to support them. We would like further information on the number of consumers who will be worse off due to a change in their overdraft rate and your strategy for communicating with them and supporting them to deal with this change.:

You have previously provided us with your initial strategy for repeat overdraft users, these are customers whose overdraft use indicates that they are experiencing or at risk of financial difficulties.

For the avoidance of doubt, we note that we are requesting the material above voluntarily.

We would be grateful if you could provide us with a response by 10 February 2020. Please could you reply to Sheldon Mills and David Geale directly.

We may wish to meet with you following receipt of this information to discuss in further detail, and we will be in touch shortly to organise this where needed.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...