When The Financial Times does what they’re good at – covering financial markets and not technology – then they do produce some fascinating content. Case in point is the latest coverage of JPMorgan Chase’s (JPMC) 2019 results.

The bank’s latest results are stunning, with the fourth-quarter profit soaring to $8.52 billion or $2.57 a share. A year earlier, the bank reported a profit of $7.07 billion or $1.98 per share. It is now one of the most valuable banks in the world (after the Chinese), with a market capitalisation of almost half a trillion dollars ($430 billion), and builds upon a wildly successful decade of market growth, beating all of the banks’ US peers.

Source: The Financial Times

The Financial Times had two exceptional columns reviewing JPMorgan’s success.

The first looked at the US banks overall, and tracked the fact that the past decade since the financial crisis has been kind to American banks (unlike European banks). America’s largest universal and investment banks – Bank of America, Citibank, Goldman Sachs, JPMorgan Chase, Morgan Stanley and Wells Fargo – have more than doubled their collective profits since 2009.

You could put this down to the strength of the American economy, which has seen eleven years of continuous growth, but its more than this. For example, the big banks are eating the small banks deposits, with Bank of America and JPMorgan increasing deposits by 4% and 6% respectively last year, even as economic growth slowed.

The FT quotes Mike Mayo, an analyst at Wells Fargo:

“The moats around the largest banks are as deep as they’ve ever been. That’s due to technology and marketing skills, but also due to new regulations that require a good degree of overheads.”

And The FT continues:

“Remarkably, banks’ return on equity remains near the levels of a decade ago, despite rules requiring them to hold much more capital. Cost-control initiatives have played a key role in this. Bank of America is again a good example: its overhead costs last year were $65bn, $10bn lower than five years earlier, despite higher revenues.

“A decade ago, too, there was much concern that financial start-ups and big tech companies would invade industry territory. But marketplace lenders, social media platforms and other tech groups have, for the most part, ended up partnering with banks rather than displacing them … and why has JPMorgan outperformed all the others by such a large margin? It came out of the crisis with fewer holes in its balance sheet than Citi or Bank of America, and unlike Wells Fargo, has not had any major scandals. In banking, more capital and fewer mistakes are a potent combination.”

Nice.

There’s then an opinion piece by Tom Braithwaite that expands on JPMC’s strengths.

Jamie Dimon is causing headaches for rivals — and himself

One line in Tom’s piece really strikes the point home about how Europe is languishing and America, particularly JPMC, are steamrolling over the banking world:

“JPMorgan’s market capitalisation of $430bn is higher than the combined value of Barclays, Société Générale, Standard Chartered, UniCredit, Credit Suisse, UBS, BBVA, Royal Bank of Scotland, Crédit Agricole, ING and Lloyds.”

Wow! Just wow!

OK, JPMC is worth less than Apple, Google, Amazon, Tencent and Microsoft, but is worth a lot more than the largest group of European banks. It makes you realise that Europe’s banks are now valued about as much as half a Stripe … if they’re lucky. Shoot.

And Tom builds on the earlier point, that it’s not just about America’s economy.

“The comparative strength of the US economy is helpful, but it cannot be the only explanation. After all, Mr Dimon is also embarrassing Wall Street rival Goldman Sachs, whose once stellar profits have dimmed and whose new gambits, such as consumer banking, are yet to pay off.

“You can point to JPMorgan’s boost from consolidation. Mr Dimon swooped on Bear Stearns and Washington Mutual in 2008. But he was only in a position to strike those deals because he had protected his own balance sheet. And if crisis-era acquisitions were all that mattered then Barclays, which picked up the core of Lehman Brothers, and Bank of America, which bought Merrill Lynch and Countrywide, would be worldbeaters too.”

In other words, it’s all down to having a strong balance sheet, good management, great leadership and a focus upon innovation and regulation in equal balance. Meantime, for all the bleating about disintermediation, disruption, digital transformation and revolution, JPMC is a bank that truly is showing how to deal with all these challenges and find a strategy for success. No wonder they are one of the stars of my new book Doing Digital.

Finally, in a third piece, The FT interviews Brian Moynihan, the CEO of Bank of America (BoA) over the past decade. Brian doesn’t like BoA being compared with JPMC, even though the latter has a valuation a third more than BoA today when, ten years ago, they were neck and neck. He claims that this is because JPMC was far better capitalised as it came out of the crisis although, imho, that’s not the answer.

I always remember reading a research report in the 2000s about BoA’s amazing success at turning customers online when many were struggling. This was due to a time-series analysis the bank performed which discovered little online banking usage in the first six months, as customers didn’t trust it. After nine months it picked up however and, after eighteen months, online was the primary customer focus. This led to BoA becoming an internet banking lead in the USA (see end note). Today, BoA is lagging behind JPMC in online, digital and mobile banking.

Brian Moynihan: “We have 38 million digital customers and 29 million-plus mobile customers who grew 10 per cent year over year.”

JPMC has almost 52 million digital and 37 million mobile customers.

No wonder Mr. Moynihan reckons that Bank of America can double their market share: “Our market share in consumer is probably 12, 13, 14 per cent, depending on who counts . . . The reality is, you could double that.”

And they will do this digitally. Not by opening more branches.

OPTIONAL READING

This is a TowerGroup (now part of Gartner) research note from 2004, written by George Tubin.

How Bank of America became the biggest US online bank

Coming out of the dot-com boom, brick-and-mortar businesses across all industries were forced to reexamine their online strategies. After the mad dash to gain market share and “online real estate,” the real economic underlying value of the online channel came under considerable scrutiny. This question was especially difficult for the banking industry with its highly complex delivery system, organizational structure, product mix, and geographical reach. In short, measuring the economic value of the online banking channel is difficult.

Unlike most other top-tier US banks, Bank of America was determined to confront this issue head on. Realizing that measuring the profitability or return on investment of the online banking channel directly was fraught with problems, the bank decided to approach this issue from a customer-centric perspective. Rather than trying to determine the value of the online channel in isolation, the bank chose to determine the value of customers that used the online channel compared to those that did not.

Online Banking Time Series Analysis

Although the approach and results of Bank of America’s online customer profitability study have been publicly available for some time, a brief description is warranted for those who may not have had the opportunity to review it. After evaluating approaches to determine the nagging question of profitability of the online channel, Bank of America took a unique approach to determine the answer. Rather than simply comparing the profitability of online customers as a segment to that of offline customers, the bank performed a time series analysis that tracked both online and offline customers over a period of time.

Online customers were compared to control groups of customers who were not online, based on several measurements taken over an extended period. To isolate the effects of the online channel on the overall customer relationship, control groups were chosen that had demographic and tenure attributes similar to those of the online group. This analysis was structured to isolate the effects of online banking on customer profitability.

Bank of America started collecting this data in late 1998 and completed the first time series analysis in the middle of 2000. The study showed that, after going online, customers actually became more profitable than their control group counterparts. Put another way, the study determined that online banking led to higher customer profitability.

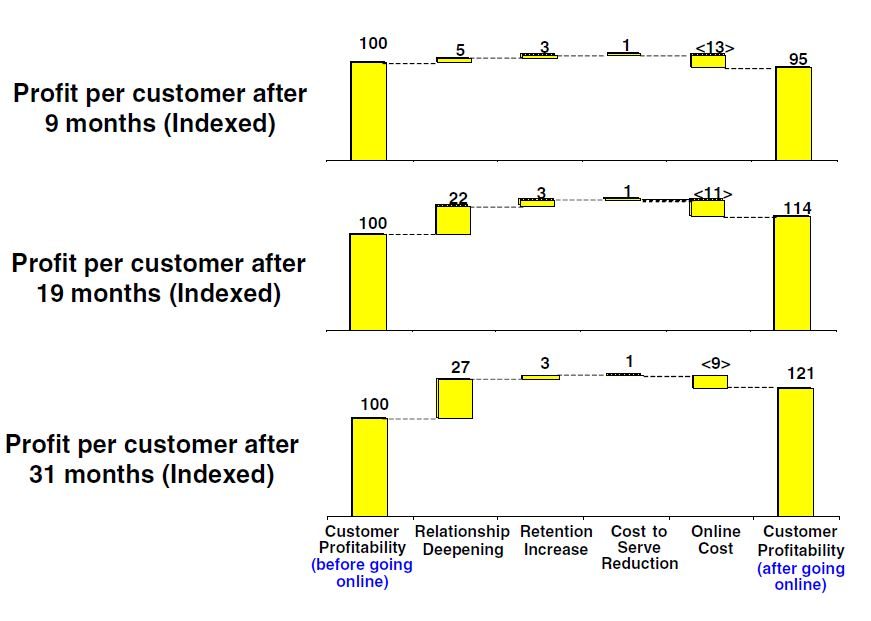

Although online bill pay customers cost more to serve, these costs were more than offset by an increase in account retention rates and an expansion in the number of products used. But the most significant profit driver for online customers proved to be an increase in account balances. That is, the interest income derived from higher account balances produced the most significant lift in customer profitability. After nine months, profitability of the online groups was 5% lower than the profitability of control groups, but by the end of the 31-month period, online customers became 21% more profitable than their offline counterparts.

Results of Bank of America Online Bill Pay Customer Time Series Analysis (2001)

To gain the backing of the entire organization, Bank of America’s e-commerce unit realized that it should share the online profitability findings widely. Not only did the bank communicate its findings across the entire organization, but Ken Lewis, Bank of America’s CEO, actually presented the bank’s findings outside the company. In fact, the presentation is publicly available on the company’s Web site.

The results of the time series analysis formed the crux of how the bank makes decisions about online banking, including the decision to offer free online banking and bill pay. As a result of this and subsequent studies, Bank of America decided to aggressively pursue projects that would increase online banking adoption and usage across its customer base. Subsequent time series studies with different customer groups have shown similar results.

As the technology infrastructure was being improved to support the bank’s anticipated growth, the organization focused on overcoming customers’ potential misperceptions or objections to online banking.

Deeply committed to Quality and Six Sigma approaches, the bank’s management believed that by really listening to customers and understanding their needs, the bank could focus on implementing programs to improve customer satisfaction and delight its customers. The organization believed that this approach would lead to broader relationships and, hence, higher customer profitability.

The bank used a Six Sigma approach known as “Voice of the Customer” to understand what customers really wanted in an online banking application and to prioritize projects aimed at removing barriers to customer adoption and usage. This approach allowed the bank to target its marketing and development efforts to areas that would produce tangible results. Further, the bank shared findings from the Voice of the Customer project across the organization to provide a common understanding among the thousands of bank associates.

After carefully planning, a Voice of the Customer project involves gathering both solicited and unsolicited input from the customer base. Solicited input came from several sources, including focus groups, online questionnaires, and mail surveys. Unsolicited input came from e-mail, mail, contact centers, and branches.

To obtain a comprehensive view of the customer base, the bank ensured that input came from both online and offline sources. Reams of data were then organized and scrubbed to provide a good basis for Voice of the Customer analysis. As with any data analysis project, the first step was to ensure the validity and accuracy of the data to be analyzed.

Voice of the Customer analysis proved fruitful

The bank was able to translate and prioritize customers’ objections to online banking into several categories but discovered that four objections were the most significant barriers to adoption. By concentrating on these top objections or barriers, the bank was able to implement programs and policies that directly addressed the areas that would eventually provide the most benefit to their clients, and henceforth, the bank. Although the bank continues to conduct conducts Voice of the Customer projects and share the analysis across the organization, on its road to 11.2 million customers, the bank needed to overcome these four primary barriers to online banking:

Barrier 1: “Online Banking Costs Too Much”

Today, it is fairly common practice for large retail banks to offer online banking for free. However, this was not the case just a few short years ago. Most banks would charge a monthly fee for online banking or online bill payment, or provide it for free with high minimum balance requirements. In May 2002, Bank of America announced it would join the budding movement to provide online banking with bill pay free of charge. This decision removed one of the largest obstacles that kept customers away from banking online: cost.

Thanks to the bank’s sheer size and market impact, almost the entire industry followed suit and began offering free online banking with bill pay. However, many of the other banks did not fully grasp the impact of this move. They had not performed any kind of detailed customer profitability analysis and did not know the value of their respective online banking programs. Most banks feared that online banking was unprofitable for them to begin with and that giving it away would only make it more unprofitable.

But, because the largest retail bank in the US was giving the service away, other banks felt forced to provide the service for free as well. They hoped that Bank of America knew what it was doing and that providing free online banking would somehow provide a benefit.

Indeed, Bank of America knew exactly what it was doing when it made the decision to go free. Its time series analysis proved that customers became more profitable as a result of going online. The elimination of online banking and online bill pay fee income was far outweighed by the increased profitability derived from customers banking online.

Barrier 2: “Online Banking Is Not Safe”

Online security continues to be a top concern for many consumers, especially in light of the many phishing and spoofing scams that have surfaced across the financial services industry. Even before the recent spate of phishing attacks, consumers were wary of conducting financial transactions online. Consumers continue to believe that simply signing up for online banking could enable a fraudster to gain access to one’s username and password and thereby gain access to the account, either by intercepting information during an online banking session or by simply “hacking” the username and password. Consumers believe that without an online account set-up, they are not vulnerable to this type of fraud. They are unaware that thieves can use stolen identification information to establish an online banking account.

In order to make customers more comfortable with banking online, the bank realized it had to stand behind its product. Bank of America was one of the first institutions to offer its customers an online banking guarantee, providing “$0 Liability” for any unauthorized activity originating from online banking.

Customers, of course, are required to protect their usernames and passwords, not leave their computer unattended during an online banking session, and promptly notify the bank of any unauthorized activity.

Barrier 3: “Online Banking Is Difficult”

Bank of America realized that many consumers stay away from online banking because they fear making mistakes in performing financial transactions. Ordering the wrong book is one thing; accidentally sending your mortgage payment to a shell company in Dubai is another. The bank continues to focus considerable effort on simplifying their customers’ online experience from enrollment to transaction execution to cross-sales.

In a recent review of top online banking providers, TowerGroup found Bank of America to be clearly in the top tier (along with Citibank and Wells Fargo). The top providers not only provide a higher level of features and functions than their peers but also seem to have a knack for providing highly usable and intuitive user interfaces.

Barrier 4: “There’s No Real Need to Bank Online”

Other than simple ATM withdrawals, consumers traditionally looked to branch and contact center agents to execute their financial transactions. The checkbook remains a sacred relic and check writing a venerated practice among US consumers. Suggesting that bank clients stop using their dear and trusted friends at the local branch and deprecating the check register are considered heresies in many circles.

Yet, online banking promises to replace or supplement traditional banking methods with simple, real-time, 24-hour banking.

According to TowerGroup primary market research, approximately 93% of all consumer banking customers continue to visit a bank branch at least once a month. Bank of America realized that the most effective way to convince its client base to try online banking was to do so in their branches. But, to promote online banking in the branches would require the branch staff to fully understand and support this effort. If consumers sensed that the branch staff was not enthusiastic about online banking, or worse, unwilling to use online banking themselves, the response would be clear: “If bank employees don’t use it, why should I?”

To encourage the branch associates to use online banking, the bank ran several enticing promotions with prizes, including a PT Cruiser and $10,000. Not surprisingly, in a short time over 80% of all branch associates were using online banking on a regular basis. Because of the genuine enthusiasm for online banking exhibited by the branch staff, in-store enrollment for both existing and new customers showed a marked improvement. Today, the bank generates a greater proportion of new online banking enrollments via the banking centers than via the Web, with the majority of customers being new to the bank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...