Varun Mittal, Associate Partner with EY, recently posted a couple of interesting slides about the launch of virtual banking licences to encourage challenger banks in Asia.

If you’re not aware, there’s a great deal of digital banking activity across Asia. It’s not just in China, but there are notable things happening in Hong Kong, Malaysia, Singapore, Taiwan, Thailand and more. In particular, there has been a launch of banking licences for digital firms with Alibaba, Tencent, Xiaomi, Grab, SingTel and more making bids. In other words, the Big Tech giants are moving into digital banking in Asia. It’s not just the Big Tech world that’s moving in however, as Scott Bales notes that OCBC, HSBC, UOB and Standard Chartered are also likely to be bidding for licences in Singapore. After all, why not? A large bank should have no reason to not be a challenger bank as RBS’s Bo would tell you.

In fact, this would follow the example of Hong Kong – a first mover in awarding online-only digital banking licences – where Ant Financial, Ping An, Tencent, WeLab and more have received licences. Equally, so have Standard Chartered and Bank of China. In fact, the most interesting aspect of the HK experience is that many of the new banks are partnerships between Big Tech and Big Banks. For example, Fusion Bank is a joint venture between Tencent, Industrial and Commercial Bank of China (ICBC), Hong Kong Exchanges and Clearing (HKEX) and Hillhouse Capital.

This environment of creating mobile-first online-only new digital, virtual banks is interesting and will probably diverge from the European and American markets, although some recognisable names like Revolut and Tandem Bank are also in the mix. The reason it will be different is that the culture is not the same and, with big players like Alibaba, Ping An and Tencent in the mix, it will be fascinating to see how it plays out.

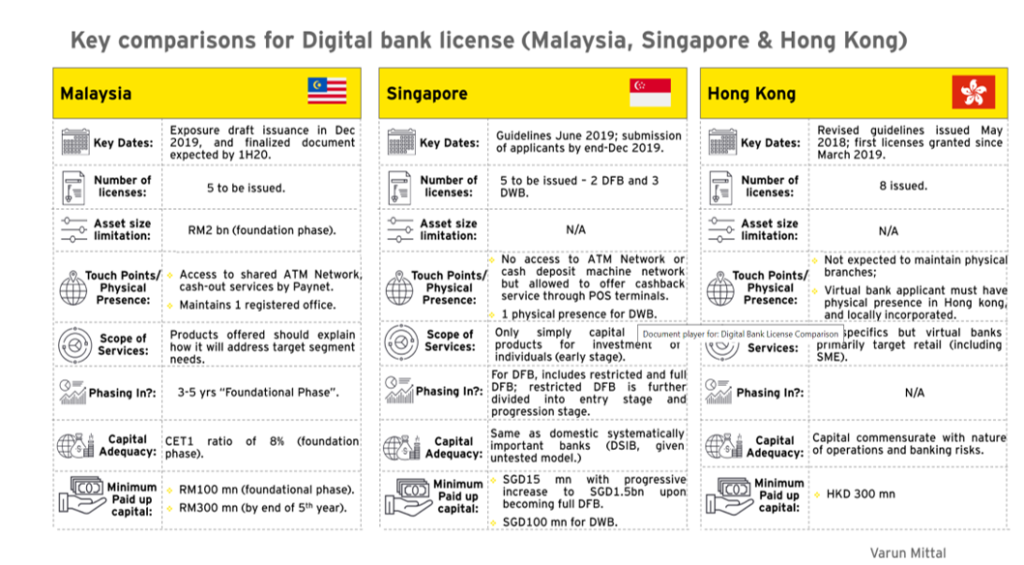

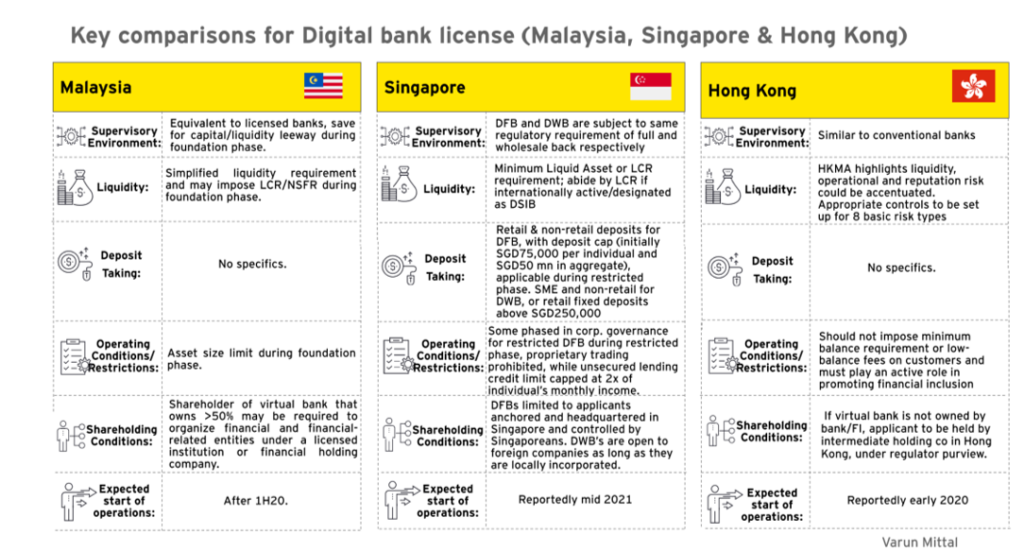

Meantime, assuming this is of interest, here’s a comparison of the three major markets that are opening up, kindly shared by Varun on LinkedIn.

Finally, as it's a great link, here's a summary of the current challenger banks in Hong Kong according to FinTech Futures:

Ant Financial (AliPay/Alibaba) received a virtual banking licence from the Hong Kong regulators in spring 2019.

Fusion Bank is a joint venture between Tencent, Industrial and Commercial Bank of China (ICBC), Hong Kong Exchanges and Clearing (HKEX) and Hillhouse Capital. There is also an investment from Hong Kong entrepreneur Adrian Cheng, via Perfect Ridge Limited.

Insight Virtual Bank is a joint venture of Hong-Kong based AMTD Group, Asia’s largest independent investment bank, and Xiaomi Corporation, a Beijing-based internet company.

Livi Virtual Bank is a joint venture between Bank of China (BOC) Hong Kong, JD New Orbit Technology and JSH Virtual Ventures Holdings (JSHVV).

Neat is a Hong Kong-based start-up that offers banking accounts for businesses. It was founded in 2015 by David Rossa (CEO) and Igor Wos (CTO).

Ping An OneConnect is the fintech arm of Chinese conglomerate Ping An Insurance, and received its Hong Kong virtual banking licence in spring 2019.

Revolut is understood to be coming to Hong Kong.

SC Digital is led by Standard Chartered, and has partnerships with Hong Kong Telecom (HKT), PCCW (a Hong Kong-based information and communication technology firm and owner of HKT), and travel services provider Ctrip Hong Kong.

Tandem Bank unveiled its plans to expand to Hong Kong in November 2019. This would be the first overseas location for the UK-based bank.

WeLab received a virtual banking licence in early spring 2019, claiming to be “the first homegrown Hong Kong fintech company to establish a virtual bank”.

ZhongAn Bank (ZA Bank), a Shanghai-based online-only insurer – and the first of its kind in China – received a Hong Kong virtual banking licence via its local subsidiary ZA International.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...