I recently spotted a great write-up on Open Banking by Alex Johnson, who has kindly agreed I can republish it. So, here we go ...

The Stories We Tell Ourselves About Open Banking

Distinguishing between what's true and what we want to be true.

| Alex Johnson | Source: FicoFinTech |

The trouble with Open Banking is that it has a great name. A name that makes you want to believe in it. A name that makes the very idea of opposing it sound absurd and hopelessly out of touch.

After all, who doesn't want banking to be more open? Banking shouldn't be closed! It shouldn't be cumbersome or challenging to navigate. Customers should own their data and they should be able to take it with them wherever they want!

Open banking feels both virtuous and inevitable and because of that we often fall into the trap of believing that a more competitive, transparent, and portable banking future will be both imminent and an obvious improvement on the status quo, even when the available evidence doesn’t necessarily support those conclusions.

Given recent industry news, I thought it’d be useful to put a few of the stories we tell ourselves about open banking under the microscope.

Story #1: Market incumbents are committed to giving customers control over their data and service provider relationships.

You ever wonder why U.S. banks prioritize the slow accumulation of 1:1 data sharing agreements with individual aggregators like Plaid rather than the development of industry standard for secure data sharing? All the big aggregators and most of the big U.S. banks are members of the Financial Data Exchange (FDX), which is dedicated to that exact goal. So why, when legitimate concerns about screen scraping are raised, do banks default back to the need for individual agreements?

Both Plaid and Envestnet/Yodlee have established API data sharing agreements with individual institutions, including Chase, Citibank and Capital One. As Larrimer indicates, PNC has one such agreement in place and several others close to signing.

The solution to these high-profile confrontations over data sharing “is to sign data exchange agreements with all of these aggregators,” [Karen] Larrimer [Head of Retail Banking and Chief Customer Officer at PNC] observes.

I don’t know the answer (the agreements aren’t open, ba-dum-ch!), but I’d bet it’s for a reason similar to the one that motivated five large European banks to drag their feet on delivering required open banking functionality (for which the U.K. Competition and Market Authority publicly reprimand them).

Trustee of the Open Banking Implementation Entity (OBIE), Imran Gulamhuseinwala, says: “While we are aware that the Open Banking programme has ambitious and challenging timescales, it is disappointing that some banks have needed more time to deliver some important new Open Banking functionality to their customers."

Or similar to the reason that motivated some U.K. banks to (allegedly) not focus too much on uptime for open banking functionality in Q1 of 2019.

Using the Open Banking Implementation Entity's API Downtime monitoring tool, Growth Street has calculated that Open Banking was only available 83% of the time in the first quarter of 2019. This means that for 5000 hours Open Banking customers (both business and consumer) were unable to access some integration features.

Greg Carter, CEO, Growth Street, says: "Banks talk a good game on open banking, but the raw data shows a very different picture."

Bottom line: Most banks will only do the bare minimum to facilitate easier access to competitive services for their customers and if fintechs were in their place, they would act the same.

Story #2: Open banking will unlock tangible new value for consumers, especially those who are financially vulnerable.

I’ll let the U.K.’s Open Banking Implementation Entity (OBIE) make the case:

People could stand to gain £12bn from Open Banking-enabled services over the course of a year … To realise all the value, consumers need products more closely tailored to their needs, which are designed to engage them more meaningfully and really enhance their lives. Access to transaction data allows firms to offer services at the exact point in time when a consumer needs them, reducing the background noise and offering something genuinely valuable.

And 11:FS can elaborate:

the overstretched segment (defined as individuals that are resilient and borrowing) stands to gain the most at £287 per person, equivalent to 2.5% of income, according to the findings. This segment represented only 18% of UK adults that need help in improving financial security and managing debt.

In this instance, some of the existing Open Banking solutions that can be used to address these problems include PFM tools such as Yolt and Emma, which in addition to providing an overview of a person’s finances, assist with budgeting and offer tips on money management based on the insights from the transaction analytics. This segment was also shown to struggle with debt and therefore could benefit from accessing debt management advice from Open Banking platforms such as Tully and Toucan.

Despite the widely-held belief that the U.K. is far ahead of the U.S. on open banking, U.S. consumers have had access to PFM tools that provide “an overview of a person’s finances, assist with budgeting and offer tips on money management based on the insights from the transaction analytics” for some time. It’s called Mint.com and it was founded in 2006, three years before reckless lending and borrowing behavior crashed the global economy. In the decade since, U.S. consumers (with access to Mint.com and a slew of other PFM tools and services) have taken on crushing levels of debt.

Consumer debt, not counting mortgages, has climbed to $4 trillion—higher than it has ever been even after adjusting for inflation. Mortgage debt slid after the financial crisis a decade ago but is rebounding.

Student debt totaled about $1.5 trillion last year, exceeding all other forms of consumer debt except mortgages.

Auto debt is up nearly 40% adjusting for inflation in the last decade to $1.3 trillion. And the average loan for new cars is up an inflation-adjusted 11% in a decade, to $32,187, according to an analysis of data from credit-reporting firm Experian.

Unsecured personal loans are back in vogue, the result of competition between technology-savvy lenders and big banks for borrowers and loan volume.

Bottom line: you can build some nifty fintech apps off of the data insights aggregated by open banking functionality. No doubt. But if the consumers who download those apps don’t actually change their underlying financial behaviors, then the value provided by open banking will remain theoretical.

Story #3: Open banking will create a wide open competitive landscape and consumers will have more choices than ever.

The vision for open banking—as expressed by its advocates—is one of unbundling. When data can flow freely, a whole ecosystem of fintech providers will spring into existence. Each one will attempt to disrupt a slice of banks’ product portfolios (personal lending, deposits, mortgage, etc.) and thus, the standard bank product portfolio will be unbundled.

And in this environment, banks will have no choice but to embrace this new ecosystem and become curators of open marketplaces or platforms, as Chris Skinner (@Chris_Skinner) passionately argued for:

And in this environment, banks will have no choice but to embrace this new ecosystem and become curators of open marketplaces or platforms, as Chris Skinner (@Chris_Skinner) passionately argued for:

Customers should not have to go and find the 1000s of APIs in the Open Banking marketplace that might be relevant to them or that might work for them. The bank should do this for the customer.

Customers should not have to go and perform due diligence on 1000s of start-up firms that are light regulation, little history, restricted capital and no trust. Banks should do this for them.

Customers should not have to work out how to take 1000s of APIs and integrate them into their ecosystems. Banks should do this for them.

This story may end up being true. The first part certainly happened. Today, we have a massive number of niche fintechs fighting for consumers’ attention. However, looking forward it is also reasonable to predict a banking ecosystem that looks a lot like what we have now. There are two reasons for this:

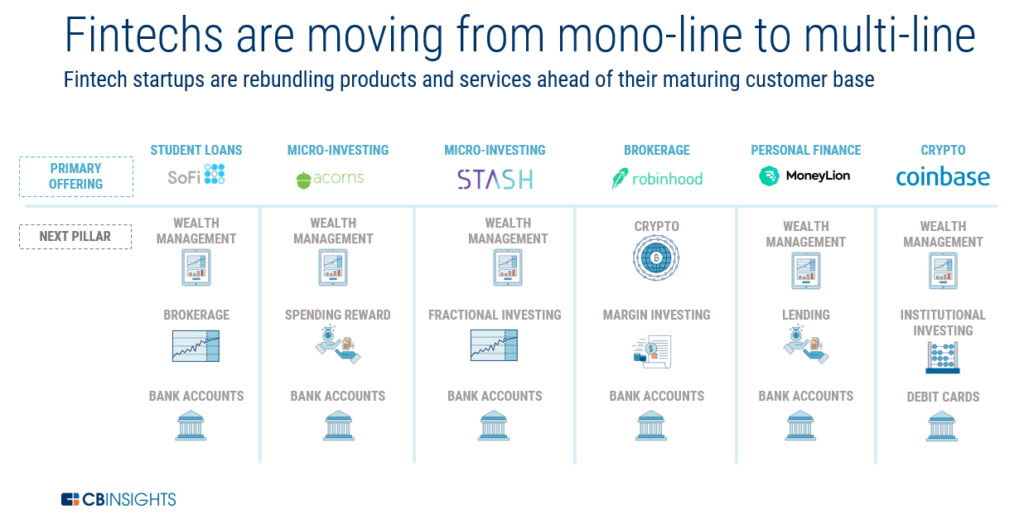

- Rebundling. Unbundling is great when your goal is to drive a wedge into an existing market and disrupt it. Once you’ve accomplished that, the question becomes how will you retain, grow, and monetize your customer base? The answer, for many of the most successful fintech companies, is rebundling—expanding into new product lines with a focus on generating revenue and locking in customers.

- For more on this trend, see Charley Ma (@CharleyMa)’s analysis on fintechs’ mid-game strategy and this wonderful graphic from CB Insights:

- For more on this trend, see Charley Ma (@CharleyMa)’s analysis on fintechs’ mid-game strategy and this wonderful graphic from CB Insights:

- Fintech Infrastructure. And for fintechs that don’t want to rebundle themselves into full bank competitors (or have been unable to do so), there is a very attractive alternative path forward: providing their technology to banks and other fintechs. Avant now offers Amount. Kabbage launched Kabbage Platform. OnDeck spun off ODX. And a myriad of new companies aren’t even attempting to build a consumer-facing brand, they’re just jumping right into the fintech infrastructure business, as Angela Strange (@astrange) at a16z noted recently:

Some of the most exciting investment opportunities in this space are the infrastructure companies that are powering the addition of financial services for both consumer and B2B products. For consumer companies, the rise of “infrastructure as a service” already enables card issuing, regulatory compliance, money movement, servicing, collections, and more.

Bottom line: Our banking future may end up looking less open (a huge ecosystem of niche providers organized through marketplaces and platforms) and more like the landscape we’re already familiar with (a concentrated number of large, multi-line providers, powered by an array of invisible infrastructure companies).

Additional Reading:

- Another interesting takeaway from the OBIE’s open banking survey — U.K. Consumers haven’t yet gotten the memo on how great open banking is. 64% of consumers surveyed agreed that open banking means your details will be more at risk of fraud. And 47% of individual consumers and 52% of SMEs think Open Banking will give them less control over their financial data.

- Ron Shevlin (@rshevlin) speculates that other banks may follow PNC’s lead in trying to drive customers from Venmo to Zelle, if the blowback from the PNC news isn’t too severe.

- Taking the argument for open banking to its logical extreme, how about the idea of letting consumers directly sell and profit from their personal data? Gregory Barber (@GregoryJBarber) at Wired tried doing this exact thing. Guess how much money he made?

Thanks,

Alex Johnson

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...