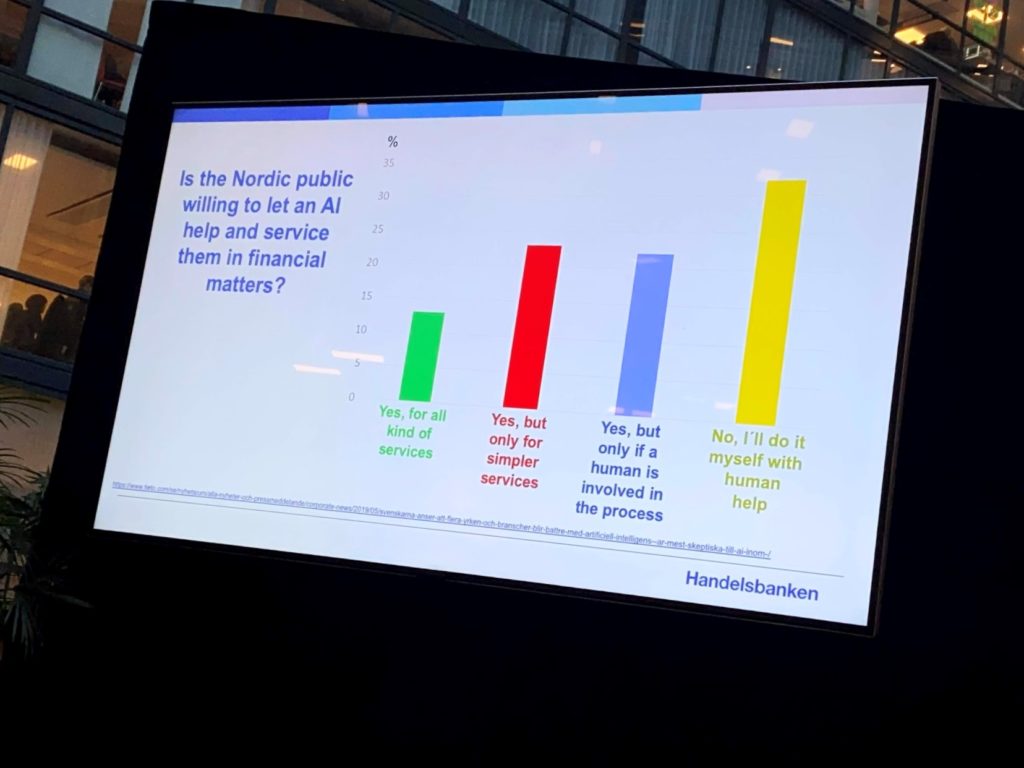

We had our first 2020 meetings of Nordic Finance Innovation last week. The theme was digital transformation and its implementation, and was co-hosted by our partner Swedbank. One of the slides struck me as particularly noteworthy. It came from a presentation by Stephan Erne, Chief Digital Officer at Handelsbanken, in reference to artificial intelligence (AI).

The slide is based upon a survey by Tieto of Noridc consumers, and their views of AI. As a result, I downloaded the report after the meeting and here are some of the key insights.

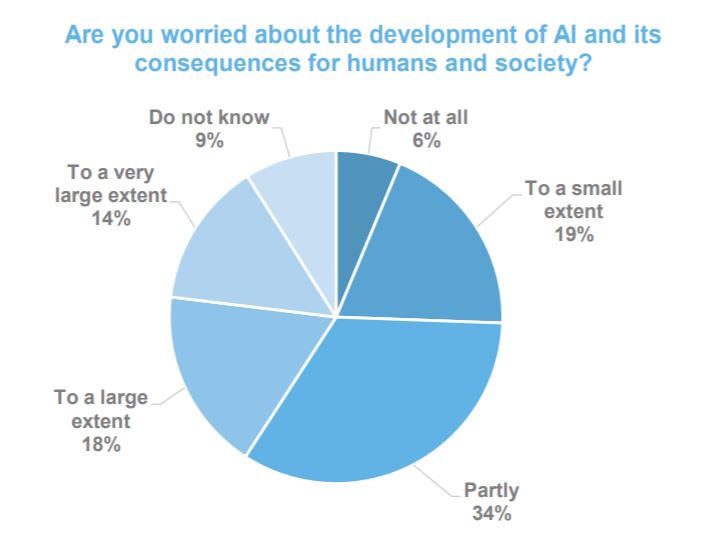

Tieto surveyed 3,659 people in Sweden, Norway and Finland in 2019, to understand the general public's views on the development and use of AI in different areas. The survey consists of two parts, the first part is focusing on industries and occupations, and the second part covers ethical considerations.

Notably, most people aren’t too worried about AI’s impact on society. Only a third are really concerned.

And I thought it particularly amusing that 58% of Nordic citizens think AI could do the job of a politician better than a human (I agree).

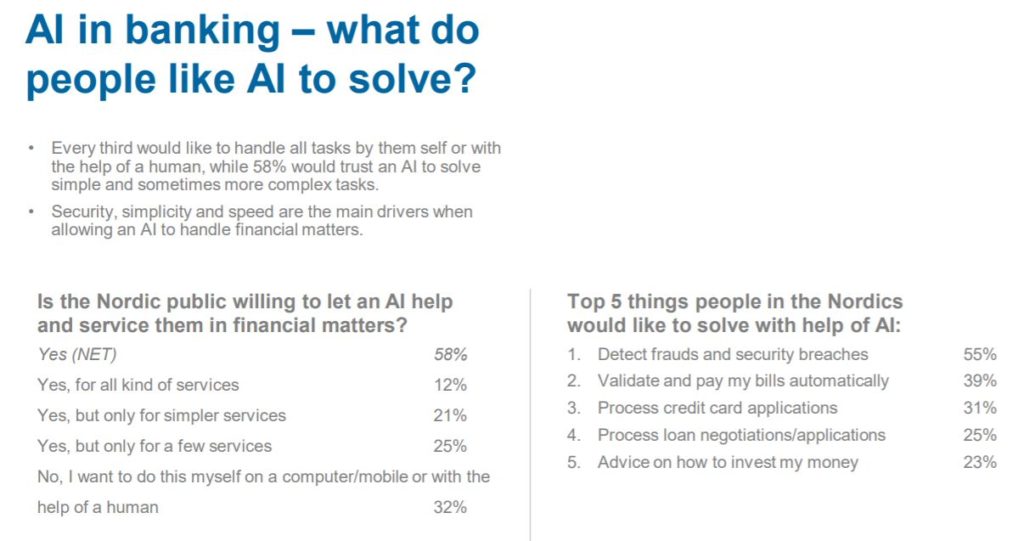

In banking a similar number, 58%, are happy to have AI help them with their financial needs, but 32% definitely would not like that assistance (a further group said don’t know if you’re wondering where the missing 10% is). That’s a little contradictory, as I’m pretty sure many in that 32% zone are using chatbots and not realising that this is what banks call AI. I call it a chatbot, which is a rudimentary AI. Even so, it’s still AI.

The top five things that Nordic folks think AI can help with most are:

- Detect frauds and security breaches 55%

- Validate and pay my bills automatically 39%

- Process credit card applications 31%

- Process loan negotiations/applications 25%

- Advice on how to invest my money 23%

Interesting report, as I haven’t seen many surveys of consumer views of AI in finance and society. You can download the Tieto report here.

Nevertheless, I did see a report by EY on AI in banking. The AI in Financial Services global study (pdf) - jointly conducted by the Cambridge Centre for Alternative Finance at the University of Cambridge Judge Business School and the World Economic Forum, and co-sponsored by Ernst & Young - shows that, by the end of 2022, two-thirds (64%) of respondents expect to be “mass adopters” of AI, compared with just 16% currently.

So one in three consumers don’t want AI in banking … but two of three banks are doing it anyway.

Resistance is futile!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...