I was quite relaxed about the coronavirus thinking it would blow over (no pun intended). Yet, as the days and weeks went by, it’s obviously a lot more serious than first thought.

I first thought, Oh, it’s Wuhan. It's not over here. It will sort itself out. Then we had the Diamond Princess incubating the virus amongst the ship’s tourists for weeks. Then South Korea says it’s got a massive outbreak too, and raises the alarm there to the highest level. Japan follows China and South Korea. Then Iran has an outbreak rapidly spreading. And, over the weekend, Italy jumps into the fray, and closes towns, supermarkets and football matches, the last one being sacrosanct.

Is it a pandemic?

It’s certainly more serious than first thought.

For me, it’s become a worry as, like most of us these days, my business is global. We take travel as a basic human right these days, and don’t think about jumping on a flight. But imagine if all the airports in the world had to shut down and we take that right away. Imagine all the airlines go bust because of coronavirus. Imagine no one moving between towns and cities. Imagine all of us locked away like tourists on a cruise ship.

We haven’t got there yet, but is that what coronavirus means? Is this the ultimate ‘inferno’?

It’s certainly a strain on the Chinese and, consequently, global economy. For example, the G20 met over the weekend and the Chinese weren’t there. UBS Chairman Axel Weber reckons that global growth will experience a massive drop from 3.5% to 0.5% and China will post a negative growth rate in the first quarter. That’s not happened since at least 1990, according to Bloomberg. Google “coronavirus economy”, and you can see that this is now a real stress test of global trade and finance.

So many countries depend upon not just Chinese manufactured goods, but on Chinese tourism. It’s bigger than that though as South Korea, Japan, Italy and other countries start to lockdown on the movement of people. It means the world grinds to a halt.

Oh, doom and gloom.

Want some good news?

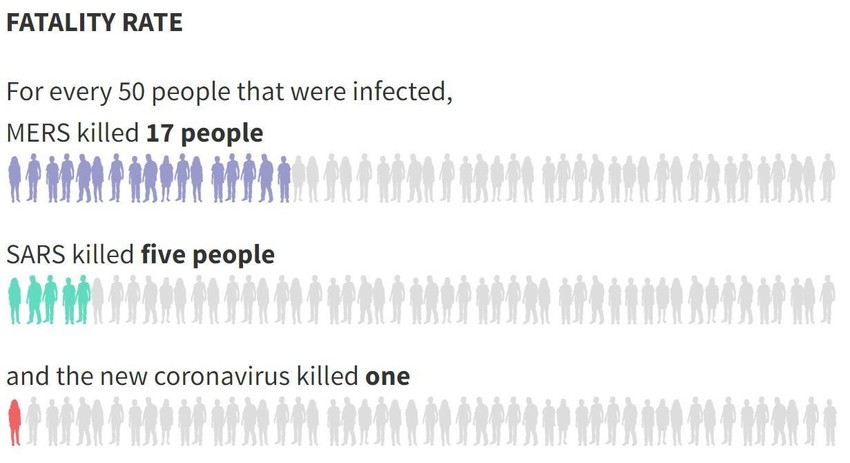

Hmmm … well the good news is that you’re less likely to die of coronavirus than previous pandemic outbreaks.

Image: Reuters

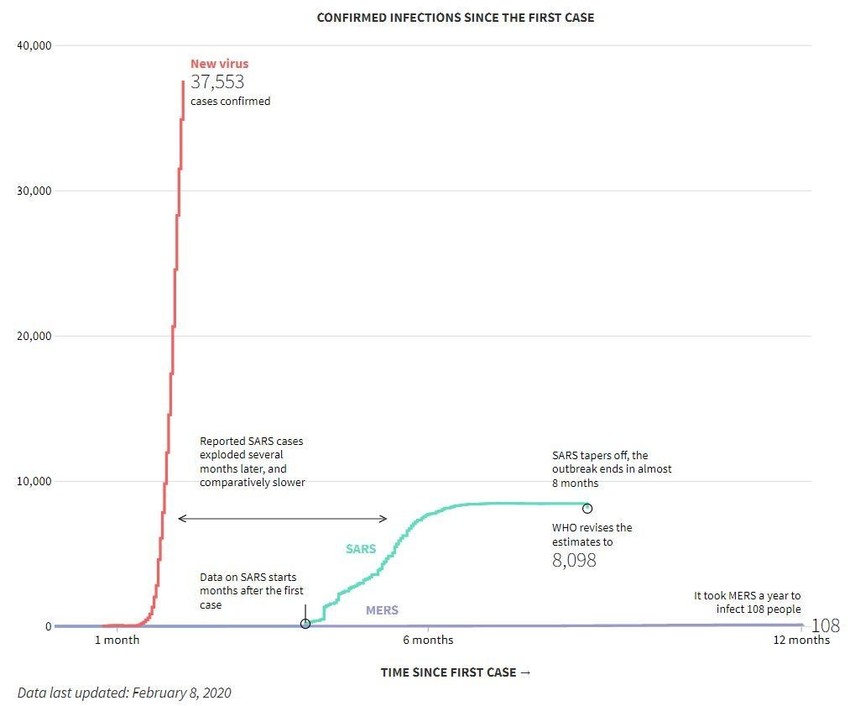

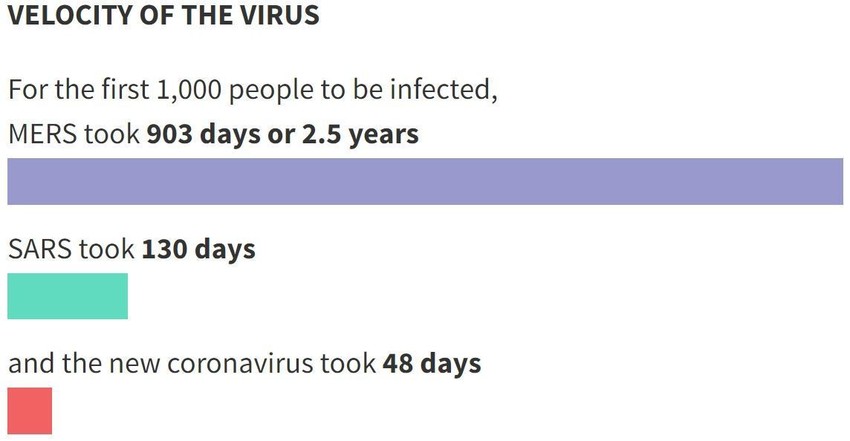

But the bad news is that it’s far more viral …

Image: Reuters

… and fast spreading …

Image: Reuters

… than any previous disease.

It’s the latter two that are the real worry for governments and why so many countries are on lockdown. Meantime, it’s already estimated that over $1 trillion of global trade may be lost to the virus. Bloomberg writes:

By most accounts, the carnage will be substantial and indiscriminate—laying low giants like Apple and mom-and-pop trinket shops in turn. The disease may be particularly brutal for Amazon, which relies heavily on products from third-party merchants … The real alpha these days isn’t so much keeping inventory skinny as it is making sure it’s elastic—meaning it can be scaled up and down quickly depending on demand. Wal-Mart is apparently great at this, but those dark arts are largely moot when workers can’t leave their homes and cargo planes aren’t taking off.

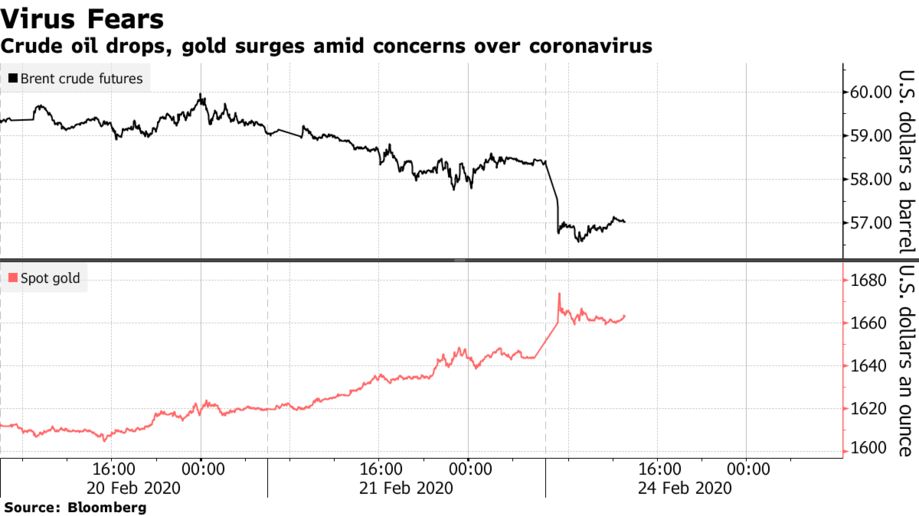

Maybe that's why oil is down, as less travel is forecast, and gold is up.

Source: Bloomberg

So much for the common cold.

Oh, and don’t read too much Dan Brown for the next month or two. It might make you seriously worried.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...