Anyone who’s read this blog since 2007 or my books since 2014 will know that I have a regular rallying call: replace core systems; refresh the bank’s technology stack to an open architecture; embrace APIs, apps and analytics; deep dive on data; transform to be digital and not industrial; rethink the culture and organisation; replace the hierarchical and monolithic structure with a flat, agile and small team microservices structure; yada, yada, yada.

All of the above takes strong leadership and management change, and will never happen if you don’t have the commitment to do business as unusual. So, it’s not surprising that most banks haven’t embraced digital transformation. Instead, they do digital as a project, delegate it to a function, give delegation to an individual and allocate a budget for small change, in all senses of the word.

This is why banks spend millions on digital with large armies of people and achieve little or nothing.

I say these themes so often, I’m even boring myself these days. Which makes it nice when someone else is saying it. The problem is that when other people say it, I always wonder what their agenda is. So often we see consulting firms saying: you will lose billions in the next decade unless you do this, that you think it’s pure bait to get management to call the consulting firm and pay them millions to avoid the billions of losses.

Nevertheless, I did like this report: When Vision and Value Collide by Oliver Wyman.

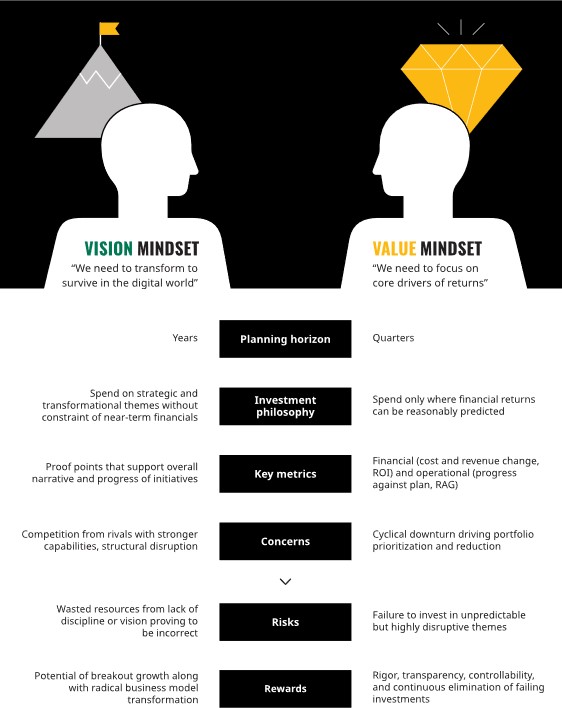

The report is about the clash of cultures between the leaders who have a vision to transform the bank to be digital, and the reality of the banks’ values which drive quarterly results with justifiable investments. This vision and value clash is summarised here:

And in this chart:

Source: Oliver Wyman

The report make it clear that you need a balance between the two mindsets.

“When the value mindset dominates within firms, the result is myriad small changes with known but low-impact outcomes. And when the vision mindset dominates, aggressive amounts of spending can go into transformation efforts that don’t yield results …

“Firms have hired Chief Digital Officers and teams, rolled out new ways of working, and have large technology programs in progress. Incubators, accelerators, and innovation teams have also been set up, often consuming significant management attention. Some breakthroughs are occurring. Yet positive impact on the bottom line has been rare, and few firms we speak to are happy with the rate of change.

“Until recently, this has been a concern but not a crisis. But pressure is building. Investors, analysts, and management teams are asking more and more questions about the rate of progress.”

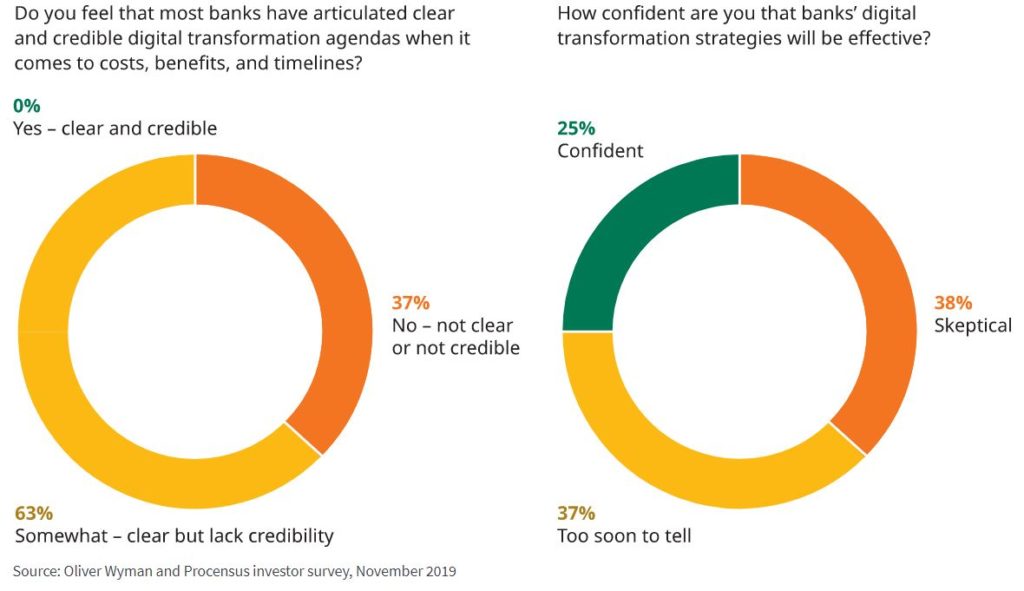

Even worse is that investors have lost confidence in banks’ digital transformation programs, as evidenced by the fact that the combined market capitalisations of the 20 largest financial services firms has grown $800 billion since 2010, compared to a $3.8 trillion increase in the market capitalisations of the 20 largest technology companies.

Oliver Wyman “conducted a survey of investors to find out what they think about the financial services industry, its response to digital, and current investment programs. This showed that only a quarter of investors are confident digital transformation strategies will be effective, and hardly any believe plans are well articulated. Investors understandably struggle to make sense of programmes and end up being outright sceptical. As one put it: ‘It is all jumbled up – IT replacement, automation, customer journeys ...’”

I agree.

The lack of practical advice as to how to transform – business as unusual – whilst delivering the results required by the markets – business as usual – is the core issue here. It is one that came up pretty often during my dialogue with the banks about doing digital (the new book), and Oliver Wyman’s report, which is worth a read, touches on some of these lessons but misses the most critical one.

I won’t tell you all of this – I’d rather you ordered my new book – but the key is that doing digital needs a Board mandate. If the CEO and Chair of the bank are focused upon business as usual and delivering regular returns as usual, then no transformation happens as there is no vision or leadership. If the CEO and Chair have a Board mandate to transform the bank and ignore results – to focus upon the change and doing business as unusual – then the collision of vision and value can be achieved. If the CEO and Chair have to focus upon vision and value, they will fail; if the CEO and Chair have to focus upon vision, whilst the management team can focus upon value, then they can succeed.

Add that to your next report guys.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...