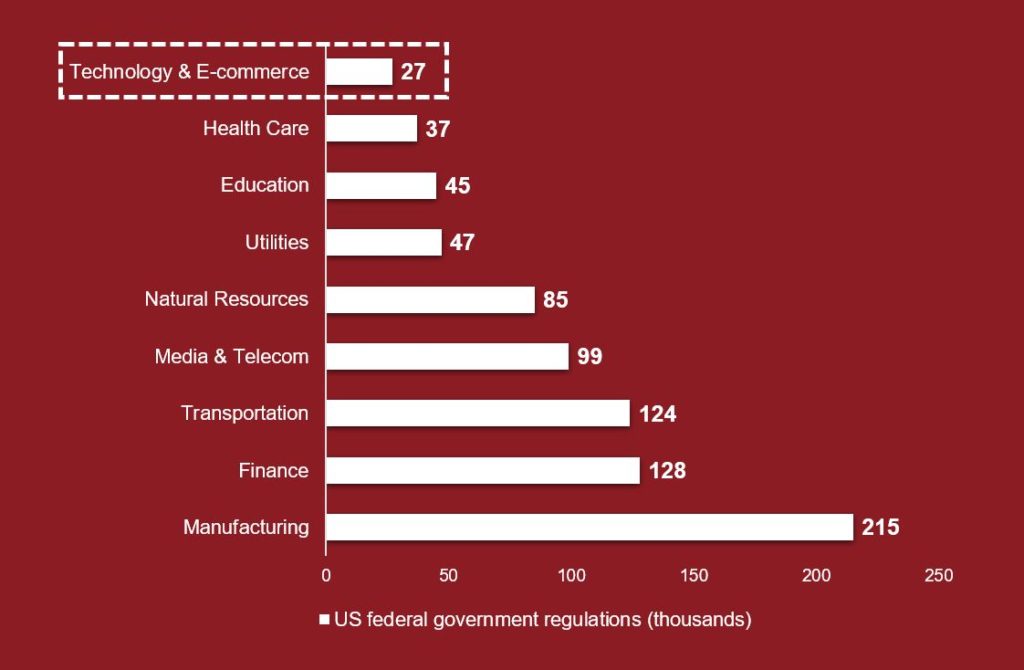

I often talk about how banks have five times more regulation than technology firms. That stat comes from Bank of America Merrill Lynch who published this chart a while ago:

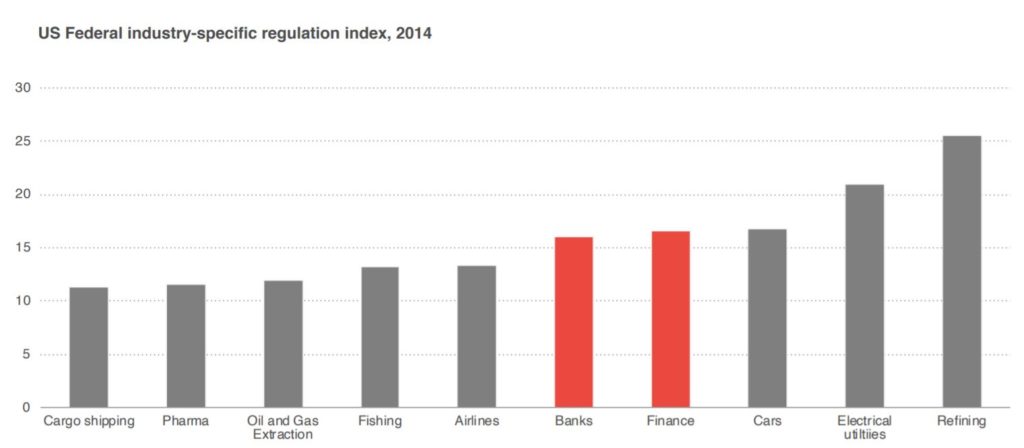

This is confirmed by similar charts, such as this one from Benedict Evans, a Partner at the firm Andreessen Horowitz, who just shared his Davos presentation.

Every year I do a big macro presentation. This year, ‘Standing on the shoulders of giants’; we connected everyone (!), and wonder what's next, but meanwhile, connecting everyone means we connected all the problems. Tech is becoming a regulated industry https://t.co/7v8Hcmulf8

— Benedict Evans (@benedictevans) January 28, 2020

In the middle of it is this chart:

Yep, banks and financial firms have more regulations than airlines and pharma, and a lot more than tech firms. Add onto this that if you’re a global financial platform, like a JPMorgan or HSBC, that regulations change ever twelve minutes, and that’s a real headache.

Equally, the light regulation of technology giants like Facebook in the USA, is a reflection of lobbying in Washington, or so insiders claim. Therefore, it intrigued me to pick up The Sunday Times and find a headline:

Big Tech likes rules, so long as it writes them

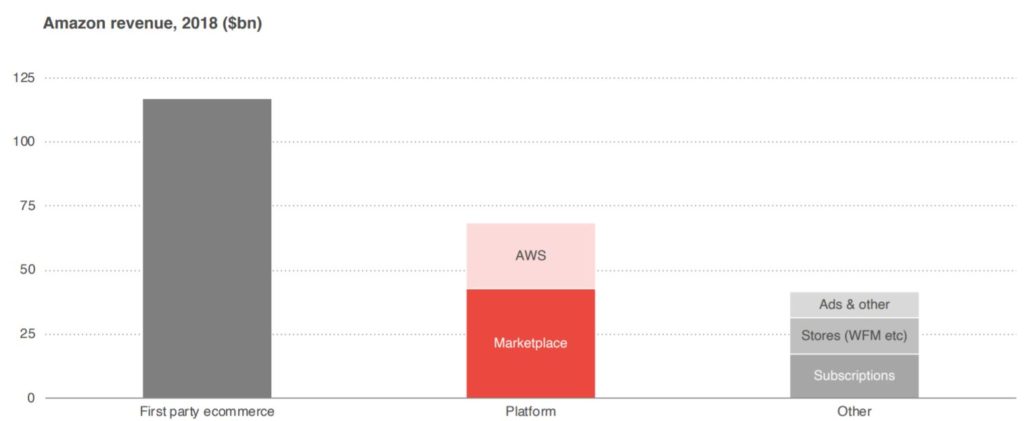

there were a few interesting stats in there, such as Amazon being the top lobbying firm, spending $16.8 million in 2019 to run a 100-strong team of people to crawl all over the politicians. That’s the cost of the people, not the cost of paying off the politicians which would run to millions more. Even so, it’s just peanuts in the annual revenues of Amazon.

Similarly Facebook spent $16.7 million on 71 people in Washington whilst Google dropped to ninth, with just $12.7 million spent on lobbyists, according to figures from the Centre for Responsive Politics.

Their main activities?

Avoid the break up of the Big Tech giants and protect Section 230 of the Communications Decency Act (CDA). CDA was passed in 1996, when just 10% of Americans used the internet, and gave website owners immunity from any legal action as a result of content posted by their users. This is the cornerstone of what has allowed the Big Tech giants become giants, and there’s no way they want that situation changed.

Interestingly, Ben Evans concludes his Davos presentation with a focus upon these areas (see slide 72 onwards in his presentation). And concludes that the internet is global, not American, and so even if the US authorities change Section 230, you’ll still have companies like TikTok out of China running outside the rules.

Nevertheless, the banking system still deals with the high cost overheads of regs. ...

No wonder the tech firms want to keep the rules, write the rules and run the rules and, with their armies of lobbyists, they are doing a pretty good job of keeping it that way.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...