I’m sitting staring at the wall. It’s been a long time now since being in a face-to-face meeting, conference or catching a flight. I’m staring at the wall. Thinking. Thinking. Thinking … what’s the meaning of all this? What’s the meaning of life? What’s the meaning of money?

Money is meaningless … it’s generated out of thin air by governments. It’s only worth something if the government is worth something.

We’ve seen this recently in Venezuela, where a toilet roll was worth a lot more than money.

That's even more true during this pandemic.

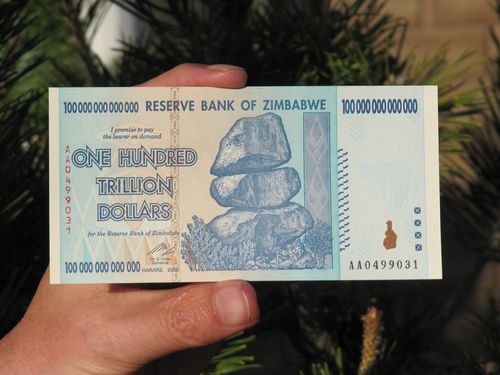

We saw it a decade ago in Zimbabwe, where a country issued 100 trillion-dollar notes.

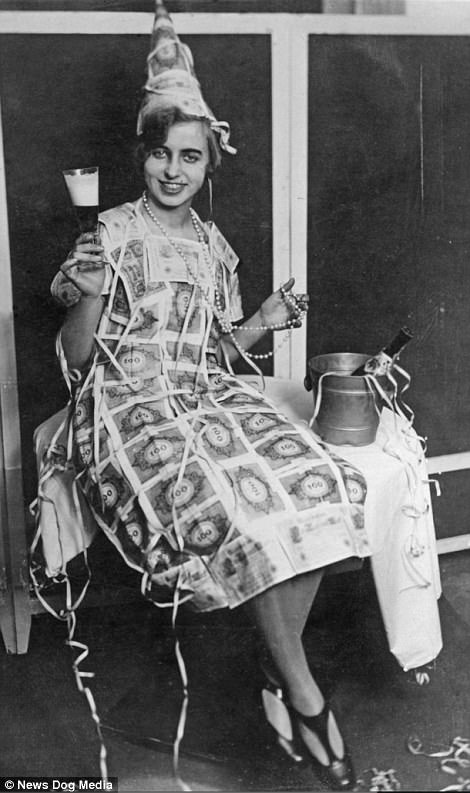

And we’ve seen it throughout many crisis in history, such as the post-First World War Germany, where the Deutsche Mark became a fashion accessory (a dress worth less than $1).

Money is meaningless. It’s value is purely there because governments say so, and that value is only realised as long as that government is trusted.

This raises interesting questions as money’s value becomes meaningless when a government is in crisis and, right now, we have several governments in crisis.

Italy is a great example. Italy, a good EU state and member of the euro, is in crisis with the coronavirus and Christine Lagarde, the new head of the European Central Bank (ECB), should have stepped up to the mark to back the Italian economy. Instead, she messed up big time.

The result is that there is a real discussion now of the end of the Eurozone, something that is a consequence of this virus crisis. Italy will be the first to go, followed closely by Spain and others. Why? Because if the ECB tells Eurozone countries to dig themselves out of the coronavirus crisis on their own, then these states will fail all tests of Eurozone membership eligibility.

We see this already in Italy. Bearing in mind the impact of the Global Financial Crisis, which was closely followed by a European Sovereign Debt crisis, Italy’s economy has been fragile to say the least. Several of its large banks have been under-capitalised and on the brink of death, including the world’s oldest surviving bank Monte Paschi di Siena. In 2020, it may well be buried, as may many other institutions.

The Economist picked up on this story last week, and makes clear that both the Italian government and ECB are backed into a corner. They cannot reduce interest rates, they cannot create money from thin air, they cannot back their banks, they cannot continue … unless something drastic is done.

What?

Who knows? There’s no answer. I guess the answer will be to rethink the rules. To rethink money and what it means. To rethink the systems and how it works.

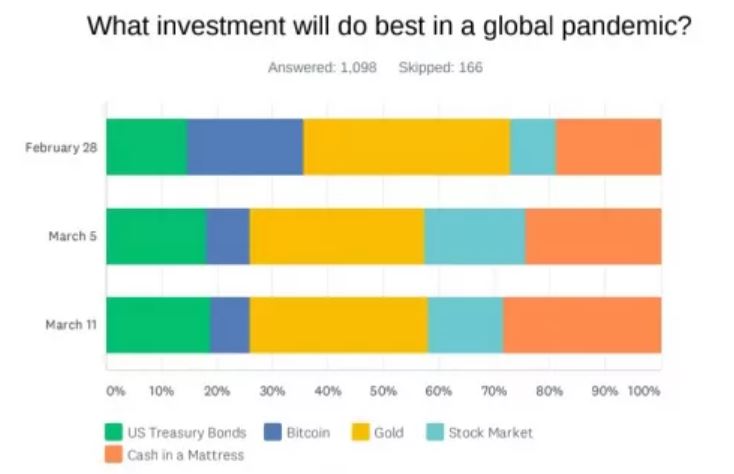

Some of us thought it would be a rush to bitcoin, but bitcoin’s price is going through the floor as folks cash in to give themselves cover.

People thought it was a rush to gold, but gold prices increased and have now plateaued as people cash in to give themselves cover.

In other words, what people are doing is liquidating all assets to give themselves immediate short-term liquidity. Cash may be worthless, meaningless and irrelevant but, in an environment of massive uncertainty, it’s the one thing you can guarantee will give you access and opportunity.

So, cash may be meaningless, but it’s still king. Now, there’s a surprise.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...