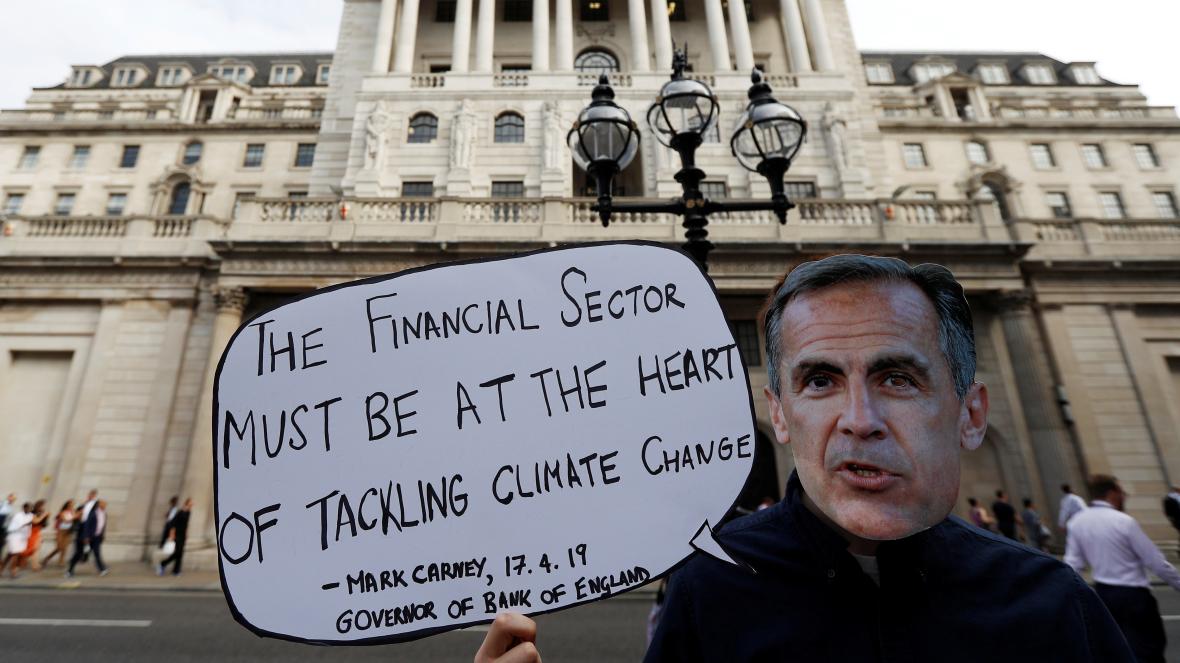

On Sunday, Mark Carney leaves the Bank of England after almost seven years at the helm.

There's an interesting review of Mark Carney’s tenure as Governor of the Bank of England on Bloomberg. Joining the Bank back in 2013, before the Scottish referendum and Brexit vote, it charts his seven years in charge as he is due to leave on March 15 this year.

Mark has been integral to the UK economy during this turbulent period and, more than this, has been instrumental on the Financial Stability Board and other committees. One thing jumped out in the review however:

“While Britain’s protracted exit from the EU dominated his tenure, that didn’t stop Carney pursuing passion projects such as exploring financial risks from climate change ... His green efforts were initially scoffed at for being outside his remit; now, the topic is so fashionable for central banks that he seems visionary.”

So, what has Mr. Carney been doing about climate risk?

A lot.

In fact, it’s his passion, along with other things. Even back in Canada in 2008 he was working on climate policies. After working with the Canadian government to sell their share in Petro-Canada, “Mr. Carney was devising market-friendly ways to tackle climate change”.

Soon after starting with the Bank, he reported to MPs that much of the oil, coal and gas reserves were unburnable and would become stranded assets. That letter was seen as a highly unusual move, according to the Financial Times, and a “sign of regulators’ concern about the potential financial fallout of global warming.”

In 2015, Mr. Carney followed up this passionate focus upon sustainable finance with a speech at Lloyds’ of London, where he states:

There are three broad channels through which climate change can affect financial stability.

First, physical risks: the impacts today on insurance liabilities and the value of financial assets that arise from climate- and weather-related events, such as floods and storms that damage property or disrupt trade.

Second, liability risks: the impacts that could arise tomorrow if parties who have suffered loss or damage from the effects of climate change seek compensation from those they hold responsible. Such claims could come decades in the future, but have the potential to hit carbon extractors and emitters – and, if they have liability cover, their insurers – the hardest.

Finally, transition risks: the financial risks which could result from the process of adjustment towards a lower-carbon economy. Changes in policy, technology and physical risks could prompt a reassessment of the value of a large range of assets as costs and opportunities become apparent.

And concludes that: “The combination of the weight of scientific evidence and the dynamics of the financial system suggest that, in the fullness of time, climate change will threaten financial resilience and longer-term prosperity.”

The speech was a landmark moment and worth the 30 minutes to watch it.

Alternatively, you can read the speech here.

After the speech, there was a “firestorm of criticism” and he was viewed as a bit of a basket case. Not so today.

However, since that 2015 speech, there has been a continuance of work by both the Bank and Financial Stability Board (FSB) on climate risks. This work led to two key movements. First, the Prudential Regulation Authority (PRA) and Financial Conduct Authority (FCA) created a joint Climate Financial Risk Forum in March 2019. Second, the FSB created the Task Force for Climate-Related Disclosures, which I referenced recently.

The result is that Mark has become friends of a few climate activities like Greta Thunberg. When she was invited to guest edit BBC Radio 4’s Today programme in December 2019, she chose David Attenborough and Mark Carney as star guests. On the show, he states:

“A question for every company, every financial institution, every asset manager, pension fund or insurer: what’s your plan? Four to five years ago, only leading institutions had begun to think about these issues and could report on them. Now $120 trillion worth of balance sheets of banks and asset managers are wanting this disclosure [of investments in fossil fuels]. But it’s not moving fast enough.”

For all of this, he has seen Britain through a Brexit crisis, overseen the rise of London and the UK as a FinTech centre and managed to ensure the economy hasn’t gone off the rails when the British government has changed more often than most.

No wonder he ended up being voted Central Banker of the Year by the world’s central bankers this year and is now moving to a new role as the United Nations Special Envoy for Climate Action and Finance.

Respect.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...