I have a few favourite FinTech firms: Ripple, Prosper, Lending Club, SoFi, Zopa, Monzo, N26, TransferWise, Klarna, Stripe, Alipay, WeBank and more. A lot of it is because I knew these firms as fledglings and have enjoyed watching them grow up. One firm in this crew is Wirecard, the German bank behind many of Europe’s innovators. Wirecard are a partner of Alipay, provide the processing behind many FinTech startups and are a fully fledged European bank based in Germany but with global operations.

Now, I don’t like to talk about my favoured FinTech start-ups much, as this blog is meant to be neutral and unbiased, but there were a couple of recent Wirecard announcements that caught my attention and may indicate a growing trend towards the future.

The first is a joint venture between Klarna and Wirecard:

Wirecard and Klarna Launch Joint Payment Solution for Merchants

Wirecard, the global innovation leader for digital financial technology, and Klarna, a leading global payments and shopping provider, announced today the launch of a new enhanced joint payment solution. All three Klarna shopping methods, Pay Now, Pay Later and Klarna Financing, can now be embedded into merchants' checkout via a single integration through the Wirecard digital financial commerce platform to boost average order value, conversions and hence fuel growth for merchants.

This demonstrates something that Wirecard, Ant Financial (Alipay) and others are brilliant at: partnerships. Wirecard has been building partnerships for years and expanding their global footprint by doing so. I’ve written for a long time about how banks struggle with partnering, because it means an equitable relationship and opportunity. Often, the bank thinks they are above such relationships and hence treat the partner as inferior. FinTech firms who see themselves as part of an ecosystem don’t think this way. They start with a view of core competency – processing and payments – and then expand from there. That’s what Wirecard does really well.

A second announcement is also of note:

Wirecard to process GrabPay e-wallet transactions

Digital financial technology provider Wirecard AG is partnering with Grab to process transactions from the GrabPay e-wallet in Malaysia, the Philippines and Singapore. Consumers can use the GrabPay e-wallet to pay for transactions online and offline, for Grab services like ride-hailing or food delivery, but also for purchases on e-commerce sites or at physical stores. Through this partnership, Aschheim, Germany-based Wirecard will process card transactions for GrabPay through its digital financial commerce platform and extend GrabPay to more merchants to expand the acceptance of the mobile payment method.

This again shows the spirit of partnering in an ecosystem, but extending this out to non-financial third parties who need easy financial processing. It wouldn’t surprise me if Wirecard expanded in future, for example, to offer Grab drivers loans and deposit accounts. That’s a strategy I would follow.

Then there’s a third announcement that came out the other day:

Alipay owner Ant Financial takes minority stake in Klarna

Some big moves in the payments platform space: Ant Financial Group, the owner of China’s Alipay payment platform, has announced it’s taking a minority stake in Swedish payments platform Klarna . Klarna has a strong European presence and a flagship product that lets shoppers buy now and pay later in interest-free instalments (typically 14 or 30 days after the purchase).

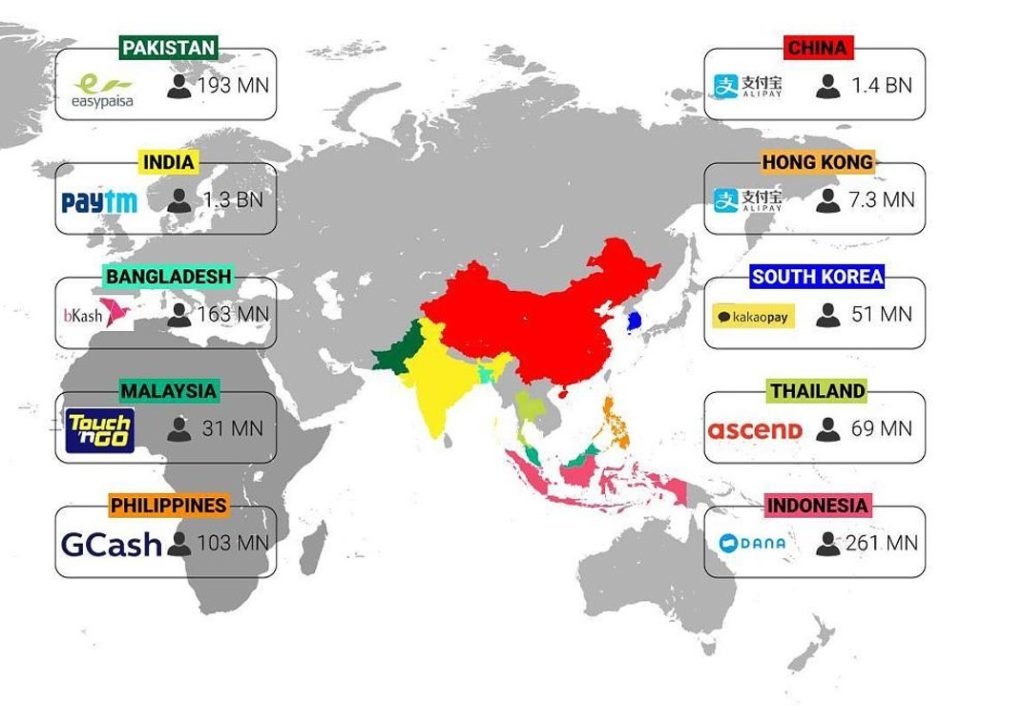

Bearing in mind that Alipay and Ant Financial are the power behind most of the world’s mobile wallets …

... and work with Wirecard as a partner in Europe, they really understand the partnering model by building a global ecosystem of specialisations on their platform .

The reality of these three announcements is that it shows how a global financial ecosystem is maturing. It’s something I’ve blogged about for ages, but come back to this specific blog entry from 2017:

One brilliant thing is way better than 1000 average ones

If the bank that does 1000 things average, cemented to its past, is not agile enough to update daily and refresh their core regularly, they will be outsmarted by those who can. Those who can will then recognise that the banks are doing 1000 things average, and will naturally come together to do 1000 things brilliantly.

This is the strategy that Wirecard, Ant Financial, Klarna and others are demonstrating and following, working together to co-create, mentor, invest and partner. A bank struggles with this model. These guys don’t. Watch this space.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...