Most of the people around the world have savings that can last them less than a month. In the USA, 29% of households have less than $1,000 in savings; in the UK, 15% of Brits have no savings at all; and in most economies worldwide, a large tranche of society have only got enough to live for a week or two.

Now, with this lockdown, I wonder what it is doing to those people, particularly in the USA. Half of America won’t get a pay check next month. According to The Guardian:

“An additional 4.4 million Americans filed for unemployment last week adding to a total of over 26 million since the coronavirus pandemic shut down swaths of the US and brought its economy to a standstill … in Florida, bedevilled by the widespread collapse of its already flawed benefits system, just 14.2% of the more than 668,000 claims filed since 15 March have been paid.“

Calls to domestic abuse hotlines have shot through the roof, even in virtuous New Zealand, and some countries even locked down and banned alcohol and cigarette sales. People will be angry.

What will happen?

As someone who spends his life looking at the future, I have to admit:

I HAVE NO IDEA

I’ve never been in a position where the world just shut down and stopped. None of us have. What does it mean? What will happen? What does the future look like?

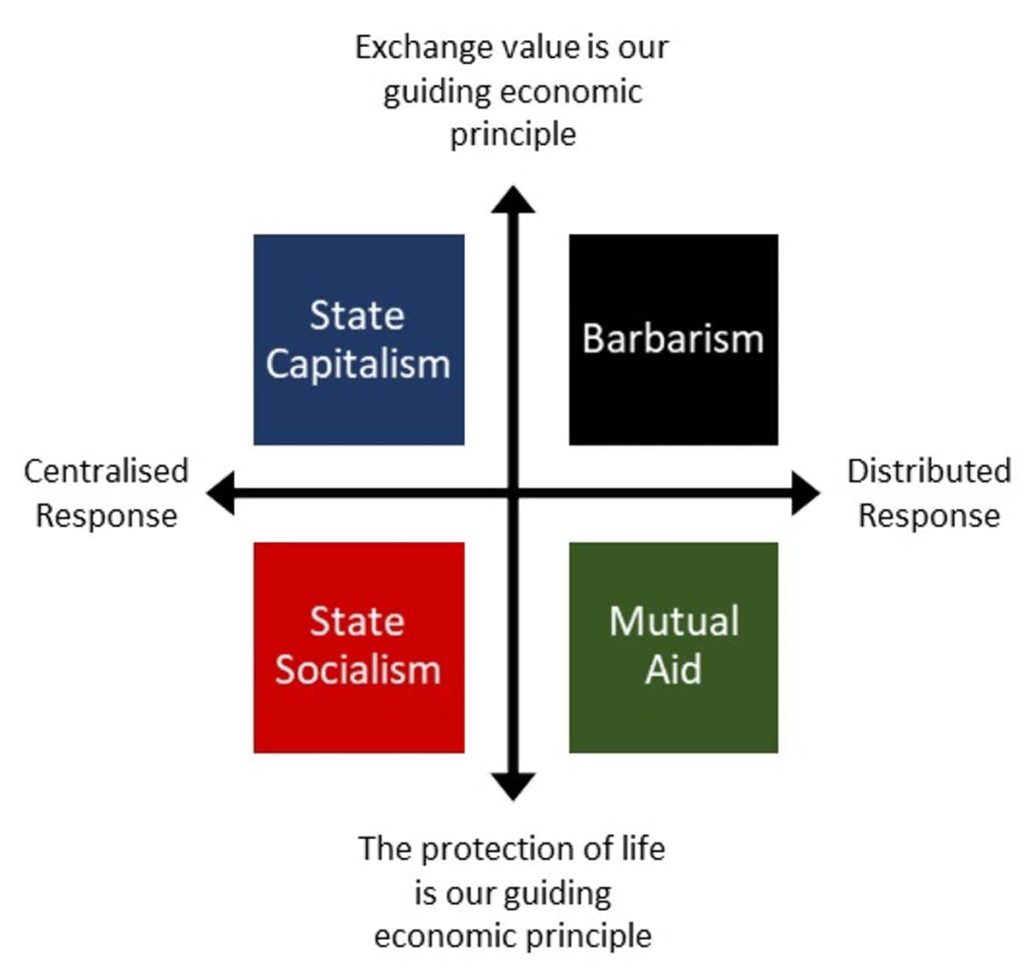

Well, there is a future. This pause in the world will end at some point. And we have been in this position before. Bubonic plague and Spanish flu came and went, as will coronavirus. But, when looking for an answer, I stumbled over this article in The Conversation which describes four future scenarios: a descent into barbarism, a robust state capitalism, a radical state socialism, and a transformation into a big society built on mutual aid.

The article is written by Simon Mair, Research Fellow in Ecological Economics at the University of Surrey, and describes four scenarios for the future (abbreviated):

State capitalism

State capitalism is the dominant response we are seeing across the world right now. Typical examples are the UK, Spain and Denmark. The state capitalist society continues to pursue exchange value as the guiding light of the economy. But it recognises that markets in crisis require support from the state. Given that many workers cannot work because they are ill, and fear for their lives, the state steps in with extended welfare.

Barbarism

This is the bleakest scenario. Barbarism is the future if we continue to rely on exchange value as our guiding principle and yet refuse to extend support to those who get locked out of markets by illness or unemployment. It describes a situation that we have not yet seen.

Businesses fail and workers starve because there are no mechanisms in place to protect them from the harsh realities of the market. Hospitals are not supported by extraordinary measures, and so become overwhelmed. People die. Barbarism is ultimately an unstable state that ends in ruin or a transition to one of the other grid sections after a period of political and social devastation.

State socialism

State socialism describes the first of the futures we could see with a cultural shift that places a different kind of value at the heart of the economy. This is the future we arrive at with an extension of the measures we are currently seeing in the UK, Spain and Denmark.

The key here is that measures like nationalisation of hospitals and payments to workers are seen not as tools to protect markets, but a way to protect life itself. In such a scenario, the state steps in to protect the parts of the economy that are essential to life: the production of food, energy and shelter for instance, so that the basic provisions of life are no longer at the whim of the market. The state nationalises hospitals, and makes housing freely available. Finally, it provides all citizens with a means of accessing various goods – both basics and any consumer goods we are able to produce with a reduced workforce.

Mutual aid

Mutual aid is the second future in which we adopt the protection of life as the guiding principle of our economy. But, in this scenario, the state does not take a defining role. Rather, individuals and small groups begin to organise support and care within their communities.

The risks with this future is that small groups are unable to rapidly mobilise the kind of resources needed to effectively increase healthcare capacity, for instance. But mutual aid could enable more effective transmission prevention, by building community support networks that protect the vulnerable and police isolation rules. The most ambitious form of this future sees new democratic structures arise. Groupings of communities that are able to mobilise substantial resources with relative speed. People coming together to plan regional responses to stop disease spread and (if they have the skills) to treat patients.

The article is a good read and it led me to conclude that the free market economics of America is probably over. The state socialism of China may take over. Martin Wolf writing in The Financial Times implies that the balance between the two world superpowers may even be at a tipping point, where China becomes the world superpower post-pandemic. We shall see.

However, one thing that really struck me in the article by Simon is that he points out how many jobs are pointless. In a crisis, the government lists essential jobs and it’s not consultants, developers and investment bankers; it’s doctors, nurses, transport and garbage workers.

Food for thought.

We are in a world where governments are bailing out the people and the people wonder what governments are for. I have no answers. I have no idea what the future looks like right now. It’s not normal. It’s a new normal. Do you have a view? Do you have an idea?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...