There’s lots of talk about civil unrest, an unjust society, the need for a universal basic income, a change in attitude towards everything from capitalism to socialism to democracy to inclusion.

Good discussions but hard to know how it plays out.

In many countries, people are suffering so much. They’re starving, they have no government bailout, they’re screaming in pain and begging for some form of help. This is especially true in nations that were strained beforehand and now are broken.

However, this equally applies to nations we thought were strong like the USA. The idea of Americans being given bailouts, free food, free healthcare, free money … jeez, that’s a real issue for many in the free world.

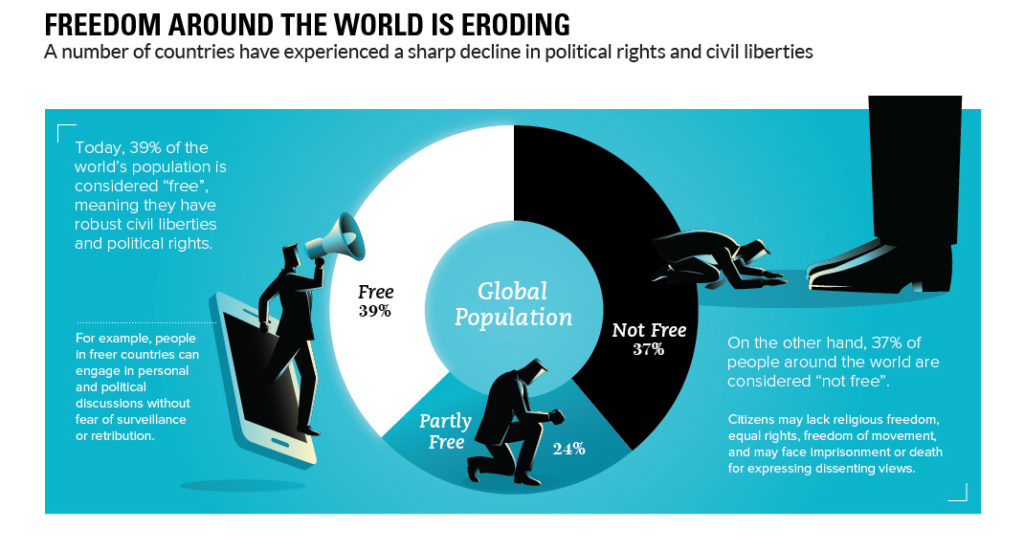

Source: Visual Capitalist

But then we question what all that means. What is a ‘free world’? What is freedom? In a shutdown, lockdown, meltdown, there is no freedom. There’s just staying in and watching Netflix in your very own small or big jail cell.

I hate the fact that my brain wanders and ponders all of these big macro and micro social issues, but then you spend so much time clicking, reading, thinking whilst this crisis continues that you find yourself wondering down rabbit holes you didn’t even know exist.

My latest one was sparked by MIT Technology Review who produced a fascinating piece:

This is what it will take to get us back outside

[The New Normal] will entail a considerable degree of surveillance and social control, though there are ways to make it less intrusive than it has been in some countries. It will also create or exacerbate divisions between haves and have-nots: those who have work that can be done from home and those who don’t; those who are allowed to move about freely and those who aren’t; and, especially in the US and other countries without universal health coverage, those who have medical care and those who lack it …

As you contemplate that future, spare a thought for the billions of people in the world for whom even social distancing and basic hygiene are unaffordable luxuries, let alone testing, treatment, and technologically advanced governments. The pandemic will roar through the slums of the world’s poorest countries like fire through sawdust. In their considerably younger populations, it will probably be less deadly than in the rich world. But an unchecked pandemic there may also oblige other countries to keep their borders closed for longer to protect their own populations.

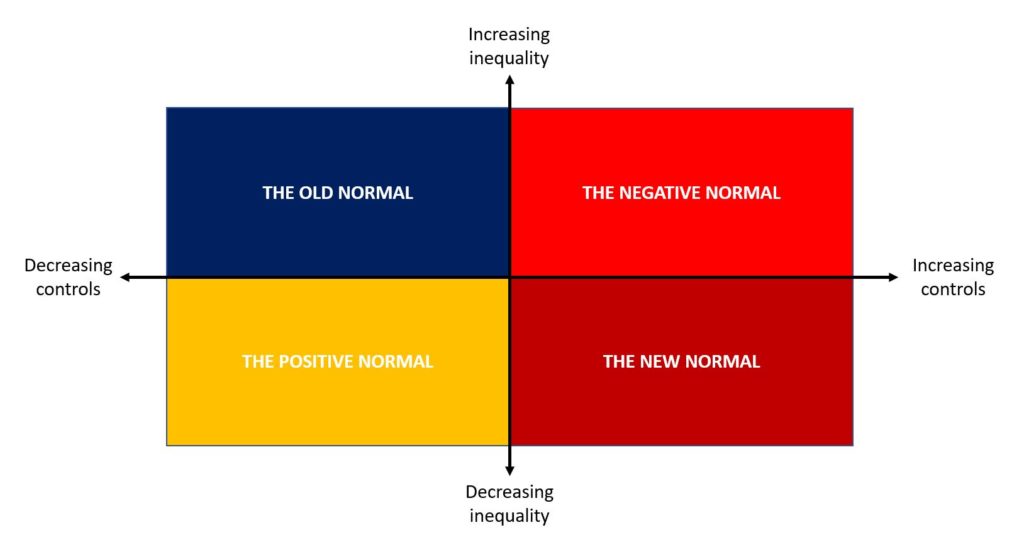

It made me consider the scenarios I would put in place, so I drew them up on a basic PowerPoint.

The difficulty with any scenario planning is the choice of axis. The choice of axis skews the bias of the scenarios and views you present, but I chose mine based on two basic ideas: the post-pandemic world will either continue to have the pre-pandemic inequality in wealth and finance that we had, but it will now be accentuated and extreme; and the post-pandemic world will either return to a pre-pandemic freedom that we had of peoples, work and commerce, or will continue to lockdown and control things to some greater or lesser extent.

Obviously, long-term, we may get back to what the world used to be like … but, I doubt it. I would rather expect that we will see a continuance of some of the lockdown practices – social distancing, limits on travel, wearing of masks, etc – and that we will see mass human action against authorities over the extremes of inclusion and exclusion.

Anyways, here are my four basic scenarios based upon the axis chosen of increasing versus decreasing inequality and control.

THE OLD NORMAL

The first scenario looks at a return to the way it was. Inequality continues and we really don’t care about poorer nations, people starving and in need. All we care about is our house price, our bank balance and our status. Now OK, that’s a little bit derisory about the way it was but hey, it is the way it was. How have your views changed? What do you think today? Do you care? Many say that post-pandemic we will be kinder, more caring and more inclusive. It is possible but many will hanker for the olden days pre-pandemic and would love this to be the new normal. It won’t be, I promise you. The old world pre-pandemic has gone forever. This means one of the three other scenarios is most likely to be the new normal.

THE NEGATIVE NORMAL

A negative normal world is one where governments increase control but do not address the inequalities in societies. They let the poor rot and the rich get richer. That world just won’t work. That world will result in civil unrest, civil wars, a mass pushback and a world wrecked. You cannot keep millions of people down with thousands of officials. They will be overcome. Let them eat cake? I don’t think so and so this world is also untenable, although some countries will be like this for the foreseeable future. They’re called dictatorships.

THE POSITIVE NORMAL

In this scenario, we open the world back to the way it was with decreasing controls but, due to the coronavirus pandemic, address the inequalities in society too. In this scenario, the dream of democracy and inclusion is created. Everyone gets a universal basic income; everyone gets their loans and bills postponed for as long as they need; everyone gets encouraged back to work; but doesn’t have to work. Oh, it’s idyllic. It’s also complete cloud-cuckoo land. That’s not going to happen, except in somewhere like Finland or Norway. Most countries cannot afford this model and don’t believe in it.

So what is the new normal?

For most it’s this.

THE NEW NORMAL

The new normal is where we all work hard with increased controls but less inequality. We won’t see a full flattening of societies and complete democratisation. Instead, we will see that yes, there are more parachutes for people in need, but not a guarantee that you can just sit at home and binge watch Netflix. People still need to work but, with work, the State will have more control over how you do that. You will probably see the long-term adoption of wearing face masks and distancing, but Asia’s been doing that for decades. What’s the issue of the whole world doing it?

I honestly think the new normal for the majority of countries will be a return to working, mostly from home if you can, and travelling only when it is essential. The idea of tourism, travel and hospitality will be hit for years to come, as who wants to go out unless it’s essential? It may well be that we get back to an older normal eventually, but I cannot see the motivation to travel to conferences or holidays being so great if it means you might get quarantined for two weeks on arrival because you happen to have a headache.

I’d be interested in your views. These are just mine, whilst I sit and let my brain wander and wonder.

Oh, and if you want a specific view of The New Normal in banking and finance, Bill Streeter summarises new research about this over on The Financial Brand. Key messages?

- The industry entered the crisis period already on the cusp of some credit challenges. Delinquencies in credit cards and auto loans have been rising for several years.

- There are two upheavals going on: the COVID-19 crisis and plummeting oil prices. The oil downturn will hurt wide swaths of the U.S. economy.

- Government actions to mitigate consumer pain may push the problem upstream. Rent deferments, for example, could lead to defaults of investment property owners. Mortgage forbearance will adversely impact servicing firms and holders of mortgage-backed securities.

- CARES Act mortgage forbearance does not cover non-conforming loans and other private-backed loans banks carry in portfolio. These account for 37% of U.S. residential mortgage balances.

- Bankruptcies in the retail sector, already beginning, will further strain shopping center owners, in turn pressuring commercial real estate portfolios.

- In addition to a likely jump in credit losses, financial institutions will face an erosion of interest revenue. The experience of the 2008-9 recession suggests that consumers, once chastened by life-altering events, hesitate to borrow again for a year or longer.

- The loan slowdown will affect origination fees, and late fees will either dry up or be prohibited, along with overdraft fees.

... I'm off for a large shot of morning whisky.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...