In the latest example of a bank that couldn’t hack the digital bank market, RBS gave up on Bó last week. It surprised me as the bank only launched last November, to a fanfare of £100 million investment and the acquisition of the start-up they had been co-funding, Loot. The bank had been brewing towards launch over a period of three years and originally was started when RBS received a firm no from their proposition to acquire Monzo. Instead, they ended up building another Monzo, with far more investment and backing than Monzo ever received.

So, why close it down? And after less than six months?

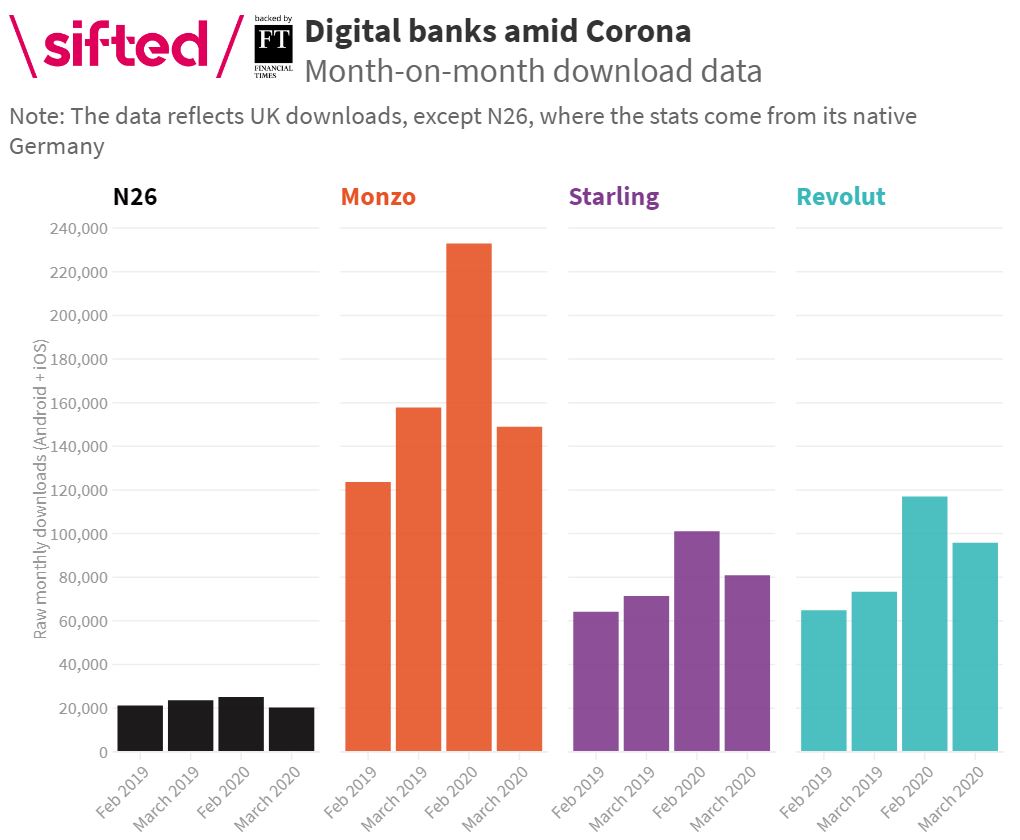

Well, times have changed. There’s a pandemic of course, and this has resulted in the UK banking marketplace flat-lining. These are the app download stats for the leading challenger banks in the UK in 2019 and 2020 for February and March, and shows a big dip in March 2020:

Source: Sifted

But it’s more than this. There’s billions being put to one side to cover losses during the pandemic. JPMorgan put $8 billion on one side to cover COVID19 exposures, and Barclays over $5 billion. RBS has already seen its profits wiped out in this crisis, and I’m pretty sure that building a new bank moved to the bottom of the priority list. But why not just freeze Bó until the crisis is over?

Well, it costs quite a bit to run a bank, pay the 150 strong workforce and support the 11,000 customers.

What?

11,000 customers.

After six months.

Ooooo. That’s the reason right there.

In fact, it’s the reason N26 pulled out of the UK market. They said it was due to Brexit but, tbh, how many new challenger banks does one country need? And how many can differentiate their proposition properly and fully from the rest? And how many can appeal to Gen Z and millennials as cool and not corporate? And how many can provide a service that rewards the customer and still makes a profit?

So, many questions.

There was also a lot more with Bó at issue, however.

Internal politics took over and the guy originally at the helm, Mark Bailie, left just after launch. We knew something was up right there. Why would you leave as CEO of a newly launched bank, two months after launch?

Well, background is useful and what was happening is that the CEO of RBS changed, as did the priorities of the state-owned bank. The new CEO, Alison Rose, is an interesting and strong steer at the top of the bank, and she has been making many tough decisions early. In fact, in February, it was clear that Bó was a problem child for the bank, and that she would likely cut it in the bud.

That may be the real reason why Mark left in February. It’s why they’re shuttering the bank in these tough times, and merging it with Mettle, the bank’s small business digital bank.

And, all in all in the scheme of things, Bó is not yet a major cost drain for RBS. An investment of £100 million against operating expenses of more than £9.6 billion for the bank as a whole is small beans. Nevertheless, what I could do with £100 million to build a new bank ... oh!

It reminds me of what the challenger banks tell me. They can build with 100 people and £1 million more in a month than a traditional bank could ever build with 1,000 people and £100 million in three years.

So true.

Meantime, I’ve always said that big banks who have retail operations should not build new digital retail banks, as they will never succeed. Someone asked me what blogs I’d written about it, and so here’s a small selection:

Question: change the bank or launch a new bank? June 2015

Wouldn’t it be simpler just to launch a new bank? October 2016

Clash of clans … or new bank versus old bank (Fidor, BPCE) , November 2018

Oliver Wyman recommend banks don’t try to be digital? What rubbish! February 2019

And these thoughts are best summed up in a chat I had with Jim Marous on The Financial Brand, when JPMorgan Chase shut down Finn, their digital bank (named after a Star Wars character).

“What is the commitment to the new bank’s success? Does it have the full support of the old bank’s executive team, in terms of budget, capital, resources and talent pool? What happens if the new bank eats into the products and services of the old banks’ lines of business? Will the SVPs be happy to see their bonus (or their existing career) destroyed by the newbie upstart?”

Oh, and if you want more insight on the story of Bó, checkout this Sifted article, which goes into more depth on the history, politics, failed technology stack and more. There’s also some fascinating comments on LinkedIn and Twitter when I shared the news on Friday.

Waste of time and money? https://t.co/aAk1v0JTup

— Chris Skinner (@Chris_Skinner) May 1, 2020

Postnote:

Bó is cow in Gaelic Irish (bovine) … but not a cash cow

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...