There's no logical reason for this, but I've decided the second week of June is women's week. It's a week to celebrate diversity, or the lack of diversity, in finance and technology. So, this week's blogs are all about women and finance and technology. To start with, let's look at banking.

Banks are traditionally run by testosterone. After the market crash, this was brought into question:

- Testosterone and high finance do not mix

- Testosterone is to blame for financial market crashes

- Is testosterone to blame for the financial crisis?

- Too Much Testosterone on Wall Street?

- How More Women On Wall Street Could Have Averted The Crisis

- Are men really hard-wired to take risks?

Therefore, over the past decade, an equilibrium has been occurring. Banks have been told to focus upon more diversity. However, as evidenced by my recent blog about financial myths, banks are still highly oriented towards white male rule.

That is changing, however. This struck me when I saw Anna Irrera’s write-up of UBS’s diversity figures.

UBS Group AG say that 38% of its employees in the Americas at the end of last year were women and 25% were people of colour.

That means 62% are men and 75% white.

While diversity was greater in hiring - with 42% of recruits being female and 38% non-white - it declined for promotions. A third of those promoted were women, while only 21% were people of colour.

That means two thirds of promoted people are men and 79% white.

The bank claims to have an objective to achieve a 50% level of diversity in the future, but has no timeline.

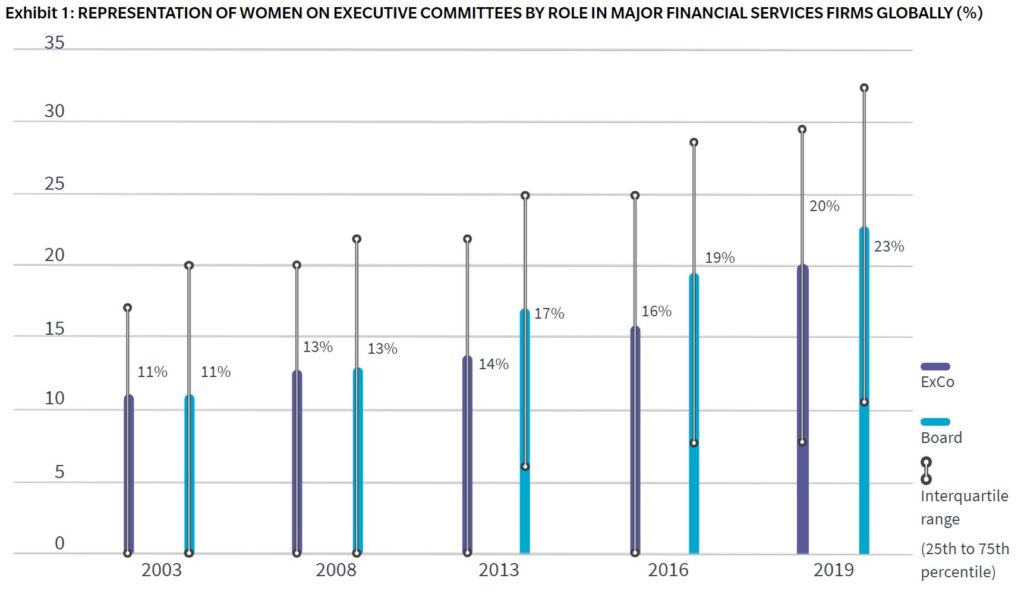

Meantime, according to research by management consultancy Oliver Wyman, women account for 20% of executive committee members in major financial services companies globally, while only 6% of CEOs are female.

It made me wonder about more diverse questions about the structure of finace and technology. After a few searches, there’s lots of information about this:

- Diversity and inclusion: Making diversity a reality: PwC

- How to create more diversity and inclusion in finance

- Diversity in financial services - KPMG Global

- Achieving Gender Diversity in the Financial Services Sector ...

- Women In Financial Services 2020 - Oliver Wyman

- The Importance of Diversity and Inclusion in Finance | Michael Page ...

- Financial services' 15-year gender diversity failure - FTAdviser ...

- Diversity in finance: special focus | Euromoney

- Diversity and Inclusion - House Financial Services - House.gov

And so I picked on one report, the Oliver Wyman report, and took a look. The report shows that female representation at board level has doubled since 2003 – yay! – but that number is still less than 1 in 4 board members – boo!

Ah well, there is still Sexism in the City.

Mind you, it’s nowhere as bad as in the technology sector. 92% of all technology funding goes to firms led by men, according to Atomico’s State of European Tech 2019 report. Surprsinlgy in countries like the Netherlands, it’s even worse with less than 1% of funding going to firms led by women.

Times will change but it leaves me with a thought from my time at Davos with the United Nations, where Goal #5 of the 17 Sustainability Goals for 2030 is gender equality. The specific aims of that Sustainability Goal is to:

- end all forms of discrimination against all women and girls everywhere.

- eliminate all forms of violence against all women and girls in the public and private spheres, including trafficking and sexual and other types of exploitation.

- eliminate all harmful practices, such as child, early and forced marriage and female genital mutilation.

- recognize and value unpaid care and domestic work through the provision of public services, infrastructure and social protection policies and the promotion of shared responsibility within the household and the family as nationally appropriate.

- ensure women’s full and effective participation and equal opportunities for leadership at all levels of decision-making in political, economic and public life.

- ensure universal access to sexual and reproductive health and reproductive rights as agreed in accordance with the Programme of Action of the International Conference on Population and Development and the Beijing Platform for Action and the outcome documents of their review conferences.

- undertake reforms to give women equal rights to economic resources, as well as access to ownership and control over land and other forms of property, financial services, inheritance and natural resources, in accordance with national laws.

- enhance the use of enabling technology, in particular information and communications technology, to promote the empowerment of women.

- adopt and strengthen sound policies and enforceable legislation for the promotion of gender equality and the empowerment of all women and girls at all levels.

Such great objectives … and, based upon current trajectory, we will get there by 2277.

Only 257 years to go girls.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...