A friend of mine, Alessandro Hatami, wrote an interesting piece on Sifted that I shared in my news yesterday. He claims that neobanks like Monzo and Starling are not reinventing banking at all. They’re just modifying and improving it. Alessandro then goes on to cite the key things that banking should really focus upon:

There are three things banking customers fundamentally need — and are worth disrupting. Let us try to imagine what ‘transformation’ in these areas could look like in ‘The Ideal Neobank’:

- A Payment Account: Imagine a bank that allows you to seamlessly pay anyone, anywhere: be it your babysitter, your favourite retailer or a holiday home abroad. The bank takes care of everything and you can always be sure you will always get the fastest, cheapest, most secure solution possible.

- A Credit Line: Instead of an overdraft, personal loan, credit card, car finance or a mortgage you get a credit line. The bank knows you and will advance cash (with guarantees if required) as you need it. You make one payment a month — like a subscription — to pay for it.

- A Savings/Protection Tool: You have some excess capital and the bank enables you to buy any product in the market that allows you to protect and grow it. This would not only include savings accounts and investments but also pensions and insurance. And your bank would sell you any such product in the market that meets your needs — whether or not it’s their product or a third party’s.

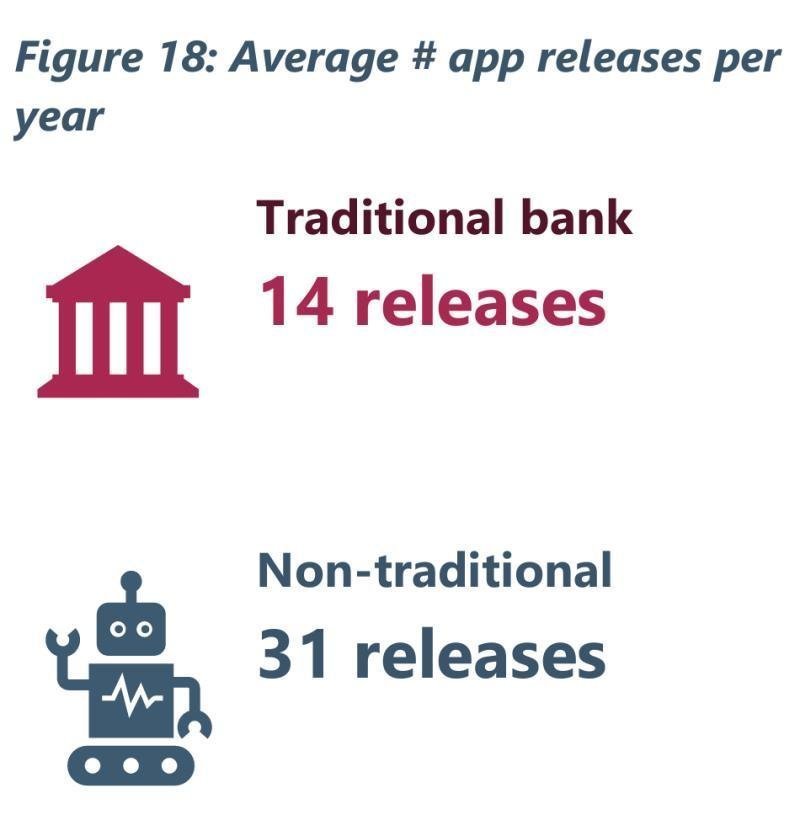

I agree and disagree with his view. I agree that neobanks are not really disrupting core banking. For example, the average old bank only updates its mobile apps 14 times a year, if they even have an app, whilst challenger banks update 31 times a year.

Source: Optima Mobile Banking App Review 2020

But do releases measure it? Do neobanks even do the right thing? Does Alessandro get it?

I’m not sure. I’ve written a huge amount of words about building a digital bank, but these musings made me go back to the whiteboard and start again. What would I do if I were launching a digital bank today?

For starters, I would ignore everything about banking yesterday. I would not start with payments, credit or savings in mind. I would go back to basics. What is banking for? Banking is for the exchange of value and getting the things you need or want.

Let’s start there.

There’s a difference between need and want. I need a home. I need food. I need to clean my teeth. I need to use the toilet. These are lifestyle things. For me, this is an important start point based upon user experience. People have lifestyle needs that involve money. I need to pay for my food, toothpaste and toilet cleaner. These are regular things that needs a regular bank, and this is what challenger banks seem to serve pretty well. But bear in mind that I’m not using the bank to pay for food, toothpaste and toilet cleaner. I’m doing this because I need to eat, wash and do that thing.

There are then the things I want. I want to have a holiday; I want a car; I want to buy a house; I want some art on the wall; I want to be better off. These are all things that are perfunctory. They are important to me, but not necessary for me. And they are mainly big-ticket items, where I need a loan or some form of credit. It’s a longer-term thing.

In other words, needs are now and wants are tomorrow. They are very different things and can be served in very different ways.

Then add to this the other communities. We talk too much about retail and consumer activities, but what about commercial and investment banking? Well, the same applies imho.

In corporations they have needs and wants – short- and long-term things. In institutional investors, they have needs and wants – short- and long-term things.

The key here is that design should start with what the customer needs and wants. The customer does not need or want payments, savings and investments. The customer needs and wants health, wealth and happiness. The customer needs and wants understanding, support and service. The customer needs and wants focus, advice and confidence.

I could go on (and on and on and on), but I guess my key point is nothing to do with customer experience or user experience; it’s nothing to do with customer journeys; and it’s definitely nothing to do with banking, payments, savings, credit or investing; it’s all about needs and wants.

Start with needs and wants, and the rest becomes obvious. The issue is that we rarely define needs and wants well. For example, I don't need or want money, payments, credit or investments. I need and want what it can do for me. That is all and, when you strip it back to that basic point, you realise one thing.

“A lot of times, people don't know what they want until you show it to them.” Steve Jobs

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...