I see lots of surveys and research about the use of technology in finance. Things like 47 percent of consumers are interested in biometric payments or 80 percent of consumers would use mobile payments. Then you look at the adoption rates and the actual usage is more like 4 and 8 percent respectively … if that.

It’s true that many technologies are available and make sense, but getting people to use them can be hard. Just look at the world’s most out-of-date markets or leading markets and you get the idea. America’s move to mobile payments and Chip & PIN has moved at snail’s pace, because paying by card, cash and check made far more sense. Meantime, Chinese consumers all jumped onto the mobile payments bandwagon, because what was there before was rubbish and the superapps offer was compelling.

This is why every market is different: it’s all down to who is offering what and how compelling is that offer.

In Europe and America, we all use PayPal because it made online payments easy; but how many of us use Apple Pay?

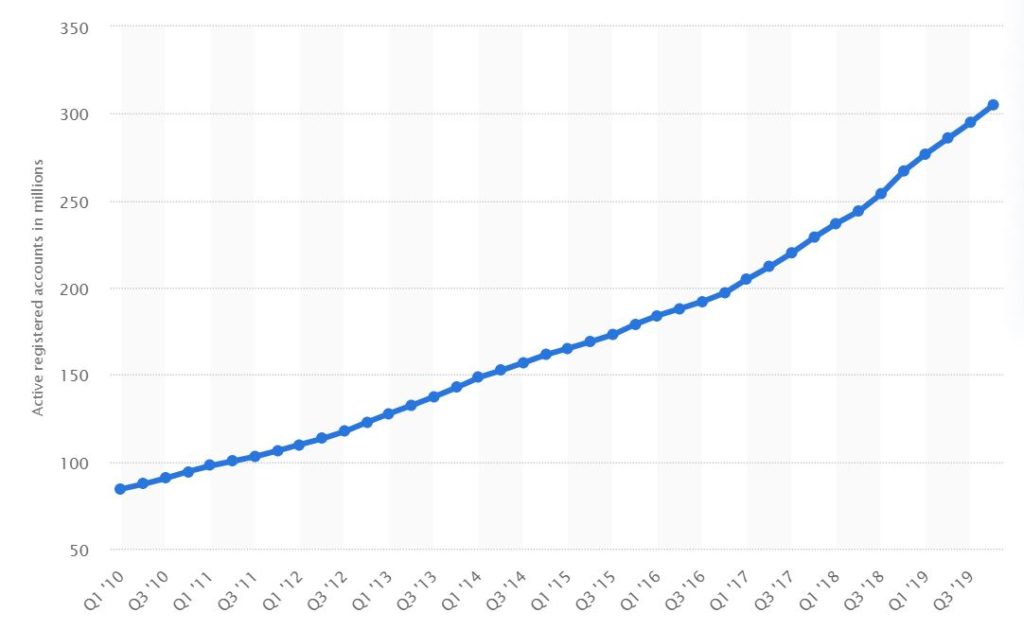

Number of PayPal's total active user accounts from 1st quarter 2010 to 1st quarter 2020(in millions)

Source: Statista

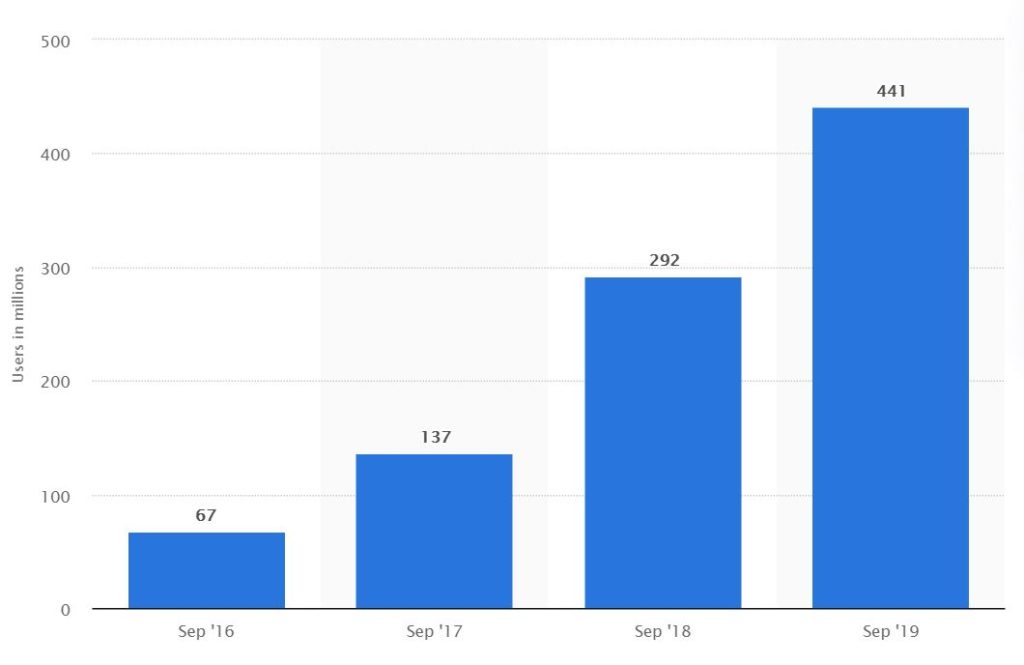

Number of Apple Pay users worldwide as of September 2019

Source: Statista

Now, there’s a surprise! 305 million active PayPal accounts (after over twenty years of operation), compared with over 440 million Apple Pay users (after five years). However, 441 million people may have activated Apple Pay on their iPhone but do they use it? According to other stats I've seen, about 1 in 5 do ... sometimes.

Hmmmm …

But do they actually use it?

PayPal processed $712 billion in payments volume last year compared to Apple Pay’s ? Apple don’t release stats but do compare themselves with PayPal. In the Q3 2019 earnings call, Tim Cook stated that:

Apple Pay is now completing nearly 1 billion transactions per month. That’s nearly double the number of transactions Apple reported in the year-ago quarter. During the June quarter, Apple rolled out Apple Pay to 17 new countries, “completing coverage in the European Union.” This brings the total number of Apple Pay markets to 47, according to Cook.

As for Apple Pay’s growth, Cook said that Apple Pay is now adding more new users than PayPal, and growing faster in terms of transaction volume: based on June quarter performance, Apple Pay is now adding more new users than PayPal and monthly transaction volume is growing four times as fast.

A billion transactions a month, where an average contactless payment is $10, would be $10 billion a month or $120 billion a year in value.

Interesting?

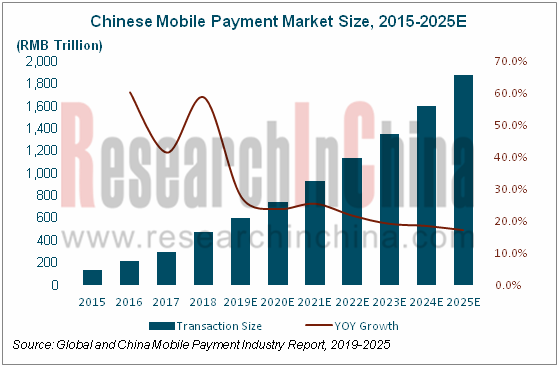

Nevertheless, these are small beans compared to the near $100 trillion of payments made by mobile in China.

Source: Research in China

Needs-must.

This is the real point. You can argue the numbers and we all respect the achievements of Apple, PayPal, Ant Financial and WeChat, but it’s all about needs-must.

Nothing succeeds if it’s not needed.

This is why I’m astounded – but not really – by the achievement of Zoom in Q1, where 169% growth in earnings occurred, mostly fuelled by March’s lockdown. Who knew about Zoom before March? Why have we all moved to Zooming? Why not Skype, Microsoft Teams, Facetime or something else?

TBH, it’s because Zoom was the easiest and most obvious choice and, due to needs-must, we were forced to adopt video conferencing as were all locked in at home. Why didn’t we continue with conference calling?

Well, part of it is due to the disembodied nature of a conference call with just voices. Who’s listening? Are you engaged? Are you still there?

The other part is that we, as humans, need face-to-face engagement. When that ability to engage face-to-face physically disappeared, we were forced to move to face-to-face engagement digitally. Needs-must.

This is what changes societies and behaviours. It’s nothing to do with technology, companies or ideas, it’s to do with timing and need. This is something that Apple has done right for years. No one wanted an MP3 player, as it was difficult to use. Download speeds twenty years ago were appalling. Who would want to use digital music? Then Apple perfected the iPod. The timing was right and the need was there, and it transformed music, markets and Apple.

The same was true with the iPhone. Who would want a phone without a keyboard? What’s the point of that?

Then mobile broadband, 3G, apps and services appeared that leveraged touchscreen and Blackberry and Nokia went out of business. Needs-must.

Always watch customers’ needs and how technologies can meet those needs. This is the point and it will make or break many companies in the years to come.

Needs-must.

Remember that.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...