I was sitting and thinking that I’ve been a bit negative in my recent posts. I don’t like being negative as I’m an optimist. So I determined that today I must write a cheerful story ... whoops! failed.

Instead, I woke up to the news that a young man had committed suicide possibly due to a FinTech app. The app is Robin Hood, a visionary start-up in the USA who I have admired from afar. It’s a standout start-up valued at $8.3 billion after a funding round in April 2020, mid-coronavirus crisis, making it one of the most valuable FinTech firms in the world.

“Robinhood is the California-based FinTech that allows its users to invest in public companies and exchange-traded funds on US stock exchanges without paying commission, foreign exchange fees or account minimums.”

Being commission-free, easy, technology-first and simple, it’s gathered millions of users over the past decade. At the end of last year, ten million users to be exact:

- “I think it’s just a testament to what we’ve been able to do,” Robinhood co-CEO Vladimir Tenev tells CNBC’s Jim Cramer about the company reaching 10 million subscribers.

- “We’re proud of the fact that we’ve enabled so many younger investors and first-time investors to have access to the markets” in the wake of the 2008 financial crisis, he says in a “Mad Money” interview.

- “We saw an opportunity to build a product that really spoke to [the millennial] generation, and commission is a part of it,” co-CEO Baiju Bhatt says.

In the wake of the 2008 financial crisis, the founders wanted to bring in “disenfranchised” millennials that were “frustrated ... with the way that the system worked,” Bhatt said. “We saw an opportunity to build a product that really spoke to that generation, and commission is a part of it. Part of it’s also building a product that’s easy to use, that’s mobile-centric and that really puts customers first” to drive us,” he explained. “The other part about this is is that from the very beginning our mission has been to democratize the financial system ... and it flows through all the decisions that we make.”

Laudable and appropriate but what happened? Why did this 20 year-old commit suicide?

The note found on his computer by his parents on June 12, 2020, asked a simple question. “How was a 20 year old with no income able to get assigned almost a million dollars worth of leverage?”

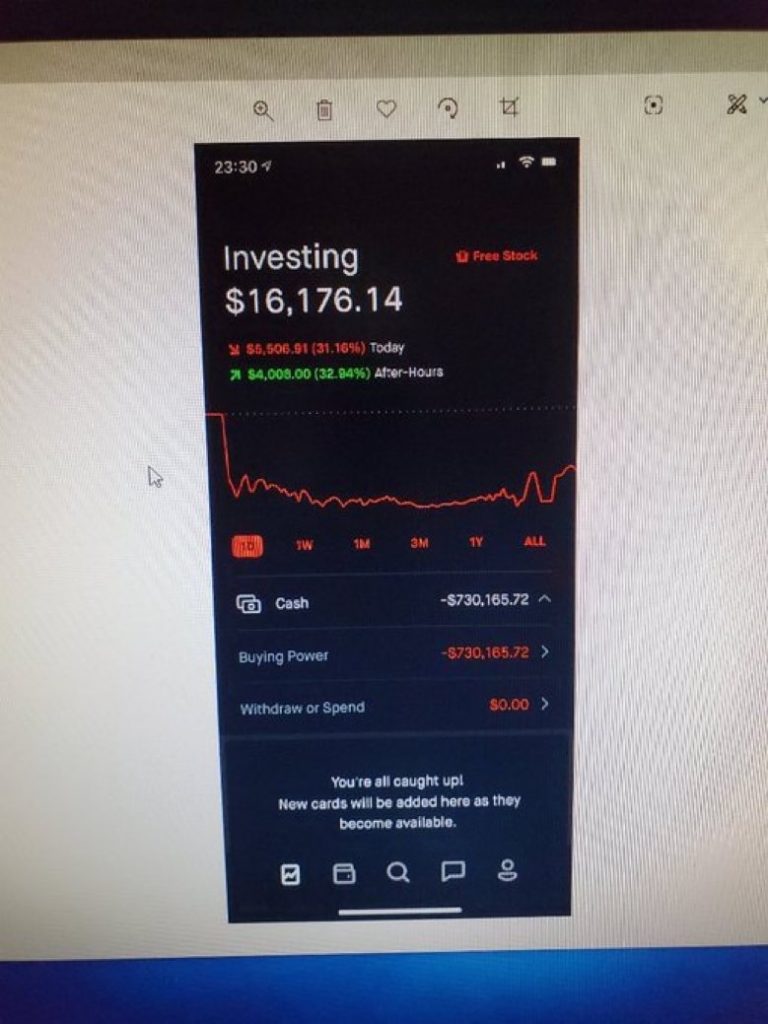

That’s a good question. Apparently young Alexander E. Kearns was checking his Robin Hood account last Thursday and saw this:

He immediately fell into despair after looking at his Robinhood account, which showed he owed a cash balance of minus $730,165. He believed that he was suddenly almost a million dollars in debt. Now, of course there may be other factors that contributed to his suicide, but what allowed a 20 year-old with no income to lose $730,165?

Answer: he didn’t.

He was trading put options. This Forbes article explains it well and the bottom-line is that it was an interface issue. He hadn’t lost $730,165 at all. He had a position on put options that meant he had an exposure which would be settled. However, instead of showing that this was his exposure and would be settled, it made it look like he had lost hundreds of thousands.

Kearns may not have realized that his negative cash balance displaying on his Robinhood home screen was only temporary and would be corrected once the underlying stock was credited to his account. Indeed it’s not uncommon for cash and buying power to display negative after the first half of options are processed but before the second options are exercised—even if the portfolio remains positive.

“Tragically, I don’t even think he made that big of a mistake. This is an interface issue, they have slick interfaces. Confetti popping everywhere,” says [Bill Brewster, Kearns’ cousin-in-law and a research analyst at Chicago-based Sullimar Capital Group] referring to the shower of colorful confetti Robinhood routinely deploys after customers make trades. “They try to gamify trading and couch it as investment.”

Hmmmm …

I really feel for this young guy and what might have been going on in his head when this happened. So sad.

Oh, and why am I posting this? Where's the cheerful bit? There isn't one, but I am posting this because it demonstrates that, whether a seasoned business or a new start-up, giving the customer the right information about money is critical for, if you get it wrong, it can lead to very bad things happening. Focus upon the customer experience, always.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...