I was having a bit of ding-dong over my article about the coronavirus pandemic being perfectly predictable and not a black swan. There are many who believe the reaction to the pandemic is a black swan, as in the lockdown of Planet Earth.

Hmmm … what reaction did we think we would have to a pandemic? Business as usual?

There’s actually quite a lot of articles about the likely view which were printed pre-pandemic.

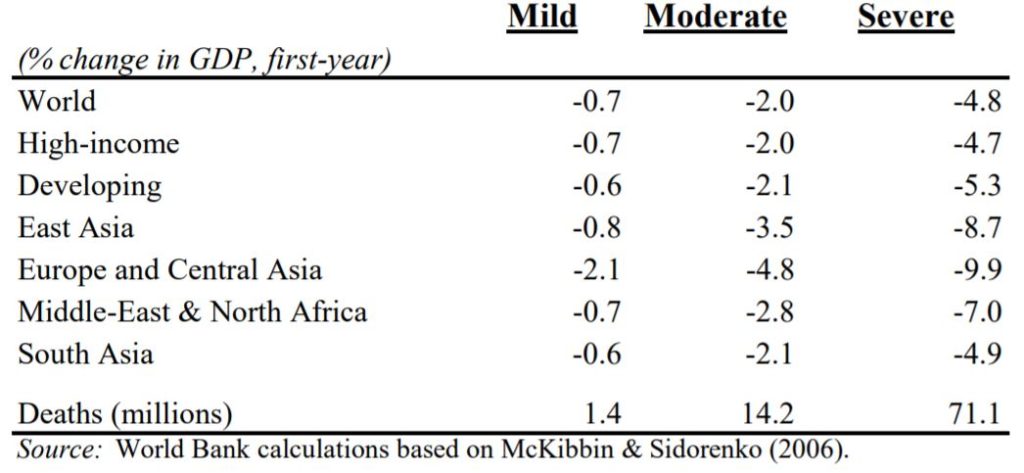

The World Bank simulated the economic impact of a pandemic back in 2008. In their most severe scenario – a repeat of the Spanish flu of 1918 – they estimated a global economic impact of -4.8% of GDP.

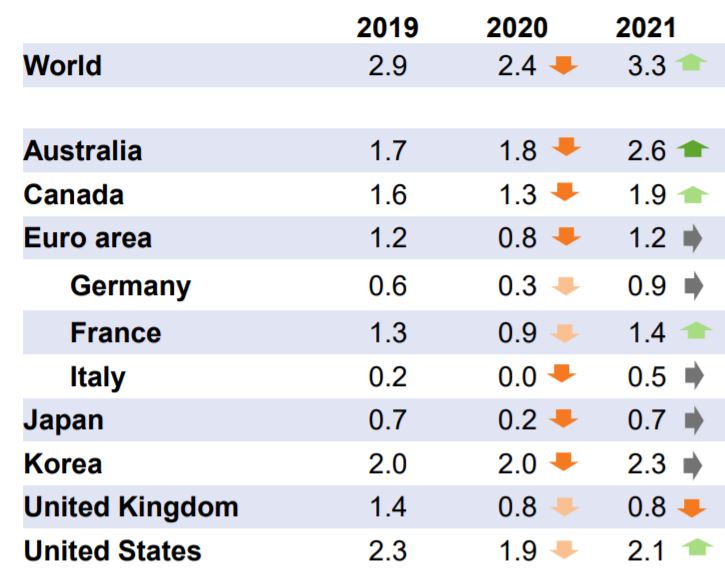

Interestingly, the OECD estimates we will see GDP shrink by -2.4% in 2020, based upon their March report.

Although the World Bank's latest forecast is more pessimistic at 5.2%, e.g. worse than their most severe forecasts twelve years ago; and Statista makes it a gloomy 7.7%.

Maybe this is the black swan aspect that no one forecast, e.g. the lockdown. Governments worldwide closing to travel, trade and movement is what many say was not foreseen. I might agree but, in hindsight, a global lockdown was obvious.

In 2015, here’s the World Health Organisation – WHO? – view:

At 2013 values, the expected losses for 2015 amounted to about 500 billion United States dollars (US$), i.e. about 0.6% of global income, per year.12 The estimated proportion of annual national income represented by the losses varied according to country income grouping, from a little over 0.3% in high-income countries to 1.6% in lower-middle-income countries.

Interesting estimates as the actual cost of the pandemic is probably going to exceed $100 trillion.

Yep, that’s $100,000,000,000,000 or 100 Amazon.com’s.

The question this raises is why were we so bad at forecasting this and the consequences?

Back in 2018, Global Risk Insights discussed the likely impact of a global pandemic and, like so many other articles, were pretty spot on with what would happen:

The Centers for Disease Control in the United States rate H7N9 as having a high likelihood of evolving into a wide-spread pandemic. Based on H7N9 cases in China, scientists know that 88 percent of those diagnosed developed pneumonia, and 41 percent of these patients died. H7N9 will not remain contained within China; as it adapts to the human body … the interconnectedness of the global economy is a blessing, but also the world’s Achilles heel. If H7N9 is the next pandemic, it is likely to affect millions of people and result in high death rates … the world devotes little to pandemic preparedness; a trend that should be reconsidered given the potential of likely social and economic disruptions that can ensue as a result of one.

And yet, when I look at the annual global risk estimates of the World Economic Forum, pandemics didn’t even appear. Here’s their chart of global risk priorities 2009-2019 (double-click the picture to see it properly):

Chronic disease – a pandemic – appears in 2009 and 2010, as that’s when the last pandemic occurred, but thereafter it's all the green stuff, as in environment that takes precedence.

It is also notable to think about the fact that, although this is the first pandemic I’ve really noticed - as it’s the first that’s really disrupted my life - they actually occur quite frequently. Just not in recent time and not as globally connected, I guess.

Anywho, this is the one we are experiencing right now. Not great, is it? But one thing’s for sure: there will be another one some time, and it’s not a black swan event.

For example, a survey of actuaries in November 2019 on global risks put the climate emergency at the top of the list. Way, way, way down the report and the lists (page 12) was the likelihood of a pandemic. The report was published in March with an extra note:

Interestingly, since the survey closed and before this report is released, a coronavirus named COVID-19 has developed and spread internationally. This will enable medical, government, and financial professionals to test their preparation work done in advance for pandemic/infectious disease risk.

Hmmm …

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...