I have a few friends around the world that I pick up on, and The World Bank and CGAP are amongst that crew. Therefore, when I saw that Peter Zetterli, senior financial sector specialist with CGAP, was blogging about financial inclusion I couldn't but help reach out to him and ask him to write a little something for me. Kindly, he did. Here it is ...

New Trends in Digital Banking for the Poor by Peter Zetterli and Ivo Jenik

With a steady stream of challenger banks emerging across the globe, there’s an ongoing debate over what this will mean for incumbents, bank customers and regulators in the world’s wealthiest countries. But another important question to ask is: how is digital disruption transforming the financial lives of the world’s three billion unbanked and underbanked customers, who mostly live in developing economies?

CGAP has been working for the last fifteen years on what could be thought of as the first fintech revolution in developing economies: mobile money.

Digital payments accounts accessed through mobile phones have enabled a billion people — many for the first time — to access basic financial services. They have helped propel basic financial access worldwide from 51 percent to 69 percent in just six years. Even so, mobile money is falling short of truly achieving financial inclusion.

In a sense, you could say that financial inclusion has been broad but shallow. Most mobile money accounts come with only a limited range of payments services, offering little or no access to credit, savings, insurance or investment products. Regulatory restrictions and business models that depend heavily on transaction fees have made it difficult for most mobile money providers to expand their offerings.

This may be about to change, thanks to a new wave of tech-driven financial services that seem likely to gather momentum over the next five to ten years.

A range of digital technologies and business models that have already transformed other industries — cloud computing, application programming interfaces (APIs), machine learning, software-as-a-service, platforms — are making themselves felt in the banking sectors of developing economies. Specifically, they are enabling three business models in digital banking that offer real potential to deepen financial inclusion:

- Banking-as-a-Service (BaaS) players are basically technology companies with banking licenses. They offer their technology paired with their license as a white-labeled service to other bank or non-bank companies. This service enables fintech start-ups and big incumbents from other sectors to deploy financial services much faster and at lower cost. Crucially, it allows such companies to retain a laser-sharp focus on their customers’ needs instead of the back-end aspects of banking. The result is an improved customer experience and greater competition for consumers. But the model also allows traditional banks to experiment with new technology and digitalize faster. Importantly, BaaS players can form the connective tissue between finance and the digital economy. For example, companies like SolarisBank (Germany), Green Dot (U.S.), Fidor (Germany) and Cross River (U.S.) seamlessly integrate payments, credit and insurance products into e-commerce.

- Marketplace banks bring the convenience of a grocery store to financial services. They curate a marketplace where all of a customer’s financial needs can be met in one place through products offered by the bank and third parties. They foster cost efficiencies and competitive dynamics that can drive down end-user prices, while making it easier for consumers to find, compare and use new products. In creating an intelligent and frictionless financial supermarket, these banks can deepen financial access across the range of financial services. Starling Bank (UK), Fidor (Germany), Alipay (China) and WeChat (China) all use this model, and we expect to see more providers move in this direction as part of a general shift toward platforms in the digital economy.

- Fully digital retail banks have a revenue model similar to traditional banks but follow a very different operational model. They run on smartphone apps and modern back-end systems and have little or no physical infrastructure. Their leaner cost structure enables them to beat traditional banks on prices, while data-driven due diligence and decision-making processes reduce their reliance on collateral and formal documentation — two significant hurdles to reaching more customers in developing economies. Meanwhile, their capabilities in product design, user interfaces, integration and intelligence allow providers to create more varied and personalized solutions that meet the needs of a wider range of customers. We find examples all around the world, regardless of income level and stage of development: Revolut, Monzo, and N26 (all in Europe), Nubank (Brazil), TymeBank (South Africa), 811 (India) and Xinja (Australia), to name a few.

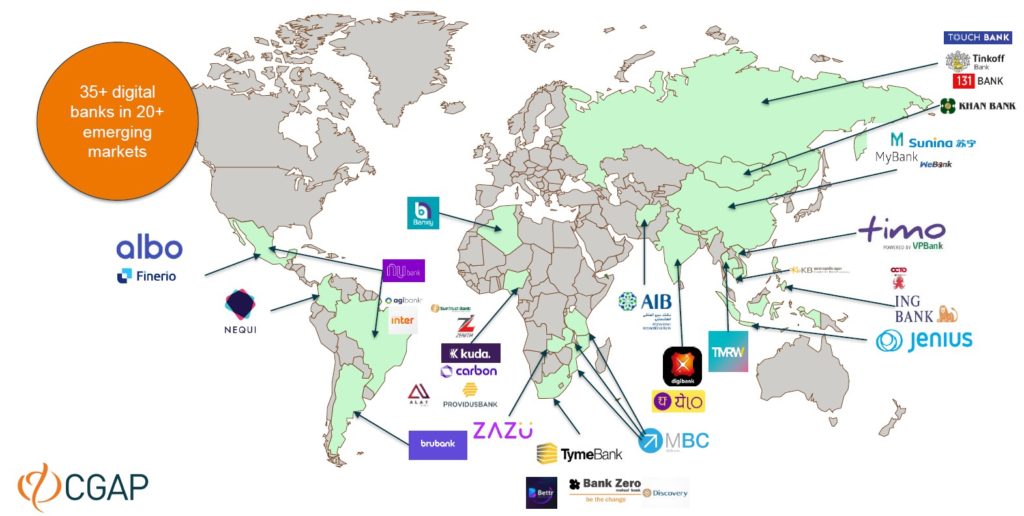

While digital banking is often talked about as a developed-country phenomenon, there are already dozens of digital banking players in developing markets that use these models, and more are joining almost every week. If the list were expanded to include players that have a payments license or rely on a partner bank’s license rather than their own, the list would be substantially longer.

As part of CGAP’s research on fintech and the future of digital banking, we will publish case studies that go deeper on some of these players’ business models and what they bring to financial inclusion. The evidence so far indicates that they can indeed address some of the key challenges faced by excluded customers, such as cost, access, product fit and relevance, and user experience.

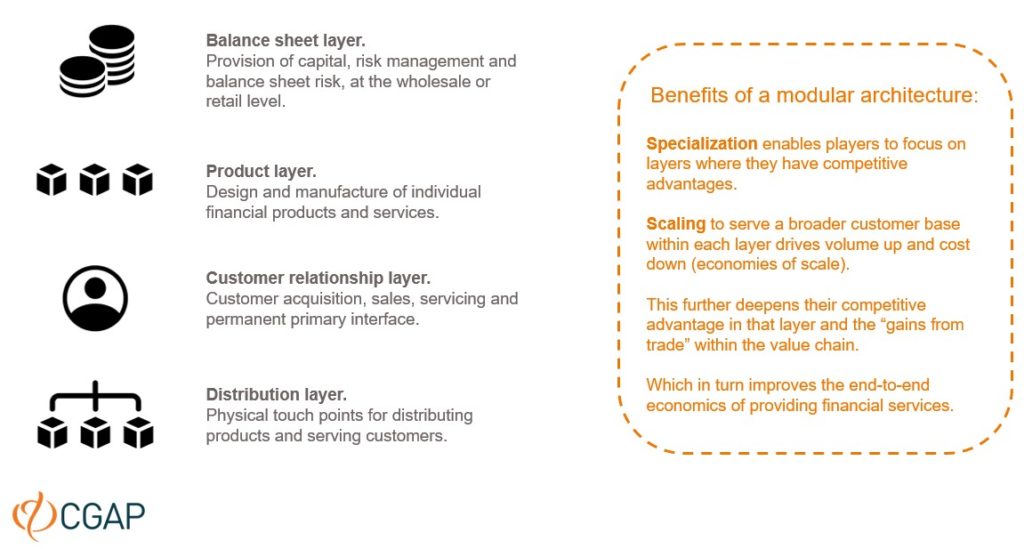

Moreover, we believe that as a result of the current trends, the financial sector will reorganize and rationalize around four main roles in a more modular architecture. This could materially reduce cost and increase value in the end-to-end chain, as different participants — banks, fintechs, platforms, etc. — each play the roles they are best suited for and form partnerships to fulfill other roles.

The four key market layers of financial services in which players will increasingly carve out specialized roles.

Whatever the details of how this modularization plays out, we believe it can be a good thing for financial inclusion. By lowering costs, expanding eligibility, sharpening competition, broadening offerings and increasing the intelligence and customization of financial solutions, it has the potential to make financial services more accessible and relevant for low-income customers.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...