I stumbled across a great article about Brazilian neobanks the other day. Bearing in mind that Nubank is the most successful neobank in the world, with 25 million users at the start of June.

As a result, when I saw a great article about banks in Brazil by Contexto, who cover FinTech LatAm, could I republish here and they kindly said yes. So, here it is:

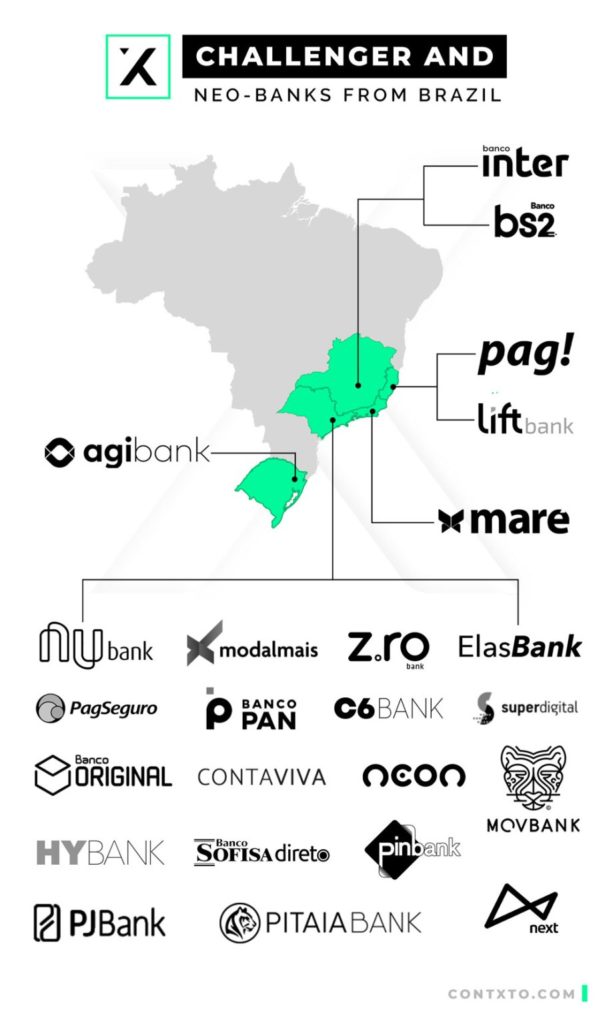

Challenger and neo-banks from Brazil. What makes them different? by Alejandro González Ormerod

Brazil is a giant, but when it comes to challenger and neo-banks is has become a titan amongst titans.

Not only is there a sizable number of contenders in this list—24 challenger and neo players to be precise—, Brazil also happens to be home to the undisputed world champion of neo-banking; Nu Bank.

(Full disclosure, this author is himself a (credit) card-carrying member of the Nu club all the way here in Mexico. I’m pretty happy with it, but tweet me to let me know if you’d like a full review.)

In spite, or perhaps because of this competition, Brazilian challengers and neos have had to up their game, and they have done it in creative and fascinating ways. Take a look, here are Brazil’s challenger and neo-banks:

Challenger and neo-banks in Brazil

Fintech tends to concentrate around hubs, so it makes complete sense that Brazil’s financial capital, São Paulo, is at the heart of the country’s banking revolution.

But, don’t discard the rest of Brazil.

Indeed, it is so vast that regional and niche opportunities abound for those clever startups who know where to look. It is in these cases where you get Inter and BS2 from Minas Gerais, Pag! and Lift from Esírito Santo, Maré from Rio de Janeiro, and Agibank from Rio Grande do Sul.

Any article on neo-banks in Brazil (or anywhere in the world for that matter) would not be complete without Nu. Weighing in at over 20 million customers, this bank is the biggest neo on the face of the Earth and has a strong presence in both Mexico and Argentina.

What all these banks have in common is a desire to make finance easy in a region famous for unfriendly, inflexible, and sneaky traditional banking. I for one am not at all surprised by the exponential growth trend we’ve been seeing recently.

It’s a trend that has been boosted in Brazil by a recently instituted Fintech Law. Will it supercharge an already booming sector? We’ll no doubt find out soon.

Difference between challenger and neo-banks

Here’s a quick refresher for those of you who may have forgotten the difference between challenger banks and neo-banks. Remember, although there is some debate around the minutiae surrounding their definitions, the clearest cut, least debatable difference is a legal one:

- Neo-banks do not have a full banking license and so depend on other established financial institutions.

- Challenger banks do have a full banking license, allowing them to operate fully as a financial institution with the whole suite of banking operations available to them.

POSTNOTE

That's the Contxto article, but I then got a ping from Antonio Rodrigues saying the picture wasn't complete and attaching this graphic. Thanks Antonio.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...