I only just stumbled across this 124 page report from McKinsey and, building on yesterday’s free research from Deloitte, this report is all about digital transformation and replacing core systems, my favourite subject.

Here’s the intro:

Next-gen Technology transformation in Financial Services

Financial Services technology is currently in the midst of a profound transformation, as CIOs and their teams prepare to embrace the next major phase of digital transformation. The challenge they face is significant: in a competitive environment of rising cost pressures, where rapid action and response is imperative, financial institutions must modernize their technology function to support expanded digitization of both the front and back ends of their businesses.

Furthermore, the current COVID-19 situation is putting immense pressure on technology capabilities (e.g., remote working, new cyber-security threats) and requires CIOs to anticipate and prepare for the “next normal” (e.g., accelerated shift to digital channels).

Most major financial institutions are well aware of the imperative for action and have embarked on the necessary transformation. However, it is early days—based on our experience, most are only at the beginning of their journey. And in addition to the pressures mentioned above, many are facing challenges in terms of funding, complexity, and talent availability.

This collection of articles—gathered from our recent publishing on the theme of financial services technology—is intended to serve as a roadmap for executives tasked with ramping up technology innovation, increasing tech productivity, and modernizing their platforms. The articles are organized into three major themes:

- Reimagine the role of technology to be a business and innovation partner

- Reinvent technology delivery to drive a step change in productivity and speed

- Future-proof the foundation by building flexible and secure platforms

The pace of change in financial services technology—as with technology more broadly—leaves very little time for leaders to respond. Therefore, CIOs and other executives need to accelerate and scale their technology transformation. We hope this collection is helpful in framing and shaping this journey.

From there, you find a series of different thought pieces from different perspectives both within and without McKinsey. Very useful.

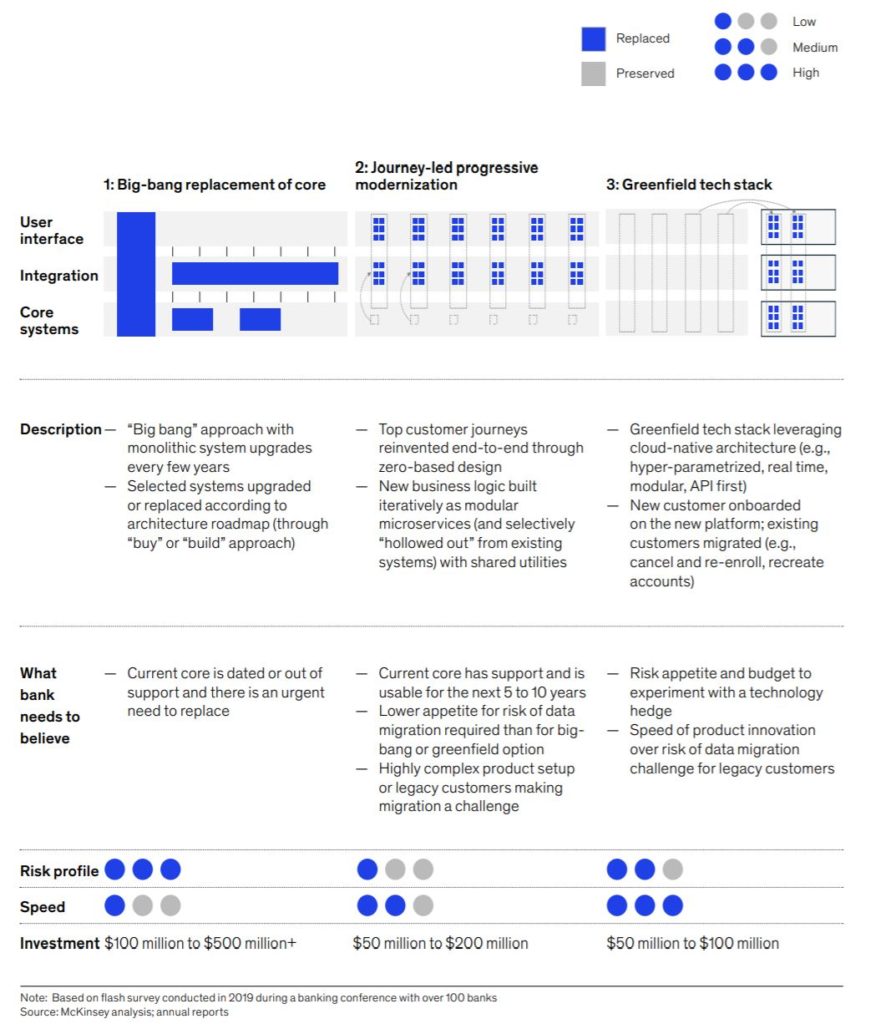

But, then I came across this chart on page 80 about core systems replacement:

The authors – McKinsey partners with first degrees – talk about the pros and cons of core systems replacement and the fact that 65 percent of the banks they surveyed are thinking about doing it. I guess 35 percent don’t give a puck.

But I looked at this and, as you can see, they have categorised core systems replacement into three buckets: Big Bang change, progressive change and start-over greenfield change.

Hmmmmm …

Hmmmmm …

Hmmmmm …

I thought about it a bit, and realised that you really should not have these three choices. There’s only one choice. Now, I know many of my readers will disagree with me here, but I do not advocate Big Bang change. It’s too risky [TSB]. I also do not advocate starting over. It doesn’t work. Believe me [Bo].

So, the choice is: do we have to replace our core systems? If yes, do it gradually.

I totally believe that core systems need to be modernised, replaced and restructured. Ideally, it should be done using apps, APIs and analytics on a step-by-step basis. After all, how do you eat an elephant? One bite at a time. So, the wholesale replacement is ridiculous. You cannot swallow an elephant in one gulp. Similarly, if you have an elephant, how do you get rid of it? Buy another elephant? That’s the greenfield thing, and that’s wrong too.

In particular, I was shockered by the bottom-line on this chart. The cost of core systems replacement is just $50 to $500 million? WTF? I know so many banks that have spent billions on core systems change, often wasted and driven by McKinsey advice.

So, I thank McKinsey for this report. Very useful. Definitely food for thought ...

... but beware of false prophets.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...