A while ago, I wrote about the IPO and whether you should invest. It's still coming, but the valuation of the company is now even bigger. 15 percent bigger to be exact. That will make Ant's IPO the biggest ever in history! Not bad for a month's work.

Interestingly, I was interviewed in the run up to the IPO by a journal Tech in Asia, who published a fascinating piece about Ant Group being the formidable foe of Visa and MasterCard. The article is behind a paywall, but here’s a few highlights:

Is Ant Group a real threat to Western payment duopoly Visa, Mastercard?

“If the banks don’t change, we will change the banks,” Jack Ma, the founder of Alibabansaid in 2011. A decade later, the Ma-controlled fintech company Ant Group is doing precisely that.

Behind the astounding growth of Ant Group are technology infrastructures and capabilities that seem more scalable than those of Western payment networks.

Though most of its billion-plus user base is in China, the company has been plotting its global expansion to Asia and Europe by partnering with local financial services providers and offering technologies that promise higher efficiency and security.

While the Alibaba fintech affiliate’s plans may face some barriers in developed markets dominated by Visa and Mastercard, the tension is set to rise as the company inches into the incumbents’ turf.

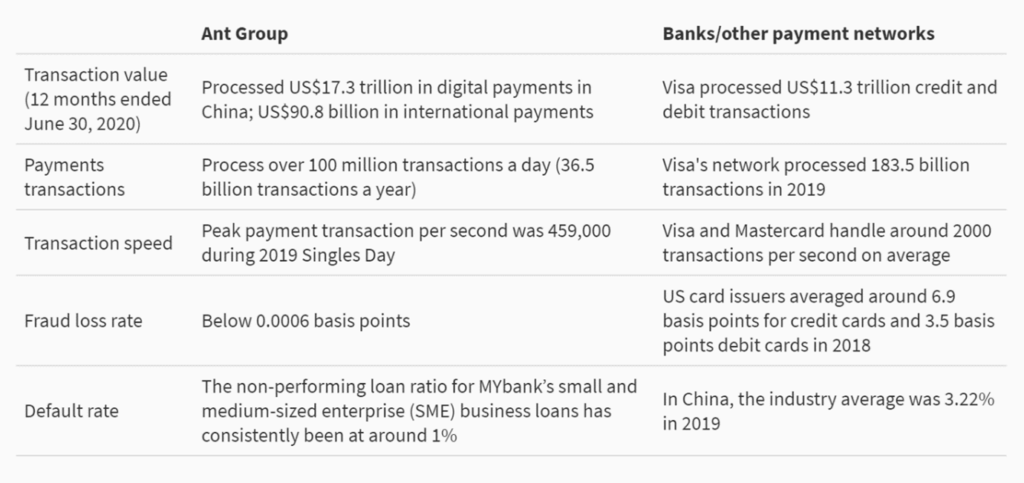

These seemingly impressive figures should perhaps be taken with a grain of salt given that many of Ant’s transactions are pre-orders, and transactions on Visa tend to be much higher in value. However, this could indicate that Ant’s technology infrastructure is more robust than traditional payment processing companies like Visa and Mastercard … the firm boasts a fraud loss rate of less than 0.0006 basis points (bps), which it claims is the lowest among digital payments providers. In comparison, the US issuers reported a fraud loss rate of 6.9 bps for credit and 3.5 bps for debit in the first half of 2018, according to an Accenture Issuer Fraud Survey.

According to a spokesperson for Visa though, the firm has poured US$9 billion into technology over the last five years and is able to prevent US$25 billion in fraud a year as a result of its security and privacy efforts.

That said, MYbank, Ant’s online banking unit, reported that its non-performing loan (NPL) ratio for SME business loans has consistently been around 1% – well below the industry’s average of 3.22% in 2019 …

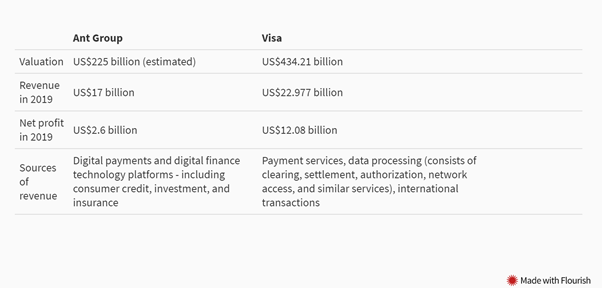

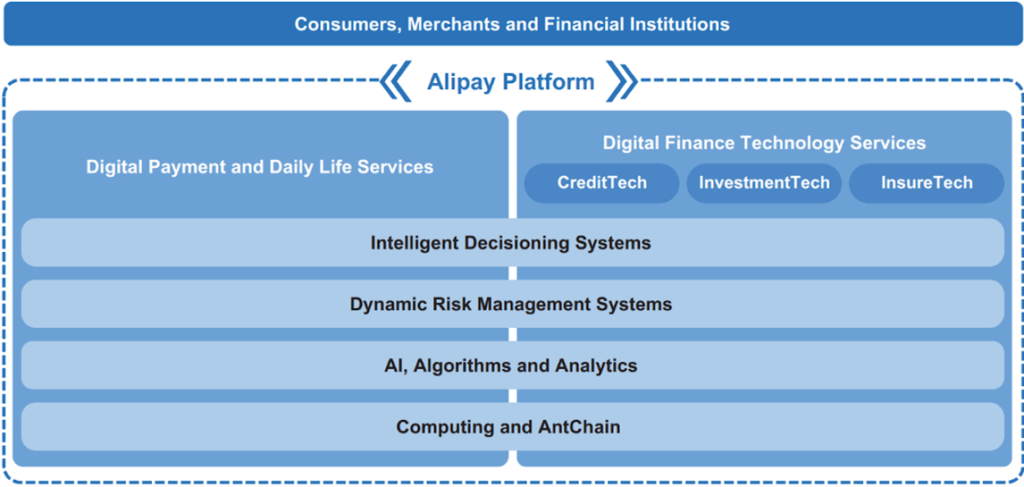

Ant has gotten to where it is today by positioning itself as a technology services provider rather than a financial services provider … Ant’s IPO filing shows that the main bulk of its revenue comes from technology services rather than from mobile payments. Its revenues from the “digital finance technology platform” accounted for 63% of total revenues, a significant jump from 56% in the previous year.

According to Ant, a substantial majority of that revenue comes from “technology service fees,” which it charges from partner financial institutions.

The filing also reveals that Ant’s digital financial services are supported by artificial intelligence analytics, risk management, and cloud computing tech layers.

Interestingly for me is that I’ve been heavily involved with an early stage company in the UK who have been focused upon bringing Alipay and WeChat Pay to Europe. The company recently hired Alipay’s lead in Europe, Rita Liu, as their Chief Commercial Officer and, coincidentally, are also moving towards an IPO in the next few weeks.

The company is called Mode, founded and majority owned by financial services entrepreneur Jonathan Rowland. What’s their value proposition?

They are building a next-generation ecosystem offering the best in payments, investment, loyalty and digital assets, for consumers and businesses alike. The company has deployed an app that allows users to manage their money and Bitcoin in one place, and will soon also allow users to make payments at e-commerce stores and receive exclusive and personalised rewards from their favourite brands. Mode also has partnerships in place with Tencent (WeChat) and Alipay for businesses looking to go beyond Europe and tap into key international markets such as China.

I asked the company what makes them different? They responded:

- one of the first financial services companies with a consumer-focused digital asset offering to be publicly listed in the UK

- developing its new and revolutionary way of payment, leveraging open banking, bringing a new way of payment to merchants, with loyalty solutions integrated.

- building direct relationships with merchants and users from day 1, with building a real connected ecosystem as the vision.

Interestingly, unlike most FinTech start-ups who seek venture, private equity or crowd funding, Mode aims to list on the London Stock Exchange, subject to regulatory approvals from the Financial Conduct Authority (FCA). That's a key point: how many UK FinTech's have IPO'd? How many FinTech's are on the London Stock Exchange's main market?

Existing shareholders include founder Jonathan Rowland (31.78 per cent), Ruskin Capital (17.60 per cent), David ’Tiger’ Williams and Caroline Williams (5.91 per cent) and the Bonderman Family (4.59 per cent). They also have Biz Stone on their Board as a shareholder and close friend to the company. Biz is a co-founder of twitter with Jack Dorsey and is a name worth noting.

You can read more about their IPO here if interested.

Disclaimer: this is a blog. I am not a financial advisor and I am not recommending or endorsing these IPOs. I purely present them for information purposes only.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...