This week I’m going to continue looking at mobile payments with a quick overview of where Square, Jack Dorsey’s card payments firm, is today. I’m sure you all saw this headline the other day but, just in case, Square is now worth more than Goldman Sachs.

Square!

Square.

Squared.

I used to blog about Square quite a lot years ago, but haven’t written anything much recently until I saw that headline.

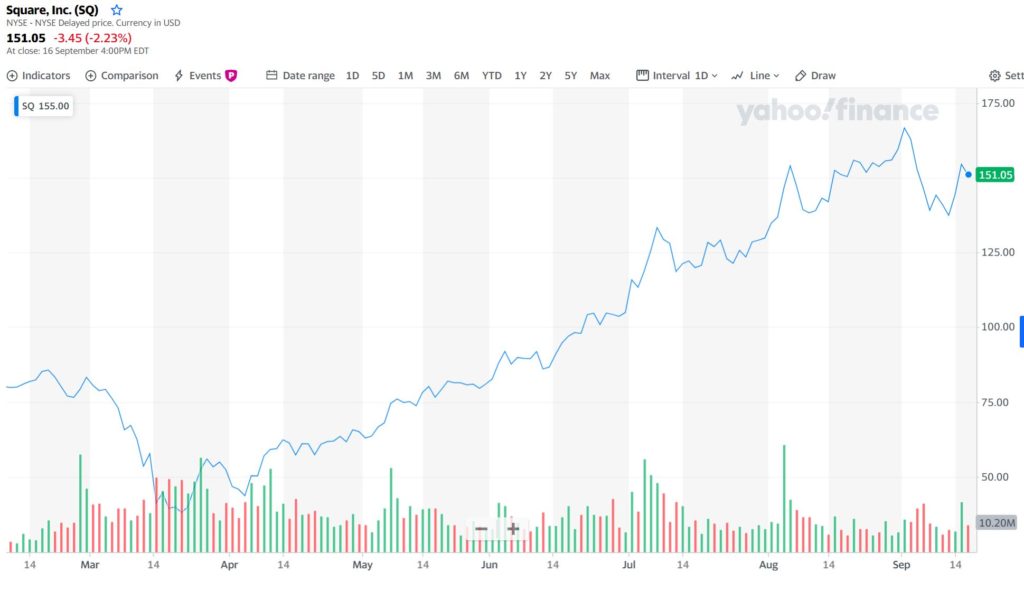

In fact, I remember writing about Square being the Apple of Finance back in the summer of 2012. The company achieved a near $3 billion valuation on their IPO debut in November 2015, then took a dip in 2016 as most post-IPO companies do. In 2015-16, the share price was $15 or thereabouts; in March 2020, it was under $40; today it’s $150 or more with a market valuation of around $70 billion which, dependent upon the day, makes it more valuable than Goldman Sachs.

What’s the story?

Well, the story is the flight to tech stocks. We’ve seen a massive surge of investment flow to the digital firms in 2020, because we all need digital services in 2020, being locked down and working from home.

Is that it?

Possibly, but no. There’s more to Square than just a firm that has flourished in 2020, with share price rising 140 percent.

For example, a 2016 case study by Christian Rauch of the American University of Sharjah, provided some decent insights. The paper looks at how to value Square back then and over the next decade, and notes that their main competitors are Global Payments, NCR, Verifone, Ingenico and PayPal.

The paper got the story wrong – he missed COVID19 – but would have been on track if it weren’t for the pandemic. The pandemic has driven a massive move towards cashlessness across the world. This is noted by Square in a recent press release:

In February 2020, just 5.4% of Square sellers across the US were cashless. By April 2020, amidst the height of shelter-in-place mandates, that number jumped up to 23.2%. By August 2020, as the world slowly began to reopen, the number of Square sellers with a cashless business model was showing signs of stabilizing at 13.4% … when comparing the share of cash transactions via Square in 2019 to 2020, the year-over-year change shows a 7.3 percentage point drop from 40.6% in 2019 to 33.3% as of August 1, 2020. If we use 2019 as a baseline indicator, we estimate this one-year shift would have taken more than three years without the pandemic.

These factors are all creating the perfect storm for firms like Square and PayPal.

Add into this mix the optimism around the digital future and you can see why the shares have risen to so fast and so much, although the rise is too much and too fast. Or is it?

Square expanded internationally this year, with the acquisition of the Spanish mobile app startup Verse, and rolled out a new program that allows merchants to send out delivery drivers for orders made on their websites and oh, next year, it will become a bank.

Tada! A decade of change and Square goes full circle from just being a puny little payment system for SMEs to becoming a full-service bank bigger than Goldman Sachs. C’est la FinTech vie!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...