Readers of my blog may have realised that, over recent years, I’ve become a little bit passionate about saving the world. It’s our world. It’s the only one we’ve got. I’m quite keen to keep it here for that reason.

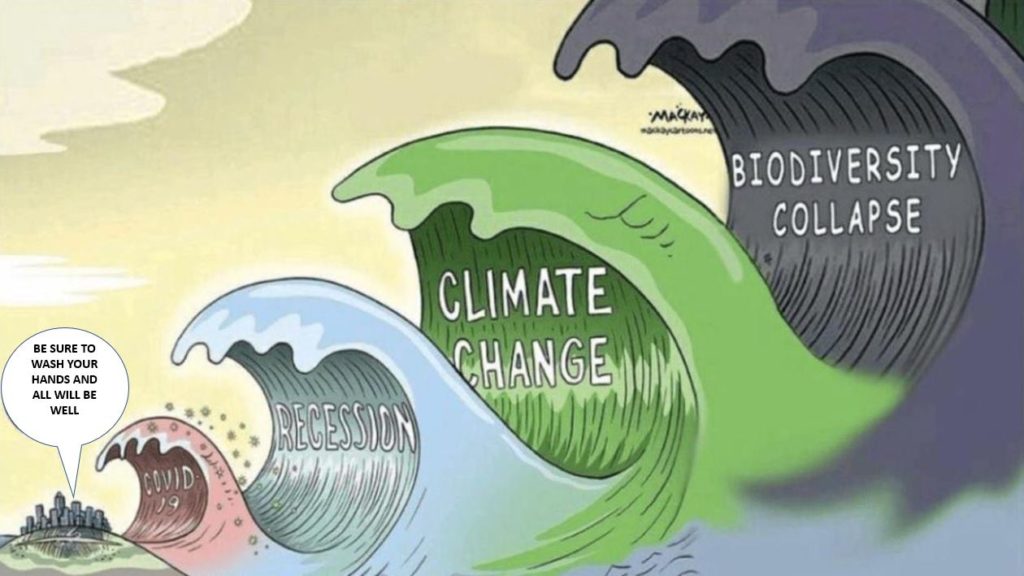

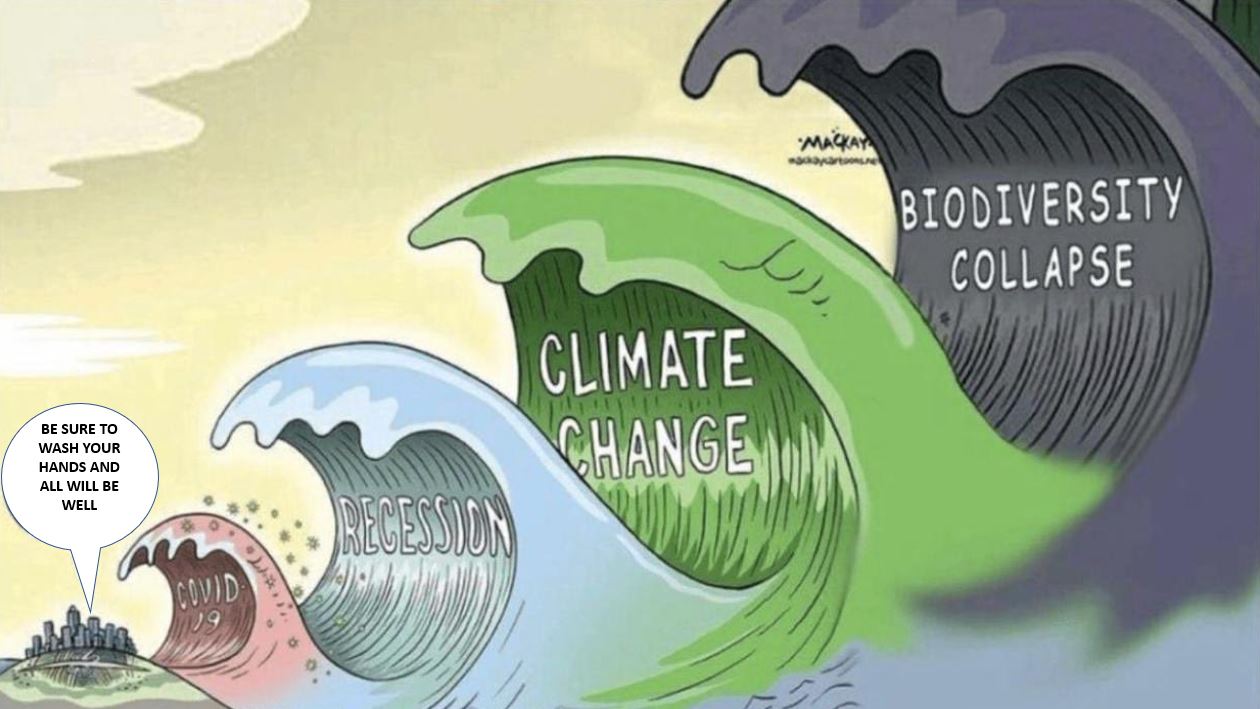

Whilst coronavirus, disease and pandemics drive our thinking, we should not forget that there are other issues. The climate emergency hasn’t gone away. In fact, it’s probably ten times bigger than COVID19.

And at the heart of our issues with running the world is … banking.

I’ve blogged quite a lot about this already as it is clear that, if banks continue to fund fossil fuel firms and biodiversity destroyers, then our planet is fracked. However, banks behaviours continue and are not changing fast enough. A bit like Donald Trump and Coronavirus, bank CEOs are ignoring the end of Planet Earth.

This came home to me in the latest research report on the subject – a subject I’ve been discussing for over 25 years – and it lays the facts bare.

The Guardian sums it up well:

The world’s largest investment banks provided more than $2.6 trillion of financing linked to the destruction of ecosystems and wildlife last year, led by Wall Street giants Bank of America, Citigroup and JP Morgan Chase.

[This new report] argues that financial institutions are unable to monitor and measure the impact of their activities on the natural world, because of limited policies on protecting ecosystems that are critical to human life and livelihoods when providing loans or underwriting services.

The findings in the Bankrolling Extinction report were produced by portfolio.earth, a new initiative led by finance, economics and environmental experts to better understand the role of the finance industry in the destruction of the natural world.

Sir Robert Watson, former chair of IPBES (the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services), said the task of rescuing nature must fall to the world’s finance industry, yet the vast majority of banks still remain unaware of their impacts on the natural world.

“Bank by bank, the report authors found a cavalier ignorance of – or indifference to – the implications, with the vast majority unaware of their biodiversity impacts, or associated balance sheet risks,” he said. “In short, this report is a frightening statement of the status quo.”

Changing this mentality is a first priority to drive change, he added.

The top 10 banks with the biggest exposure to the risks associated with the destruction of the natural world include Bank of America, Citigroup, JP Morgan Chase, Mizuho Financial, Wells Fargo, BNP Paribas, Mitsubishi UFJ Financial, HSBC, SMBC Group and Barclays.

While not all of the $2.6 trillion identified will be driving biodiversity loss, the report says that banks do not have systems in place to monitor environmental harm.

Since the 2016 Paris climate agreement, an increasing number of investment banks have implemented restrictions on coal, Arctic oil and gas, and tar sands extraction following pressure from environmental campaigners and investors. But analysis by Rainforest Action Network in March found 35 leading banks had funnelled more than $2.66 trillion into fossil fuels since the international agreement to limit greenhouse gas emissions and have not aligned themselves with goals of the accord.

Prof Kai Chan of the Institute of Resources, Environment and Sustainability at the University of British Columbia and leading author of the IPBES report, said: “A global sustainable economy sits at the centre of humanity’s much-needed transformation to meet the climate and ecological crises. And at the centre of that sit the banks and the finance institutions whose investments power development around the globe.

“Imagine a world in which projects can only raise capital when they have demonstrated that they will contribute meaningfully and positively to restoring the planet’s bounty and a safe climate for all? That’s the future this report envisions and builds toward.”

Mizuho Financial and SMBC Group did not respond to requests for comment. Bank of America, Citigroup, JP Morgan Chase, HSBC and Barclays declined to comment. BNP Paribas also declined to comment, saying it was unable to check the accuracy of the report’s findings.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...