One thing that is clear about demand and supply is, when you think about where we are today, there is little demand for anything. We are all staying at home – and so the only demand is what can be delivered to the home – that’s the issue.

This came home to me when I watched a special news report about a football team that had gone bust. The fans tried to bring it back. As they brought it back, there were lots of other human activities around the club. There’s bars, pubs and restaurants; there’s the ticket and merchandise sales; there’s the selling of rights to television and media; there’s the trading and betting that goes with the club’s results; and so on and so on. That’s basic economics right there. The building of communities and trade around shared common interests.

This is the thing that is being clearly exemplified today. We have seen the closure of the high street, the restaurants, the entertainment, the concerts, the matches … all the things that create a vibrant economy. Sure, it’s moved to online but, as this is economics in action, what does this mean to our longer-term outlook?

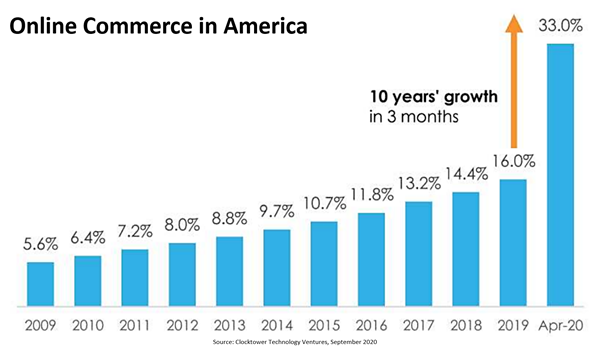

First and foremost, it means we are re-calibrating our economies. We are shifting the balance from physical to digital.

Second, this recalibration will have a big impact on places we thought that mattered. I wrote a while ago that shopping malls were already dying.

The pandemic will just make their death faster.

Due to the recalibration of physical and digital, we will need to rethink infrastructure, roads, transport and more. After all, if we’re no longer going out-of-town to shop, what happens in-town?

Fourth, yes, a few industries are thriving and prospering – online retail, deliveries, logistics, take-aways – but others will come back. We still need to eat and drink, meet and socialise, so bars, restaurants, concerts, entertainment and sport will come back. It’s just a question of when and how. Will the theatres and venues still exist? Will they still be the same?

Fifth, as online meetings soar – Zoom up from 10 million active users in December 2019 to 300 million in April 2020 – and offline meetings disappear, the whole meetings, exhibitions, conferencing, hospitality and airline industries need to rethink and recalibrate. As we’ve realised we can meet online, business travel and networking is very different. That’s a long-term change, not a short one.

I could go on … and on and on … but I find it surprisingly short-term that no one is talking about the long-term. Most people are just talking about how awful it is today and when will get to A New Normal.

Wake up!

There is no new normal. There’s just change. The issue is that no one is focusing upon the change. How will the pandemic change our industries, services, societies? What’s the long-term outlook?

I am frustrated that no one is talking about the end of shopping malls, the rise of local, the digital upside and physical downside. We are in fundamental transition to the internet folks. We’ve known this for a quarter-century, but it’s been turbo-charged by coronavirus so, what are you doing about it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...