Jack Ma had a rant about the financial system ahead of Ant Group’s IPO. As reported in The Financial Times, he thinks the Bank for International Settlements (BIS) who issue the Basel Accords is like “an old people’s club” …

“The Basel Accords are like an old people’s club . . . we can’t use yesterday’s methods to regulate the future … many of the world’s problems” stemmed from “only talking about risk control, not talking about development, not thinking about young people’s or developing countries’ opportunities” … and urged moving away from a “pawnshop” mentality of banks taking collateral for loans and towards credit-ratings based on big data.

Interesting.

I agree with his sentiment. I’d be a fool not to. After all, Jack and his team have built two of the largest technology-first companies in the world (Alibaba and Ant) and Jack said almost a decade ago …

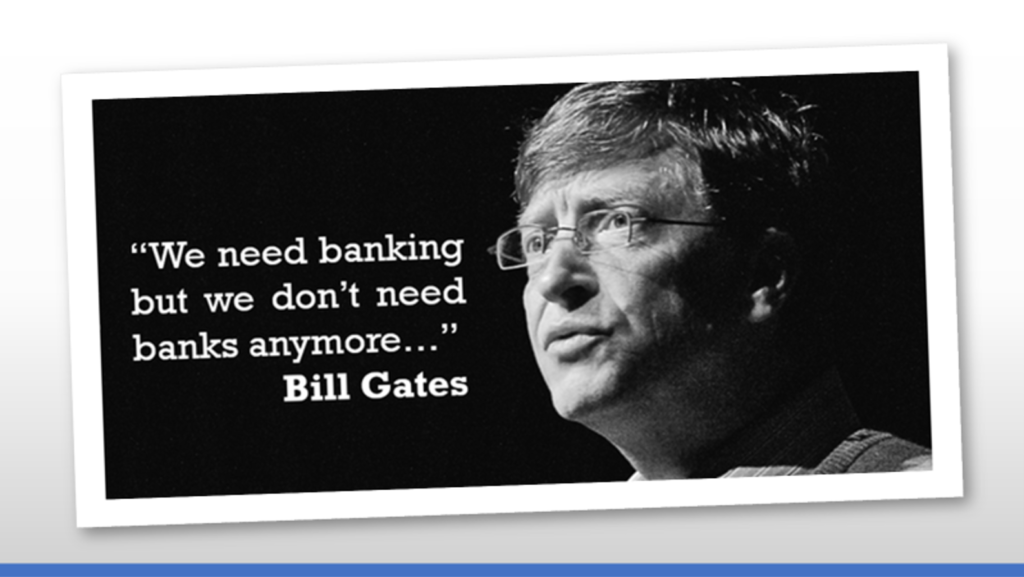

Which reminded me of Bill Gates comments from twenty-five years ago …

… but Bill Gates was wrong … we need banks to do banking. We don’t need banks to do payments, savings, investments or loans however. This is something I covered recently in two blog posts about currencies, payments, DeFi and CBDCs:

It has been a while since I sat back to think about the future bank. I talk about the future bank all the time, but the overall view of a bank in its totality. What will it look like in 2030 and beyond? I think …

Or will CBDCs destroy banking?

I keep wondering about the future. Governments vs Libertarians? Centralised vs decentralised? DeFi vs CBDC? My conclusion is CBDCs will win, in the financial markets. Why? Because money is critical to our lives. It’s a key. You cannot ignore it. It’s what we created to …

But there’s a big difference between making a payment, assessing credit risk and banking. Banks are stores of value and exchangers of value with trust. That won’t go away. But a lot of the other things that banks have traditionally done will go away as Jack Ma is right. We should talk about banking in a new way and change the banks. Ant Group and Alibaba has done that, and it looks like they have a vision for taking this further.

Mr Ma said the financial system should rely less on big banks and more on an ecosystem of “lakes, ponds, streams and brooks” that carries capital into the different corners of economy.

And this is the most critical comment. This is the categorical aspect of what I’m looking for in financial services and Jack Ma understands our world of platforms, ecosystems, open banking and the internet far more than Bill Gates did. In fact, I think he understands it far better than almost anyone as, what I’m looking for are the institutions that are truly digital to the core and completely cloud-native, as Ant Group is. Then use these technology capabilities to completely rethink financial markets and financial market structures for the internet age. And this is why Jack’s comments resonate with me so much and Bill’s do not.

Bill made his comments in the 1990s, pre-internet commitment, and made the comments as a technologist who disliked banks and banking operations as they were then, but he didn't understand banks. This is why I’ve heard such comments from technologists for over a quarter-century, and they’ve always been missing the mark. They’ve always been saying banks will die and be disrupted and disintermediated. It’s the boy who cried wolf.

What Bill should have said, and what Jack is saying, is banks should consider their structure, role and business model and rethink it or others will take it.

That’s what we are seeing for sure. Others are taking the areas where banks are poor – online and mobile payments, SME markets, financial inclusion, foreign exchange at a reasonable price, credit with no credit history, and more.

These are “the lakes, ponds, streams and brooks” to carry capital into the different corners of the economy that need it most.

That is not replacing, destroying or disrupting banking; it is replacing, destroying and disrupting financial infrastructures and operations. A much better framing of the discussion.

Hit the road, Jack.

P.S. as I expected, I'm getting some pushback on this one from those who dislike China and view Jack as a member of the Chinese Government.

Who wants to hear opinions of a high communisr (sic) party official, a comunist prienceling (sic) mascarading as a businesses man ?.Individuals like Jack Ma receive to much credit from wester media.

— George Valentin Voina (@voinageo) October 27, 2020

I was tempted to mention this before this post, but the key here is to look at what is being said, not who is saying it.

I look at four areas of the future - political, economic, social and technological (PEST) - but am only really interested in the last one. In this case, Jack and China understand our technological future better than Bill and the USA. This is why I post this and (usually) try and avoid the politics.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...