The lockdown pandemic has been interesting from a financial markets’ perspective.

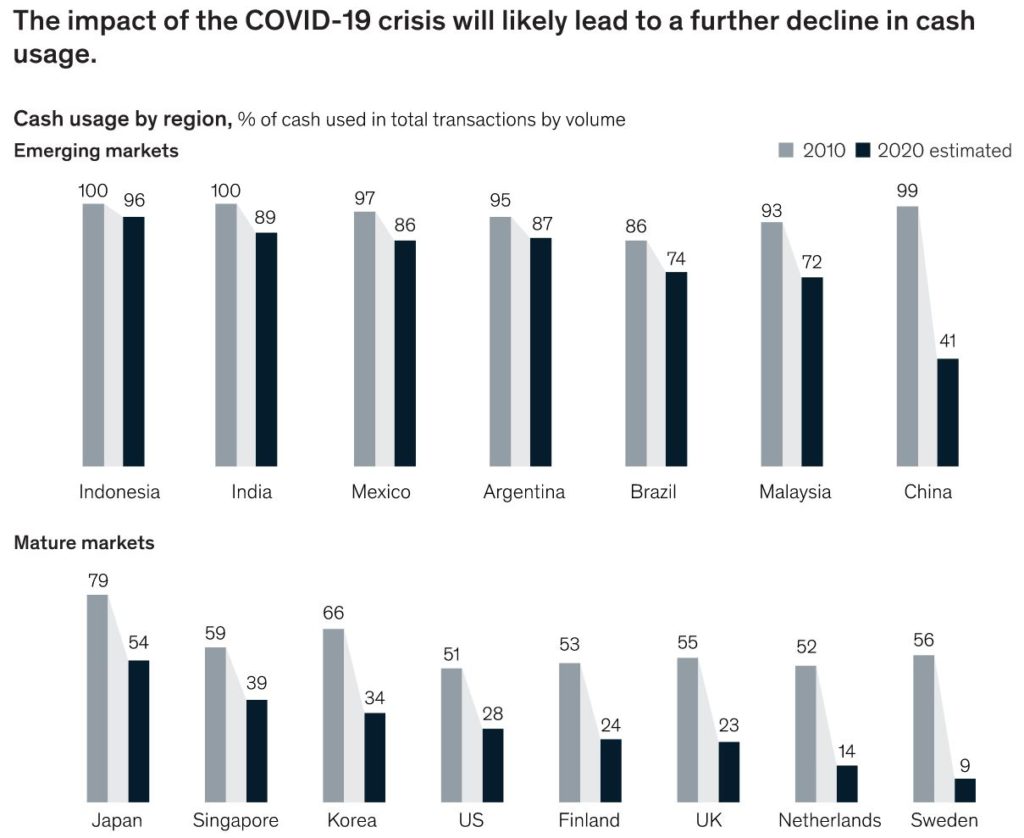

First, people withdrew as much cash as they could, worrying that things would be bad, and cash was king. It wasn’t. They didn’t need the cash. They didn’t spend it. In fact, I was particularly struck by this chart from McKinsey’s report on payments 2020.

Second, cards were used for everything from home, but cards were also carrying volumes far lower than any previous year.

American Express reported a 40% fall in quarterly profit and warned business travel would not recover before early 2022.

Visa, Mastercard and Amex profits hit by lack of international travel during pandemic.

Third, downloads and usage of financial apps has increased exponentially.

In other words, the world has contracted economically and financially, and rapidly moved from physical to digital. Pretty obvious really, but what will be the long-term implications and impacts?

Who knows?

Well, I have an idea.

My idea is this …

Everything has changed. We no longer see cash as key is #1. We all went and got cash on day one, and didn’t use it. We have realised cash is no longer king.

Second, we also know that cards are no longer key. Cards are useful, but we don’t need them. We’ve spent months ordering everything online and delivered to home. We don’t need cards or cash.

Third and most important, apps work. We can be online, all the time, in real-time and for all time, and we can pay and play and get what we want when we want it.

This last change is probably the one that will be most important and permanent. Peoples’ behaviours have been changed and altered by this crisis not just temporarily for a month or two, but forever.

Tell me: do you think we will go back to how it was?

Is cash as important as it was?

Will you still use your cards in-store or will you use your apps?

I don’t know. I’m not sure. But what I do know is that people are far more likely to use their digital connections than their physical connections since this crisis started.

Oh, and as for cash?

Central Bank Digital Currencies (CBDCs) like China’s digital yuan or Sweden’s e-krona will replace cash in the long term, according to Deutsche Bank.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...