I don’t usually cover press releases as they bore me, but this one caught my attention:

Customer Online Conversations Reveal ‘All to Play for’ in Battle between Challengers and Incumbent Banks, Finds Economist Intelligence Unit Report

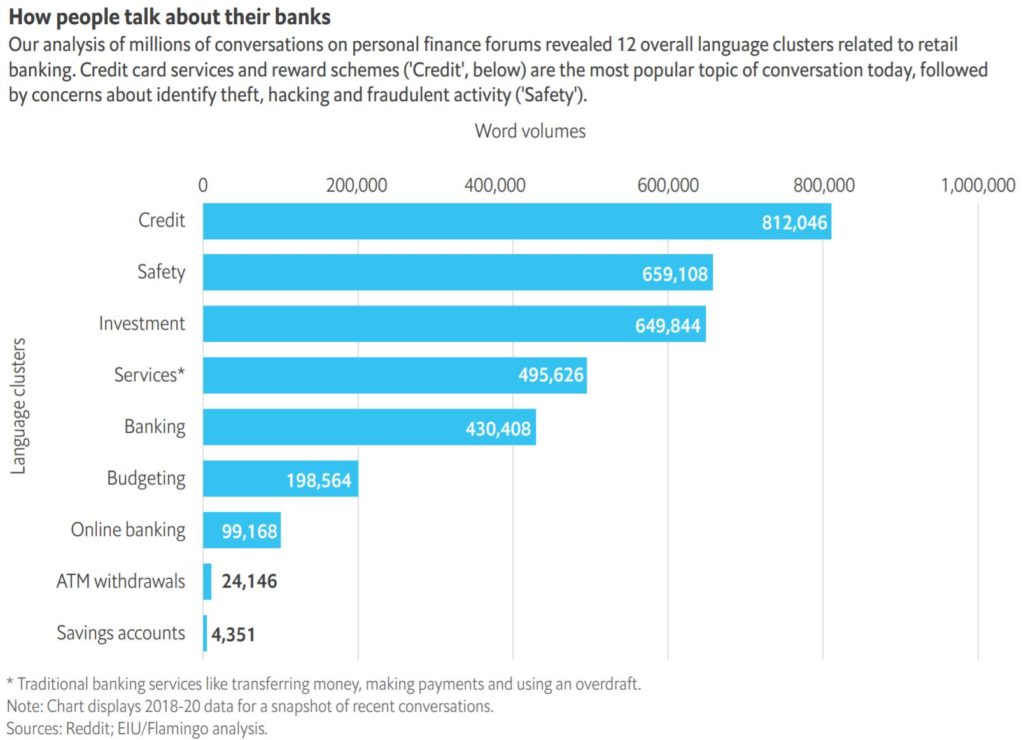

- Groundbreaking report by The Economist Intelligence Unit uses machine-learning to analyse over 10 million online conversations about personal finance

- Challenger banks are strongly associated with financial empowerment, but also twice as likely to be associated with security and privacy concerns compared to traditional banks

- Traditional banks retain strong associations with trust, a wider range of services and perks such as loyalty programs

A new report by The Economist Intelligence Unit (EIU), sponsored by Temenos, analysed over 10 million online conversations in public forums about personal finance. The report, “Customer experience: learning from online personal finance conversations”, reveals the strengths and weaknesses of traditional and challenger banks in terms of how well they are meeting customer needs. It finds challenger banks are strongly associated with financial empowerment, but also twice as likely to be associated with security and privacy concerns when compared to traditional banks.

According to the EIU report, start-up, digital-first banks and investment services have come to market promising superior customer experience and innovative services, such as budgeting apps and automated, low-cost investment tools. But traditional banks still benefit from trust, reliability and a wider range of services. And increasingly, spurred on by new digital entrants, they are investing heavily in their digital capabilities. In an earlier EIU global survey, a third (32%) of banking leaders stated that improving customer experience and engagement was their bank’s top strategic priority.

The analysis found that 13.7% of conversations about challenger banks included associations with concerns about safety, security or privacy, compared with only 6.7% of those about traditional banks. Discussions about “investment” have grown in frequency since 2015, and the analysis shows that 14.4% of conversations that discuss challenger banks include associations with financial empowerment capabilities such as tracking and budgeting, compared with just 2% of conversations that discuss traditional banks.

But while many consumers are turning towards disruptive fintech platforms for enriched tools and services to bolster their personal finances, traditional banks remain heavily associated with rewards and loyalty programs — one of the most discussed subjects overall. A quarter (24.9%) of conversations about traditional banks were related to credit cards or reward programs, compared to just 2.4% of those involving challengers.

The report also notes that the field of “financial services” is far bigger than before with open banking allowing third-parties to build innovative financial products and assist customers in many aspects of their financial lives. This could see fintech become ubiquitous in areas far beyond core banking services. The analysis shows incumbents and challengers are only associated with 18% of total personal finance discussions, with the rest covering everything from divorces and wills to car buying.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...