I woke up yesterday to find this story on Sifted, the Financial Times newish platform dedicated to innovation and FinTech:

Fintechs to cosy up with politicians to counter ‘big bank lobby’

It’s interesting, especially for a guy like me who has hovered around all of the lobbies mentioned. The gist of the article is that UK Finance and Innovate Finance is too cosy with UKGov, and not supportive enough of the challenger community. In fact, if anything, they support the incumbents, especially as a large chunk of their funding comes from incumbents.

True.

But there are multiple points in play here.

First UKGov, like any government, sees it as key to keep banks onside. The banks keep economies stable and often influence government more than you know for that reason. If governments piss-off banks, banks fight back and have some key cards, e.g., we will mess you up. This came home to me when Elizabeth Warren was talking at a US conference I attended, and said that Jamie Dimon rang almost every Senator before Dodd-Frank passed saying, in my version of the words: “if you don’t change this clause, we will not offer you any funding and, more importantly, we will block funding for any of your supporters”. Whether that was true or not, who knows but, either way, it illustrates that most bankers have most governmental testicles tight in their hands.

Second, the UKGov has tried hard to support innovation in partnership with banks, but the organisations representing those start-ups are not necessarily working in the interests of those new communities. This is because the organisations representing those communities need funding and who has the most funding? Banks.

I’ve been close to Innovate Finance – which has gone through various iterations, as I think we’re currently on Innovate Finance 3.0 – but a report into the Fintech world in August 2020 found that two-thirds of the community felt that they were overlooked by government. Innovate Finance should be protecting and supporting them? According to the research, maybe not, as Barclays Bank, Lloyds Banking Group and the Royal Bank of Scotland count among its members and have the biggest budgets.

That’s an issue everywhere: you need funding, and who has the biggest funds?

Third, it also begs the question raised by almost every movie you watch scripted by Aaron Sorkin or similar. What drives government? Money. Who drives politicians? Their benefactors and supporters. Why do you think the USA has never banned guns? Because the NRA has huge pockets full of cash. The same is true of most banks, when it comes to political lobbying.

Fourth, that is the reason why start-ups never have influence over government, and why incumbents always have the upper hand. The only way you can get around that fact is to create a totally new business model that blind-sides the governments and incumbents, such as Amazon or Facebook. That's why they are called Blue Ocean Strategies and The Innovator's Dilemma, because governments and incumbents didn't see them coming.

Fifth, when they do, they regulate them and constrain them. This is what we are seeing with Google, Facebook and Apple in European and USA courts. Their wings need to be clipped because, now we see you, we are worried about what you are doing.

Which brings me to my final point: if you want start-ups to succeed, you need to support start-ups but start-ups have limited funding, limited customers, limited talent and limited resource. All those limitations are why you need a mentoring and support service for start-ups. There are many in marketing terms, but are there many in reality?

That’s the question a new network asks: the FinTech Founders https://fintech-founders.org/

The FinTech Founders, previously the Digital Finance Forum, “is a network of the UK’s leading Fintech entrepreneurs that provides an opportunity for real conversations and better collaboration with government, regulators and other influencers across the financial services landscape”, with the objectives to be:

- the voice of founders within the fintech sector

- independent and honest about the challenges and issues that fintech has

- energetic and keen to develop stimulating new policy ideas

- an organisation that reflects its members' concerns and provides a direct channel for sharing ideas and solutions

Lovely.

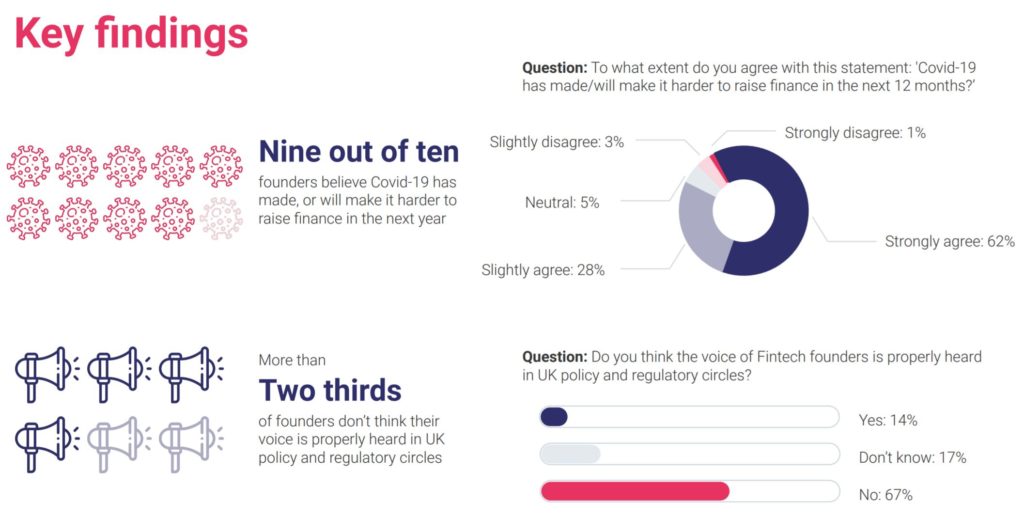

During the summer, a survey run by the initiative found that:

The result is this new group, who are distanced from any organisation associated with traditional banking, is led by inaugural members Paul Taylor, founder of Thought Machine; Fred Kelly, the founder of open-banking data firm Credit Kudos; and Christian Faes, the cofounder of property finance marketplace LendInvest.

I wish them luck but know that the more you get involved in finance and government, the more you gradually find yourself in the python’s arms. Good luck.

What I mean by this is that, having spent decades in this space, it’s very hard to change the system. The system is Government and Banking. Anyone who wants to break the system is going to find it a long, hard road. The longer you go down that road, the more you find yourself strangled by its constraints. The system wraps itself around you and gradually squeezes, squeezes and squeezes until all life and vision is gone.

Shoot, sorry, I’m being cynical. Of course, we can change the system. Go for it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...