I’m a Simple guy (?), but realised the other day that the consultants, research firms and technology behemoths do a great job of dressing up old ideas in new clothes. This hit home when I was reading the IT priorities for CFOs in 2021 by Gartner.

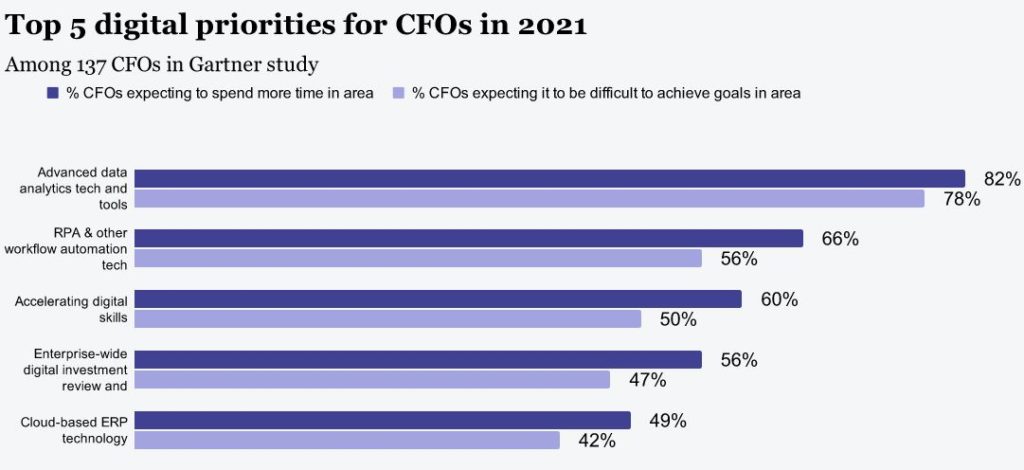

Gartner's survey asked finance chiefs where they will spend more time in 2021 compared to 2020, and where they anticipate the most difficulties in meeting goals. Among exec's digital priorities, the top three areas for greater time investment were all also accompanied by significant levels of doubt, with half or more anticipating difficulties and setbacks.

While 82% of respondents named advanced data analytics technologies and tools a top priority, 78% expected it to be difficult to achieve their goals in this area next year.

RPA (robotic process automation) and digital have also risen to high on the list.

As I was reading it, I thought that many of the terms we use these days are just old areas refreshed with new technology. RPA is just workflow automation; digital is just internet and network services; Open Banking, APIs and BaaS is just object orientation and service oriented architecture; Big Data, AI, machine learning is just data analytics; and so on and so forth.

The reason for the regular refresh is that each of these big buckets often gets a new technology, and hence it needs a new name. RPA is workflow automation using artificial intelligence and robotics; digital is the new business model required to rearchitect industrial companies for the networked age; Open everything is created by cloud and networked platforms that didn’t exist in the age of object orientation discussions; Big Data arose because we are drowning in too much data and need better tools – like AI and machine learning – to do the data analytics; and so on and so forth.

I’m sure I’m offending people when I say this, but the regular renaming of old areas is what keeps research companies and consultants in business. In that respect, my introduction of digital banking and omniaccess is part of the flow … or is it?

Having written about these areas for too long, I would claim that digital and omniaccess are very different to just dressing up workflow as RPA or data analytics as Big Data. The reason is that digital is a complete rethinking of the business, not just an addition of technology; and omniaccess is purposefully avoiding omnichannel, as channels are just an addition of technology to the business, not a rethinking of the business.

In other words, there are some areas that are rethinking technology using newer technologies, platforms and networks; and there are some technologies, platforms and networks that are rethinking business.

It’s an important distinction as the CIO, CTO and CFO teams can worry about technology refreshment; but the business leadership team has to worry about business refreshment.

This goes back to the old nugget of where the lines are drawn between business and technology. Technologists can worry about systems architectures; the business needs to worry about business architectures; and sometimes both need to worry about both.

I claim that’s where digital sits as it wraps up all the areas mentioned from business structures, products and services, through RPA, cloud and more, to totally change the business model and architecture. That’s why digital transformation is so important.

Meantime, if you’re interested in my definition of omniaccess and why that is so important to digital transformation, download our free report here.

There’s also a live event - it's free, just register on January 26 at 11:00 GMT / 12:00 CET, where I am joined by Dra Maria Joao Carioca, Member of the Board of Caixa and Dr. Edwin Van der Ouderaa, Senior Managing Director with Accenture to discuss these areas and more.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...