After a year where every day felt like Groundhog day – same shit, different day (SSDD) – I’m hoping that 2021 will be different – different shit, every day (DSED).

I’m not complaining, but 2020 was pretty awful. Some loved it – more time at home with family – but many hated it – more time at home with no family.

Anyways, we’re in 2021. What’s going to happen this year?

For the first week of the year, I’ve tried to capture views and news from around the world on what will happen economically, technologically and financially. I used to give my views but, in more recent years, feel it’s better to aggregate and integrate. So, here we go.

Where better to start than with the global economy and, to look at the economy, where better to start than with The Economist.

The Economist see ten key trends in 2021:

1 Fights over vaccines. As the first vaccines become available in quantity, the focus will shift from the heroic effort of developing them to the equally daunting task of distributing them. Vaccine diplomacy will accompany fights within and between countries over who should get them and when. A wild card: how many people will refuse a vaccine when offered? See article

2 A mixed economic recovery. As economies bounce back from the pandemic the recovery will be patchy, as local outbreaks and clampdowns come and go—and governments pivot from keeping companies on life-support to helping workers who have lost their jobs. The gap between strong and weak firms will widen. See article

3 Patching up the new world disorder. How much will Joe Biden, newly installed in the White House, be able to patch up a crumbling rules-based international order? The Paris climate treaty and the Iran nuclear deal are obvious places to start. But the crumbling predates Donald Trump, and will outlast his presidency. See article

4 More US-China tensions. Don’t expect Mr Biden to call off the trade war with China. Instead, he will want to mend relationships with allies to wage it more effectively. Many countries from Africa to South-East Asia are doing their best to avoiding picking sides as the tension rises. See article

5 Companies on the front line. Another front for the US-China conflict is companies, and not just the obvious examples of Huawei and TikTok, as business becomes even more of a geopolitical battlefield. As well as pressure from above, bosses also face pressure from below, as employees and customers demand that they take stands on climate change and social justice, where politicians have done too little. See article

6 After the tech-celeration. In 2020 the pandemic accelerated the adoption of many technological behaviours, from video-conferencing and online shopping to remote working and distance learning. In 2021 the extent to which these changes will stick, or snap back, will become clearer. See article

7 A less footloose world. Tourism will shrink and change shape, with more emphasis on domestic travel. Airlines, hotel chains and aircraft manufacturers will struggle, as will universities that rely heavily on foreign students. Cultural exchange will suffer, too. See article

8 An opportunity on climate change. One silver lining amid the crisis is the chance to take action on climate change, as governments invest in green recovery plans to create jobs and cut emissions. How ambitious will countries’ reduction pledges be at the UN climate conference, delayed from 2020? See article

9 The year of déjà vu. That is just one example of how the coming year may feel, in many respects, like a second take on 2020, as events including the Olympics, the Dubai Expo and many other political, sporting and commercial gatherings do their best to open a year later than planned. Not all will succeed. See article

10 A wake-up call for other risks. Academics and analysts, many of whom have warned of the danger of a pandemic for years, will try to exploit a narrow window of opportunity to get policymakers to take other neglected risks, such as antibiotic resistance and nuclear terrorism, more seriously. Wish them luck. See article

I agree with much of this but would add an eleventh:

11 A banking consolidation. After a year of lockdown, many banks in Europe and America will start to feel the strain of dealing with staff and customers at distance. There will be more and more movement to shore up banking capital and structures through mergers and acquisitions, and many household bank names will be absorbed by other household bank names.

Just a thought.

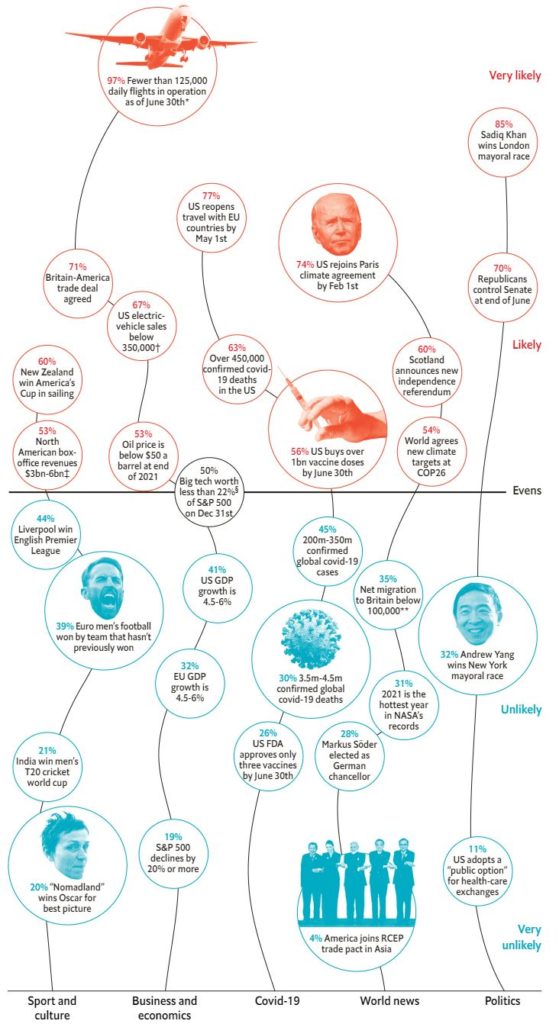

Oh, and if you're into this stuff, The Economist also gives odds on key events happening this year ...

Meantime, if you want some other views than an economist, how about a bank economist?

2020 featured unprecedented shutdowns of economic activity, a fusion of monetary and fiscal policymaking, and a vote for new leadership in the US. 2021 will see us start to shift back to pre-pandemic norms while simultaneously accelerating forward into the post-pandemic future.

I hate to say it but many are predicting 2021 will see a return to pre-pandemic norms. I just wonder if this is more a wish than a reality?

Whilst Citigroup believe there are four trends you need to focus upon for the next year and more:

As we look back on 2020, we see that the world has had an opportunity to “test drive” the future - and it looks bright. Four of our Unstoppable trends – Digitization, The rise of Asia, Greening the world, and Increasing longevity – were all in force before the pandemic struck. However, we did not fully appreciate their worth in our lives or portfolios. We have now experienced their inherent value, their “unstoppability.”

"The remarkable performance of markets in 2020 is more than just anticipation of an improved economy in 2021. It represents the complete triumph of liquidity over fundamentals:" Citigroup's Matt King from his 2021 market outlook

— Lisa Abramowicz (@lisaabramowicz1) December 8, 2020

Finally, and just for good measure, what will a Joe Biden presidential term mean for banks and credit unions? The Financial Brand lays out the land and, in case you cannot be bothered clicking the link, here's the mainline: Janet Yellen, the former chair of the Federal Reserve, is now running Treasury and that makes a mark; there will be a stronger focus of promoting FinTech innovations for small businesses and financial inclusion; and a specific ban on discriminatory lending practices or, as the Americans call it, an enforcement of "fair lending" rules. In Britain, we call it "Treat the Customer Fairly", or TCF. I'm sure most countries have similar rules. It just makes me ask: why do so many banks in so many countries treat the customers unfairly? That's the soft underbelly of banking that technology can drive a sword through.

Anyways, I could add lots more forecasts and trends here, but you can google them yourself. The key to 2021 is that we’re moving on. We’re moving onwards and upwards. We will get over this. 2020 was the groundhog year; 2021 is a New Year.

Happy New Year!

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...