It’s a big moment when one of the most respected bankers in the world Jamie Dimon, Chairman and Chief Executive of JPMorgan Chase which is one of the most highly valued banks in the world, says that he is “scared shitless” of FinTech.

This is a $3.4 trillion banking goliath but, when asked his views on Big Tech and FinTech, his answer was:

“Absolutely, we should be scared shitless about that. We have plenty of resources, a lot of very smart people. We’ve just got to get quicker, better, faster. ... As you look at what we’ve done, you’d say we’ve done a good job, but the other people have done a good job, too.”

Dimon said he sent his deputies a list of global competitors, and that PayPal, Square, Stripe, Ant Financial as well as U.S. tech giants including Amazon, Apple and Google were names the bank needs to keep an eye on. The rivals are also clients of JPMorgan’s commercial and investment banking in many cases. Competition will be particularly tight in the world of payments, he said.

No surprise there.

He then had a pop at Plaid, saying that they mis-used customer data and privacy, and said that he’s briefed all of his management to be frightened.

I’ve said for a while that you have to create a burning platform to ignite change for digital transformation – it’s one of the key lessons in Doing Digital – and you also need a clear vision of where you have to go to achieve it, and most banks don’t have one. As one CFO said to me: "our Chairman and Chief Executive know we have to be digital, they just don't know what to do or how to do it". Those questions are answered in the book.

On a similar note, I’ve heard Jamie talking the burning platform a few times now over the past half decade, but where is JPMorgan going? What’s the vision? In the JPMorgan 2019 annual report there’s very little about a digital vision apart from Drive engagement through omnichannel, customer-centered experiences (Page 27). And, as most of you will know, any mention of channel and I know there’s no vision. It’s access and omniaccess that’s needed, not more layering of channels as sticky tape over rubbish back office systems.

This is the key reason why Jamie should be scared shitless of the new tech, FinTech and Big Tech rivals, many of whom both competitors and clients of JPMorgan Chase Group. They are starting with vision and no legacy; they’re not sticking sticky tape over old core systems; they’re drawing their vision of financial firms born on the internet. This is a key difference.

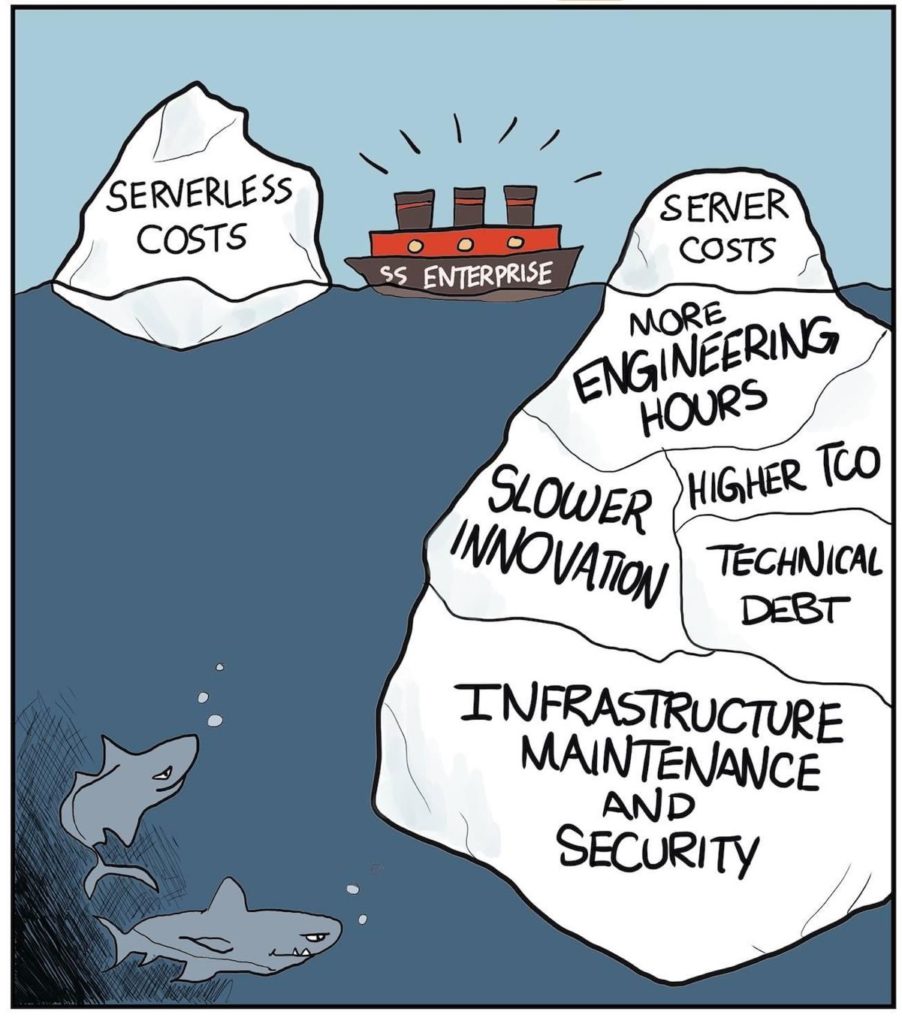

It’s funny that I recently posted this cartoon on my social channels:

I was amused by the mostly positive responses to the picture but one clearly irritated person stated:

shared by someone who is not responsible for either type of infra, manifestly

— Max Boonen (@maxboonen) January 9, 2021

Interesting.

“Shared by someone who is not responsible for either type of infra, manifestly … have you ever performed DevOps work yourself or ran an infrastructure team? The picture above is an ad.”

So, I’ll put this in context. I’ve spent more than three decades working with banks on technology transformation. I’ve never run DevOps, but I’ve worked within, alongside and managed teams who have been delivering it and yes, sure, the picture is an ad, but it is demonstrating the chasm of challenge between a new firm that begins with being cloud-native versus the heritage industrial institutions who are trying to adapt to it by being cloud-based, not cloud-native. The latter approach is the omnichannel approach – sticking sticky plasters over the cracks in the old systems – versus the former approach is the omniaccess approach – launching as a network-based, cloud-native platform.

I know which one I would expect to win, and it’s the reason why Jamie Dimon is scared shitless.

In fact, to make the point even more fundamentally, omnichannel cloud-based banks are adding layer after layer to the core engines of their firm. This hit home for me when I saw this picture.

The workers are riding on a speeding truck and the banks management, over the years, had added layers and layers to the truck. The truck is over-loaded and speeding and needs unloading and reorganising. But, how can you do that when the truck just has to keep going?

That's been traditional banks' issues for years, and still is, and that's why Jamie Dimon is scared shitless.

Finally, you wouldn’t expect the leader of one of the most respected traditional financial firms to use that sort of language, and I guess that’s why it makes a point. However, I wondered what James Pierpont Morgan would make of all this. After all, this is the bank that is still running operations based upon his industrial thinking. So, if you want to know more about the origins of JPMorgan Chase, here’s a great documentary (45 minutes) about the life of the man who created one of the world’s most valuable banks.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...