I stumbled across a bunch of interesting reports this week, so thought it worth sharing them

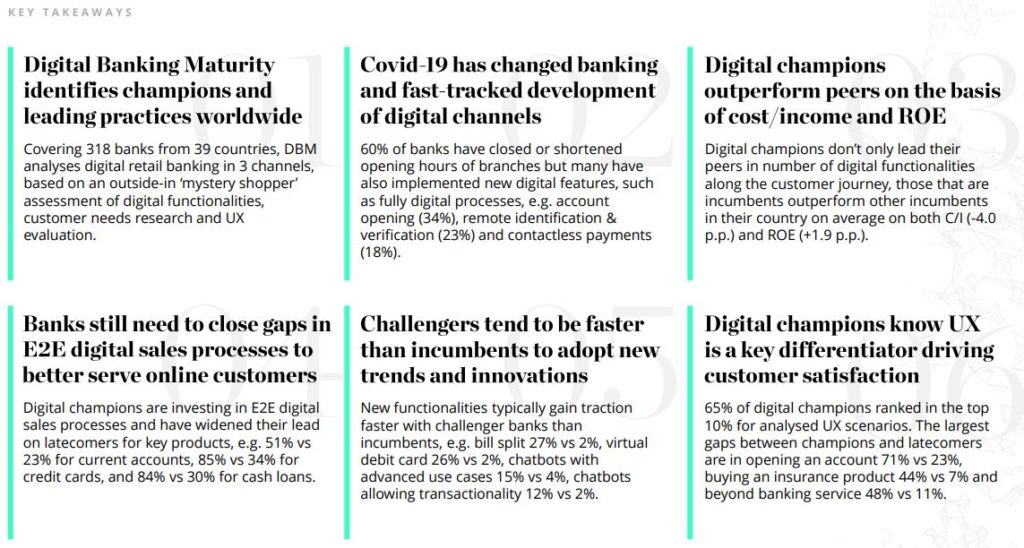

First, from Deloitte. Admittedly, it’s from October 2020, but it is useful as it tracks the state of digital banking post-COVID19. There are also some interesting charts, so let’s begin with the key takeaways.

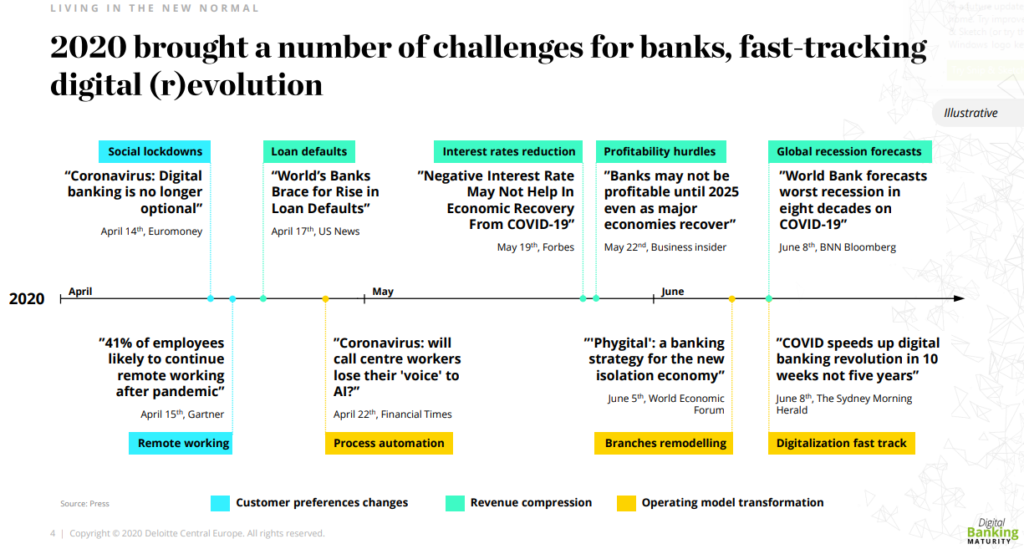

And then they tracked the key dates and events from the financial markets viewpoint in the immediate post-lockdown world.

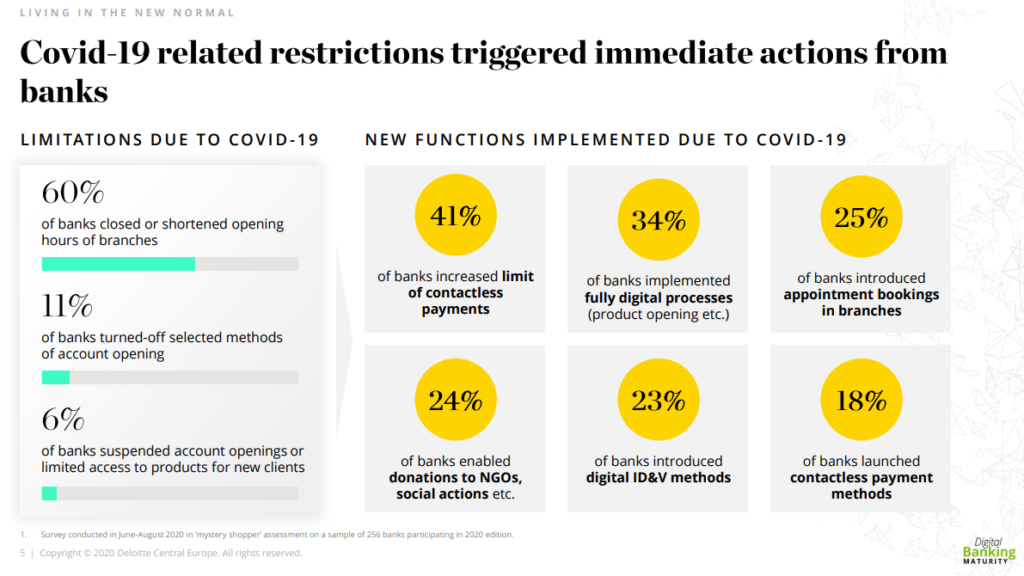

And the immediate actions the banks took to deal with the crisis from a product and service viewpoint.

I don’t want to reproduce the whole report here on the blog so, if you’re interested in this stuff then download the full report here.

What is interesting is that you can combine this report with the second one I was reading from McKinsey. McKinsey’s report focuses upon the future of banking post-COVID19. Interesting views as always and, just so you know, it’s not theirs. It’s a monthly survey of 2,000 executives across industries.

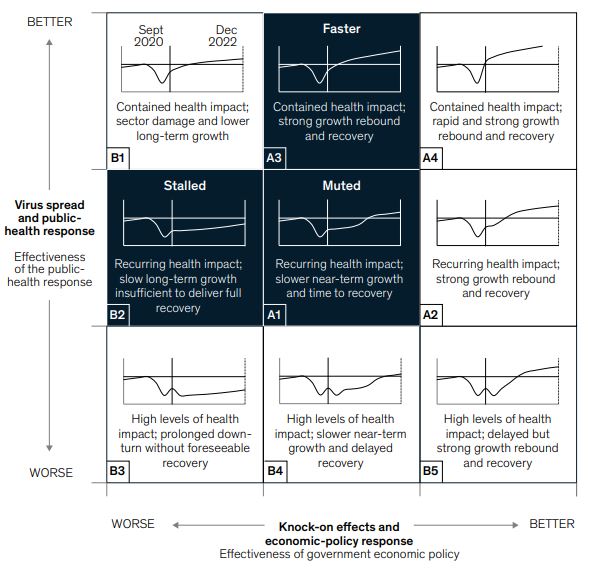

First, they offered them nine scenarios for the future and the majority say that, at the end of the day, it won’t get any better or worse than it is right now.

The majority choose the middle-middle box as the near-term future; the next nearest is middle-left and middle-top. What this means is that “for most banks, the chief concern through 2021 will be credit losses of a magnitude not seen in decades. In 2022–24 and possibly beyond, decreased demand and anaemic net interest margins, depressed by a prolonged zero-rate environment, will surpass risk cost as the industry’s primary ailments.”

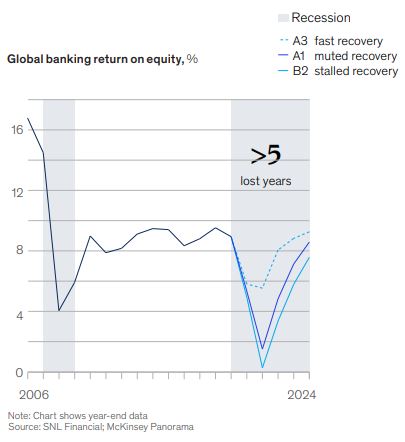

For these reasons, McKinsey reckon that bank ROE (Return-on-Equity) levels will not come back until 2025 or after ...

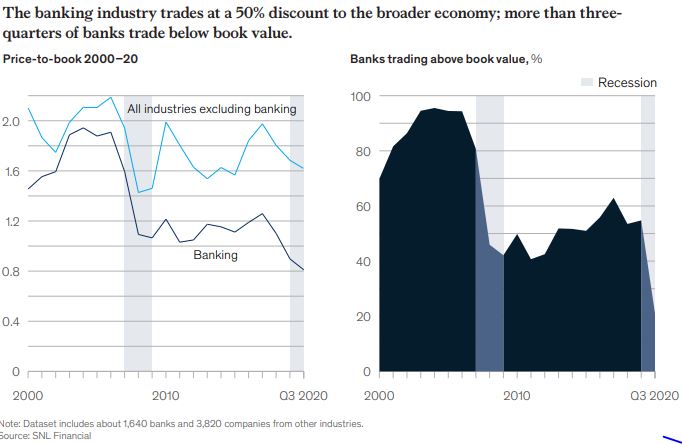

… which is why banks are trading at half their book value …

Again, I don’t want to reproduce the whole report here on the blog so, if you’re interested in this stuff then download the full report here.

Add on to these two a third report - The Global Risks Report 2021 from The World Economic Forum - and you get a rounded picture.

This report highlights a number of risk headlines, many of which are inter-related:

- Economic fragility and societal divisions are set to increase

- Growing digital divides and technology adoption pose concerns

- A doubly disrupted generation of youth is emerging in an age of lost opportunity

- Climate continues to be a looming risk as global cooperation weakens

- A polarized industrial landscape may emerge in the post-pandemic economy

- Better pathways are available to manage risks and enhance resilience

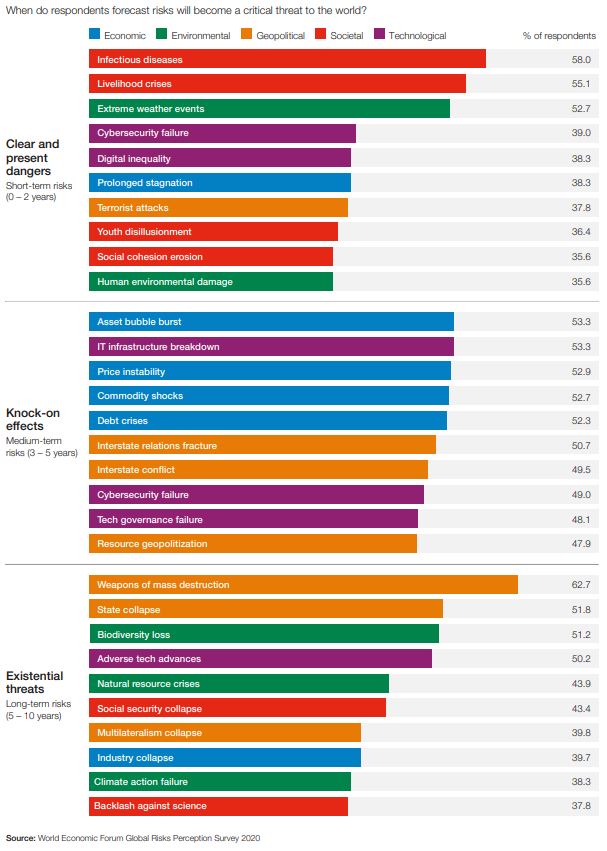

One of the key charts shows how the near-term risks knock-on as a cascade into the medium to long term.

The three reports combined give a great dual sequence of how the banking world is changing thanks to lockdown and coronavirus, which is why I’m sharing them.

Then, finally, a last report that should bring you to a somber state: how banking assists in modern slavery and human trafficking. As Dame Sara Thornton says in the opening of the report:

It was estimated that over 40 million people were held in modern slavery on any day in 2016 and of that total 16 million were victims of labour exploitation in private business … modern slavery is estimated to generate $150 billion in profits annually and is one of the top three international crimes alongside drug trafficking and trade in counterfeit goods. Financial institutions have a significant role to detect and disrupt this serious organised criminality but this report shows that through their lending and investment decisions they can do so much more.

I won’t go much further into this subject, as it is something slightly outside the remit, except to say that COVID has increased slavery and human trafficking considerably in the past year, according to the webinar I attended about the report. A lot of that is because banks do not focus on the area, and turn a blind eye.

My main surprise was how many references there were to the issue of identity documentation and the loss of it for those who are trafficked. Surprisingly, the issue was noted but there was very little about how technology, and specifically digital identities, could help. Hopefully, when they do their next report, this will crop up as a focus as, within the UN’s 2030 Sustainability Goals, a legally recognised identity for every human (Goal 16.9) is expected for all.

It is my belief that one of the ways this will be achieved will be by using digital technologies, specifically mobile and biometrics on a distributed ledger. THAT would be a big assist in reducing these human abuses according to the meetings I’ve attended.

Download the full report here.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...