Salesforce released their research report, Trends in Financial Services, near the end of last year. I had the chance to sit down with Rohit Mahna, Senior Vice President of Industries Advisors for Salesforce, to discuss the report and the shifts happening right now in the industry.

Hi Rohit. Can you give me the background on the report?

We began research in late 2019 to gain an understanding of how digital technologies like AI and automation would shape the next decade of finance. Then the pandemic struck and disrupted the industry (and the world). So, we regrouped and launched a second survey in late 2020 to investigate how the industry was adjusting. We found that questions around AI, automation, and customer experience are more pressing than ever. If anything, the need for a digitally transformed customer experience has only intensified.

In regards to financial institutions, what do they need help with right now?

There are three main buckets:

- Focusing on a great customer experience (CX): Banks need to define their “beyond banking” strategy. Do they want to be a platform and build out an incredible ecosystem that’s part of the customers’ daily fabric? For a small business owner, you help them be a better business owner, not just give them access to capital. If someone is going on a trip, you help them with all aspects of that: plane tickets, booking a hotel, travel insurance, car rental, etc. In essence, being a bank concierge. That’s all about value creation. The last component here is focusing on customer needs and not looking to sell products. The product is the by-product of focusing on customer needs.

(Key stat: 66% of customers expect companies to understand their unique needs and expectations) - Reducing costs: I think the key thing here is rethinking business processes that go beyond front office. Focusing on end-to-end customer experiences while still transforming. Things like onboarding customers, servicing customers, and navigating the ever-changing compliance landscape. How do we create those as end-to-end experiences? And, not just looking to take out costs, but trying to be more efficient and agile. (Key stat: Growth-focused FSIs are 27% more likely to digitize back-office operations than those focused on stabilizing.)

- Dealing with legacy systems: Many firms, especially big banks, are still using old technology. These legacy systems are not just going to go away. We see a lot of firms thinking about how to add more agile capabilities using these fixed systems. It means embracing microservices or going all the way to APIs. Integrating these with your legacy systems expands your capabilities to focus on great experiences and workflows. Reinventing banking was a solution five years ago. Now, it’s got to be much more detail-oriented than that.

What are the problems when they try to implement solutions for these buckets?

Sometimes you need a driving force to do some of these things. I think the first driving force is the massive consolidation in the banking sector. It’s speeding up the need to change, and COVID-19 only accelerated it that much more. The other big factor is new market expectations. Again, being fueled by emerging fintechs and big tech firms, we all understand that story already. (Key stat: 68% of customers say COVID-19 has elevated their expectations of companies’ digital capabilities.)

I think the challenge is that a lot of firms just focus on endpoints. For example, they just focus on the mobile experience or the digital experience. Yes, that’s important because it allows you to execute more of a sense-and-respond strategy and you get instant feedback. But, that can’t be the last thing you do. You've got to think about the job to be done, to reimagine a process end-to-end. The important thing to understand is that people don’t wake up and say, “I want to buy a mortgage product.” They want to buy a house. And that’s a totally different approach for a firm, for a bank in particular, to think about.

In general, what are the mistakes that financial firms make, and how can they shift and do this right?

(Key stats: 98% of FSIs are using at least some AI; 88% of FSIs have a strategy to automate financial decisions)

I feel a challenge is in focusing too much on just the immediate reaction. Saying we’ve launched a chatbot that's helping the contact center or a mobile app that gives customers account access on their device isn’t enough of a strategy. It needs to be much more comprehensive ... like rethinking customer experiences. Or, to our earlier point, it can be defining that “beyond banking” strategy. Just doing some type of digital workflow isn’t sufficient. Think about more end-to-end, a much more complete plan.

One of the takeaways in creating the Trends in Financial Services report is that what was initially thought to be the future state of financial services is the now state today which begs the question: what IS the future state?

(Key stat: 73% of FSIs have deployed autonomous finance or plan to within a year)

The long run future is about removing the most friction. What we’ve seen from every other industry, the winners are the ones who do that, like Amazon, grocery and food delivery, the list goes on and on. Removing the most friction in financial services is the job today. A customer wants to buy a house. Who’s going to help them buy a house?

The winners will be the firms that embrace the ecosystem model and focus on providing connected customer experiences. It’s blurring together traditional banks, fintechs, and the role big tech plays. Financial services need to take inspiration from outside our industry. Buying furniture is no longer about going to a big furniture store and waiting six weeks to six months to get a couch. You can go online to customize a sofa. You get it shipped to you in boxes in a few days, and you assemble it yourself. If you don’t like it, you return it. Speed has been redefined. Same thing with groceries that you order on your phone and they just show up. It’s a great experience. I tap, I pay and I leave. I don’t have to do anything.

Banks have been forced to fund and focus on things like regulatory gaps, compliance gaps, risk security, fraud issues, and cyber security. We’re now seeing that budget moving back to new products and innovation. And, that’s going to be the accelerant for everything I just said.

How can Autonomous Finance help people feel better about their financial situation? As we automate things, we take a little of the “human” out of it? How do you balance the digital and the physical?

It’s not an “or,” it’s an “and” strategy. Yes, you need automation and AI because it helps with removing friction. ”And“ you need to be there when it comes to more life-based events. To me, with autonomous finance, financial wellness becomes the core of it. Wellness is big in healthcare, but really important in financial services too. Wellness means I need to monitor something every day and that‘s where AI and automation helps out. But, I want to check-in at times. And, when I do, I want to see someone, either digitally or physically.

The physical branch of the future is going to change from a place for financial transactions to improved personal connections. Instead of depositing money, branches will be used more as life-based centers where someone goes when they want to sit down and get help with things like ensuring they’ll have money for their kids to go to college or planning a big trip. So there’s automation, but it doesn’t automate everything. What the customer wants in terms of wellness is a coach and advisor. AI and automation helps the banker put more focus on being that advisor.

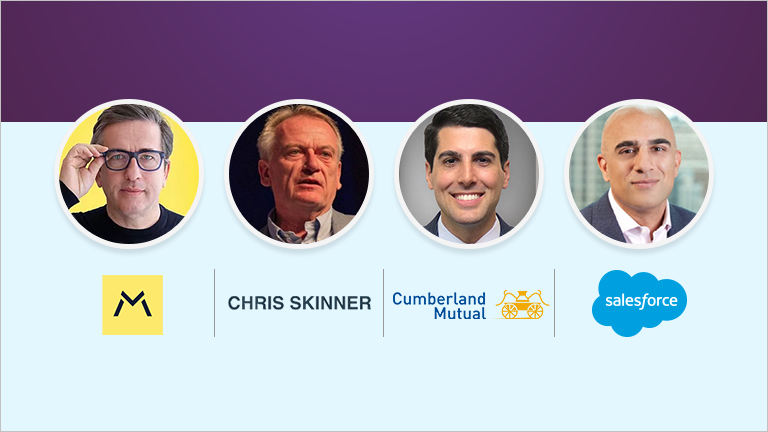

Download the full Trends in Financial Services report for the full data and insights from 2,800 global financial services leaders. You can also access a webinar where Rohit and I discussed these trends in-depth with Spiros Margaris, Founder of Margaris Ventures, and Jeff Ritter, Corporate Development, Investments, and Strategic Initiatives at Cumberland Mutual, if you prefer to listen to good stuff.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...