WARNING: THIS IS WOKE (whatever that is)

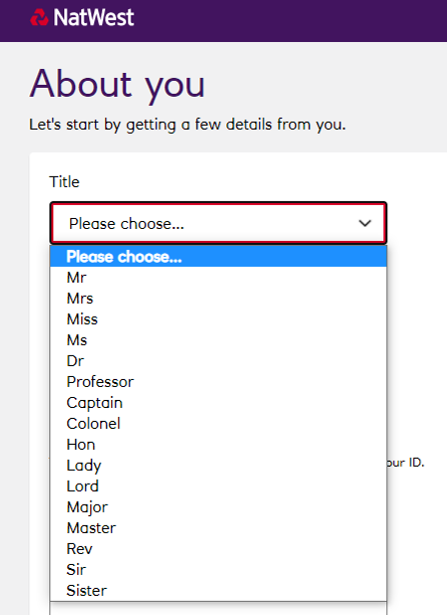

We talk a lot about diversity and LBTG+ and equality, but it’s still a long way off. In fact, I get annoyed when I see online forms with gender and title choices designed for the last century.

Why is this irritating? Specifically, why is it irritating to an old guy like me?

Because it continues the perspective that those who are not normal are not normal. More than this however, what is normal? And, more than this, when half the world is female, why should I choose to tell you if I’m a Mrs, Miss or Ms. And, more than this, it just reinforces the perspective that Mrs, Miss or Ms matter less than Mr’s.

Really? Are you an idiot, Chris?

No, I’m not. Just look at the statistics regarding (1) women in banking and (2) women who have access to banking. On the former note, I’ve blogged a lot about women, diversity and the status they have in banking (last time was International Women’s Day); on the latter, I’ve not blogged so much, so now it’s time to start.

A bit too late to be honest, but some women have huge challenges to get access to banking.

They are treated lesser than men: if they are married, the man is the only one who can open an account on their behalf; if unmarried, they are asked why, and given challenges that no man would ever face; and more.

The last World Bank’s Global Findex report found that there is a persistent gender gap in access to basic accounts in the financial system, where 72% of men have access compared to 65% of women have an account. It also confirmed that whilst there has been some progress, this gender gap has remained unchanged since 2011.

More than one billion women continue to be excluded from formal financial services, according to the 2017 Global Findex, with the gender gap in access remaining stuck at nine percent in developing economies.

I was particularly taken with this report: Advancing Women’s Digital Financial Inclusion, because COVID has made unemployment, exclusion, domestic abuse, sex slavery and human trafficking a HUGE ISSUE right now. Have you noticed?

The report was written for the G20 Global Partnership for Financial Inclusion by the World Bank Group, in collaboration with the Better Than Cash Alliance and Women's World Banking. It highlights 10 policy options to harness women's digital financial inclusion.

What are they?

POLICY OPTION 1: Support making official identity systems and documents universally accessible to all women and girls (a very important topic for me).

POLICY OPTION 2: Facilitate women’s universal ownership of mobile phones.

POLICY OPTION 3: Promote efforts for deploying infrastructure and protocols for government digital payments to women that are competitive and interoperable with private sector payment systems.

POLICY OPTION 4: Support mechanisms for enabling government payments to women to be directly deposited into digital accounts that are easily accessible and under the women’s control, allowing a range of digital financial transactions including payments to governments as well as firms.

POLICY OPTION 5: Leverage technology and behavioural insights to strengthen women’s digital skills and financial capability.

POLICY OPTION 6: Support comprehensive consumer protections, that address women’s needs, including requirements to disclose product prices and terms in clear language and appropriate measures to ensure data privacy and security.

POLICY OPTION 7: Reform discriminatory laws and take actions to promote women’s full economic and financial participation.

POLICY OPTION 8: Encourage and provide appropriate incentives for financial service providers that may increase the representation of women working in financial institutions and financial access points and in decision-making positions.

POLICY OPTION 9: Support national financial inclusion strategies that address both women’s and men’s experiences and needs in all aspects.

POLICY OPTION 10: Support work towards financial institutions providing anonymized sex-disaggregated data as part of reporting requirements, make these data available publicly and use these data to address the needs of women in product design and/or marketing.

It’s a really worthwhile read and there are many others:

- How to Make Financial Inclusion Work for Women, CGAP

- Financial Inclusion for Women: A Way Forward, G20 Insights

- Gender Inclusive Finance, AFI

Discrimination and diversity is not just in the workplace but in everyday life. Shouldn’t we fix it?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...