I’ve not talked much about bitcoin on the blog lately*, but I have tweeted a lot about it. The key take-away? It’s not going away.

People have said bitcoin is dead thousands of times. In fact, there’s a website dedicated to the subject, tracking and tracing the death of bitcoin:

- Most Recent Death: Cryptocurrencies – A product of government malfeasance, March 17th, 2021

- Oldest Death: Why Bitcoin can’t be a currency, December 15, 2010

People have been saying bitcoin will die for a decade, but it doesn’t go away. It’s doing the opposite. It’s rising and growing. Now we have Tesla investing in bitcoin as part of their treasury operations, as are firms like MicroStrategy; we have Morgan Stanley, Goldman Sachs, JPMorgan Chase and, in the latest announcement, State Street getting in on the action; we have Visa, Square, PayPal, Mode and more committing to cryptocurrency payments; and we even see bitcoin being discussed as the next reserve currency of the world.

Why not? I’ve said for a long time that we need an internet currency that is global. Maybe bitcoin is it.

Of course, there are still many who decry it, but the key here is: what does the customer want? If the customer wants bitcoins, then banks have to offer it or become irrelevant. That’s what’s happening here. No wonder Fidelity Investments believe we have passed the tipping point.

What does it mean for governments? It means governments are losing control. Just as Amazon, Facebook and Google govern the world, bitcoin may well become their currency.

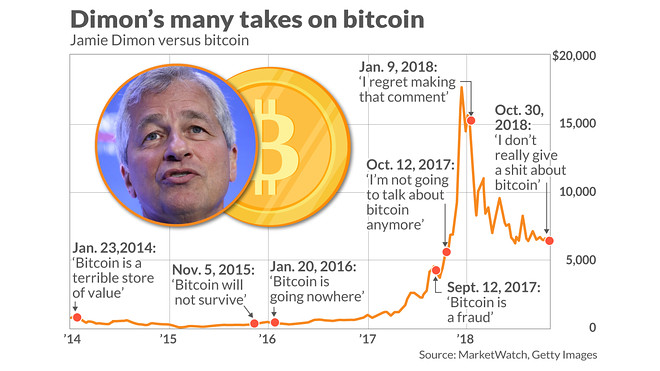

Like many others, such as Jamie Dimon

I’m changing my view. I’ve always said that bitcoin is worthless as it is not backed by anything. Now, I realise that it’s backed by the network. If that is the case, then sure, it could rise in value to $130,000 (JPMorgan Chase), $150,000 (Citibank) or even $400,000 (Bloomberg) in the near future.

The real question we must ask is if bitcoin is rising against the US dollar or if the US dollar is falling against bitcoin.

How the world has and is changing. I guess the biggest kick in the butt for bitcoin is the pandemic. After all, I’ve been HODLing (hold on for dear life) for years, and remember that in March 2020 my hodling holding sank to a new low. A year later, it has risen 20x over and is expected to continue rising for the foreseeable.

The key to this is all about who believes in what. If you believe in gold or oil, then that has a high value. If you believe in bitcoin or ether, then that has a high value.

It’s all related to the blog I posted the other day: what you value is what you value.

Who am I to question this?

The most intriguing aspect of all of this is that bounce over the past year. Why has bitcoin risen so fast?

Oh, a pandemic. Oh, stuck at home. Oh, living digital. Oh, losing confidence in governments. Oh, believing that we need a new way of working and paying:

As central banks on the African continent fight to keep cryptocurrencies from going mainstream, many more migrant workers are increasingly turning to money-sending platforms that use cryptocurrencies when moving funds across borders.

Interestingly, from a global view, you have Peter Thiel, famous for founding PayPal, saying that bitcoin is a Chinese weapon of financial destruction to China realising that bitcoin mining might destroy its climate ambitions.

The world is changing. Keep up.

* apart from an April Fool joke about Venezuela replacing their national currency with bitcoin

Postscript:

My favourite explainer of bitcoin

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...