I was reflecting, which is dangerous.

I was reflecting on my antipathy towards bitcoin as, like most bankers, it appeared to be a bit of a scam with no asset behind it. Then I woke up to what the libertarians have been saying to me all along: any currency is a scam. The US dollar is a scam with no asset behind it, except a US government. If you believe in the US Government, you believe in the US dollar. If you don't, then you find something else to believe in, as would be true of most currencies.

This is why the Venezuelan Bolivar is a scam, as is the Zimbabwe dollar.

It's all about what you believe in and who do you trust.

Gold is scam with zero value – you may say there’s an asset behind it, but what is that asset? The belief that it has value and is an asset? What if you stopped believing that way? What if you stopped believing in the nation state? What if you stopped believing in bank notes and the banks you deal with? What if you stopped believing?

Don't stop believing ...

... or take the red pill.

What if you believed in digital, the network and the democratisation of the world?

So, I finally get it: cryptocurrencies are not a scam, but are about what people believe in.

Now, with bitcoins meteoric rise as a currency system in the past year, along with ETH and others, it looks like the world believes in cryptocurrencies.

This all came to a head this week with the Coinbase direct listing (note: not an IPO). I was listening to this interview on BBC Radio 4’s Today programme re the Coinbase listing (see end of blog for script).

[audio m4a="https://finansernextjs.wpengine.com/wp-content/uploads/2021/04/Coinbase-R4.m4a"][/audio]

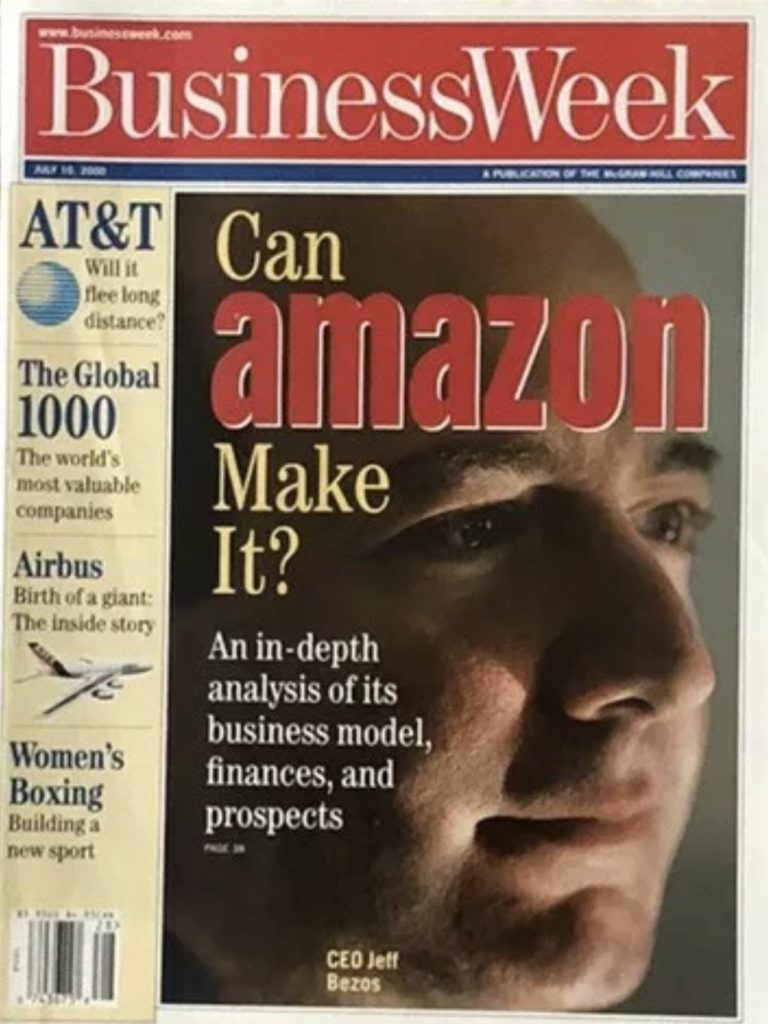

In the interview Emilie Choi, President of Coinbase refers to the digitalisation of value or, as I prefer to call it, the creation of a ValueWeb. She refers to historic moments in digitisation, such as the launch and success of Amazon and Facebook. In fact, it made me laugh the other day when I saw this front cover of Business Week from the Year 2000 (remember those millennium buggers?):

The article that was posted with the picture in July 2000 had an interesting paragraph that formed the basis of the debate:

On June 22, Lehman Brothers Inc. debt analyst Ravi Suria released a scathing report about Amazon's deteriorating credit situation … where Bezos and his band of Wall Street believers think Lehman's report went astray was in focusing on the one year of Amazon's greatest expansion and projecting those costs forward into the future.

Actually, Lehman Brothers Inc made some more errors later in the 2000s ... just goes to show how way off the mark people can be.

In this case, Ravi Suria had missed the vision that Amazon was creating. Incorporated in 1994 and initially just selling books, it had no real online competition. Then, in late 2000, they launched Amazon Marketplace which allowed customers to sell used books, CDs, DVDs, and other products alongside new items. In expanding their offer, they had to make a big bet on infrastructure and service. This is well illustrated by this thread of thinking from one of their early developers:

NOTE: it’s worth clicking through and reading the whole thread

So, Amazon had spent a gazillion of investment to reinvent their infrastructure in 2000. They completely rearchitected their systems to run on Linux and HP servers, rather than Sun Microsystems. It was a risky gamble, and they were not far off going bust.

But it also led to Bezos realising, once it was built and they had survived, that the company had a huge amount of spare compute power.

Which led to the creation of Amazon Web Services (AWS) and the company has become the richest in the world, as has its founder.

This was the company that created commerce using the network effect.

The network effect?

I’ve talked about it before, but then went back to a speech by an old boss of mine Ken Olisa (now Sir Kenneth Olisa), who I remember talking about fax machines and the network effect way back when. Now, we see the network effect in a lot of digitalisation.

As Emilie of Coinbase mentioned, we saw it with Facebook, and we’ve seen it with Apple and with Amazon and others. The thing is that none of these companies were obvious at the time.

- When Google started, AskJeeves and Yahoo! dominated

- Did you truly believe Apple would recover from John Sculley’s time there? (Michael Dell didn't)

- Did anyone expect Amazon to survive the dotcom crash?

- When mobile took over, did anyone believe Facebook would survive the onslaught of new network services? (they almost died in early 2010s)

And each of these have defined moments of the digitalisation of the world, caught the network effect to dominate, and then leveraged that domination to expand across markets and countries. The result is the digitalisation of social, commercial and financial services through the network.

First, there was building the hardware (IBM et al); then there was the creation of the software platform (Microsoft et al); followed by the movement of that platform to a networked world (Cisco et al); then finding stuff (Google et al); placing that network in the hands, pockets and purses of every user around the world (Apple et al); giving them apps and more to do commercial services (Amazon and co); as well as to be social (Facebook and co); and financial (… urm?).

It’s that last bit that bitcoin, crypto and Coinbase is playing to: the next generation of money.

We think PayPal, Stripe, Square and co was where the action was. We did. But the networked world is demanding a global currency, a global ability to exchange value and the digitalisation of value in a democratised and decentralised form. That’s why PayPal, Stripe, Square and co, are all now dealing in cryptocurrencies, as are many of the large banks and custodians. It is because customers want it and by customers, I mean both retail and corporate (remember Tesla putting $1.5 billion of treasury reserves into bitcoin?).

I get it.

Thing is: will governments allow it and, more importantly, if they don’t like it how could they stop it?

The internet does not recognise countries and borders. However, governments recognise the threat of the internet and maybe the best example of a country dealing with this is China. Look at what they’re doing to the networked giants, cryptocurrencies and tightening of the Great Firewall of China.

Interesting times and great to observe the reimagination of life on Earth ... well, at least life for humans on Earth.

End-note

I enjoyed Emilia's interview so much that we got it transcribed:

BBC: The value of cryptic currencies has been incredibly volatile. The most famous one, Bitcoin crashed a few years ago but has been rising sharply to a record high.

The Bank of England and other Central Banks have warned for years that they are inherently risky.

When shares in a massive crypto exchange Coinbase start trading in the US later, some analysts forecast the company could be worth more than $90bn by the end of the day, that’s more than $10bn more BP but we’ll have to wait and see.

I’ve been talking to Emilie Choi, the President of Coinbase. Why has the company decided to go public with a direct listing where existing investors sell their shares right now?

Emilie: “Coinbase is a company that represents Crypto, and we want to bring Crypto to the world and we felt that this was a great way to do so. It’s also a great way for us to have a public mark on our stock which allows to do things like M&A and that’s a large part of the strategy that we do.”

Coinbase could be valued at more than the British oil giant BP. Do you think crypto currency platform deserves such a high valuation?

“It’s not for me to say what the market should assess our valuation to be. I think that’s actually the beauty of what we were trying to achieve with the direct listing. It’s vet much almost like a crypto philosophy in the sense that market will tell us what it wants to value us at and it’s a free market, so it’ll be interesting to see how it trades.”

It’s been suggested that you are selling shovels in a gold rush. What do you make of that, you are enticing people to buy into what some people do worry could be a crypto currency bubble, an incredibly frothy market?

“We believe that, in the same way that email was the digitisation of information as you and I send emails and used to send each other snail mail, crypto is the digitisation of value and so our focus is on furthering that mission. It’s not about trying to think about what point of the market we’re in or anything like that. Ultimately, what we want to do it we want to enable everyone around the world to do all sorts of interesting things within the crypto economy and that is what the company is founded on.”

But if we say again the kind of volatility we’ve seen in previous years with the likes of Bitcoin, some people on your platform could lose quite a bit of money couldn’t they.

“We don’t think about it that way to be honest with you because we are long term thinkers. I think that if you said something like “Oh there was a technology bubble back in 1999” or something like that. Ultimately, we saw what technology ended up achieving and continues to achieve and I think that there’s going to be volatility with new technologies and the companies that are associated with them and that’s ok. That’s actually a feature and not a bug.

"The way that we look at everything we do is long-term cycles, the same way that Amazon did when they went public. Don’t get focused on short-term quarterly things. Don’t get over indexed on things like high volatility. If you believe in the long-term idea of digital value and what crypto assets create, you’re just going to play this as a long-term thing. You’re not going to think about short-term ups and downs.”

Long-term, do you think crypto currencies will be more widely used? Perhaps even more stable than an awful lot of regular currencies today?

“Yes. I mean look around the world. There are quite a few currencies around the world that are quite volatile as well. We believe that this digitisation of value, it’s going to be foundational in the way that it enables people to use their different assets. So, yes we believe that is the future.”

Yet your shares will float in an old-fashioned currency.

“Well, you know, we’re pragmatists. It is a direct listing, so a direct listing is a new form of stock offering. We felt like that was something that was very much in the spirit and the ethos of crypto but of course at some point we have ambitions to do our own token offering as well. I think the cool thing about Coinbase is there’s a little mix of the traditional and there’s pushing on the crypto space and so you get the best of both worlds in many ways, with the way that we do things.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...