Building on yesterday’s blog, it’s an interesting moment in time.

The old world structures reject cryptocurrencies whilst the new world structures accept them en masse. This was typified for me by a couple of headlines the other day:

- UK Bank NatWest Bars Businesses That Accept Crypto

- Signature Bank Goes Head-to-Head With Silvergate in Bitcoin-Backed Lending

It really represents the seismic movement of these tectonic plates from paper to data.

This was even more pressed upon me when I saw that a lot of GenZ are heavily into crypto-investing.

A survey by financial group Charles Schwab found that 51% of UK investors under 37 now trade cryptocurrencies, double the 25% of whom that buy or hold equities; while a report by the UK regulator FCA found that new crypto investors in the last year “tend to skew more towards being female, under 40 and from a BAME background.”

I found that interesting as, being a FinTech guy, I’ve had several people from countries that are blocked from crypto approaching me to buy bitcoin, ETH, XRP and more for them, and often female. For some reason, they trust me. And there’s they key point: trust.

Someone responded to a tweet I made about bitcoin saying it’s a Ponzi scheme. I replied that the US dollar is a Ponzi scheme, if you think of it that way.

Think about it.

Why do you believe that piece of paper in your hand has value?

Let's say it's a $50 dollar note you are holding. Why is that worth $50? It's just a piece of paper. If the US government announced that, from tomorrow, all $50 are worthless then you realise it's just a piece of paper. It has zero value. It's only value is what you and the merchant believe it's worth. It's just a construct.

The US dollar only has meaning because we believe America has a strong and stable currency, backed by the US government. Before that construct, we believed the world was tied to the gold standard. Before that, it used to be the King. It used to be the Pharoah. We only believe in the constructs of our society, our world, our governments and our financial institutions, for as long as we believe in them. I’ve said for many years that countries don’t exist, companies don’t exist, governments don’t exist. We just created them.

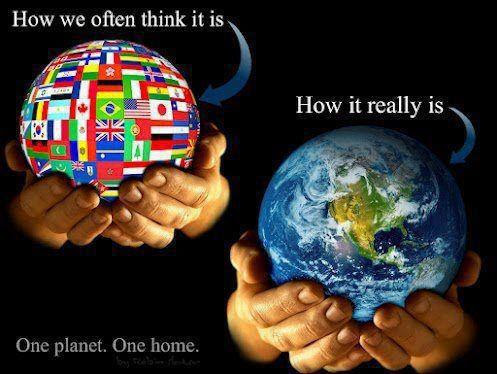

People have cut up and carved the world into countries with borders. Networking is removing the world with countries and borders. The network is taking over.

In the last century, we had a world with borders organised by little ability to travel across those borders and, if you did, you would find a whole new world of language, commerce and currency. Today, we can connect with anyone, anywhere, anytime; we all speak the same language: basic English; and we can all transact using the network of currencies.

This last point is a critical point.

The whole complex structure of banking was created for cross-border transacting between countries with trust. It is a complex structure due to the very nature of physical borders and country rules. SWIFT exists to overcome this, as does MasterCard and Visa, but we now have a whole new construct being developed: the networked economy.

In the networked economy, no-one cares about countries, borders and governments.

Still from the movie Mile 22

They care about ease of transacting; ease of work; ease of dealing with each other; and ease of moving through the network.

Banks were created to overcome the difficulties of moving around the global network of physical entities; can they evolve to deal with the global network of digital entities? Based upon what we are seeing with cryptocurrencies, probably not. I guess that then brings us around to the hardest question: can governments evolve to deal with a global network of digital entities? And that’s the most important point which, when answering the question, it remains to be seen.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...