I just rang my pension fund. I realised that I’ve paid £1000’s into the fund, but hadn’t had a statement recently. I also realised I couldn’t login online, as I’d forgotten the details.

Once someone picked up the phone, which took a while, they took me through the security sign-in. Name, age, address, etc. The final security question was: name one of the funds you’re invested in?

I had no idea. The last time I thought about my pension was around 2010. As I hadn’t thought about it for years, I said no idea, ask me another question. Sorry sir, came the answer. You have to answer this question, or I cannot access your account.

That’s when the conversation finished and then it struck me: how many people die with pensions worth £1000’s and leave them unclaimed?

In the UK alone, it’s over $25 billion. Worldwide it must be more than $200 billion.

What a good business to be in.

Pension pots can be ‘lost’ when an employee moves jobs and ends their membership of that particular workplace pension scheme ... without the reminder of regular annual statements, they may forget about that pension pot altogether. Moving home is the most common cause of pensions being forgotten, but there are others – including the death of the holder, leaving their partner or beneficiaries unaware that the pensions exist.

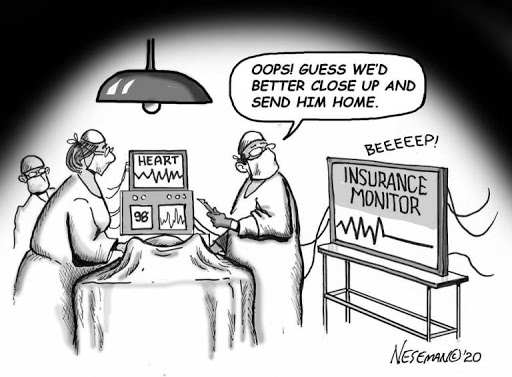

In fact, insurance and pensions is fairly contradictory. On the one hand, it is meant to be there for the day something bad happens; on the other, it is often not there when something bad happens, as they find a clause to refuse payment ... and I say this as someone fairly expert in insurance (I took a post-graduate degree in it).

Insurance is meant to sort out issues that you pay to protect yourself against. Insurance gathers the funds of the many to pay out the issues of the few. That’s the basic idea. Thing is that many people pay for years and never claim or use the services and then, with pensions, many people pay into a pension and may forget about it. During my lifetime, I’ve had a number of pension providers. To be honest, it’s got to the state that I cannot remember who they are or how many. It’s been too long. I’ve moved around too much. There’s too much chaos in my life to remember who that company was who provided my pension in that job I had twenty years ago.

It’s a broken business.

It was built in a world of jobs for life, where employers paid premiums and employees stayed for forty years or more. In that world, you don't need to track and trace the customer. In the world of today, the relationship is broken.

What this demands is a new way of thinking. Why should the customer have to remember who they had a pension with? Shouldn’t the pension provider remember who the customer is? Is this a distributed ledger use case?

I think it is. A retrievable record of contributions for the lifetime of the policyholder, always there, ever-ready. But then that would be bad news for the insurance industry as there’s a fundamental issue here: people buy insurance to cover the future unknowns; insurance dodges the customer when the future unknowns happen.

Of course, I’m in the wrong here. Of course, insurance is a highly respected industry that does its best to provide cover for when the worst happens.

Does it?

Last time I made a claim on my contents insurance, my premiums doubled the next year (even though it was for a small claim); my last car accident resulted in the insurer saying it was my fault, even though I claim it was not, and premiums doubling; I pay £1000s each year for health cover that I never use; and then there are pensions that suck contributions and can avoid the customer by asking what fund you invested in, ten years after you last made contact.

This is why the insurance industry has a bad reputation, and it is primarily for these reasons: they don’t know the customer; don’t care about the customer; avoid the customer; and tell the customer they are wrong when they need help.

HUGE OPPORTUNITY for a start-up FinTech or, if you prefer, Insurtech.

Postscript

I was asked to clarify what happens to unclaimed pensions. Answer: they can be claimed by the contributor or their dependents, if they can find it.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...