I found this article from The Asia Times interesting. It discusses the idea that China is trying to displace the US dollar as a reserve currency.

Difficult.

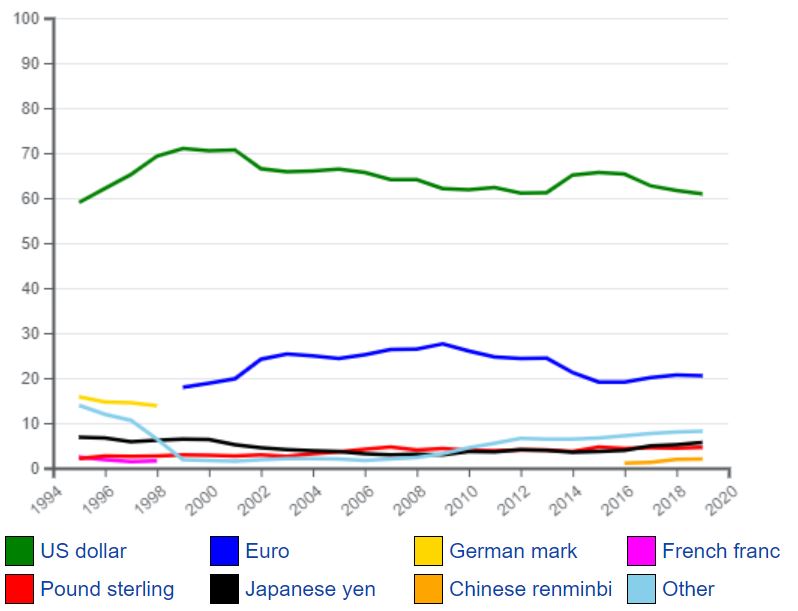

The US dollar represents over 60 percent of all currency reserves around the world.

For more, check Wikipedia

The euro is 20 percent and yuan/renminbi doesn’t even register.

But …

Well, what the article makes clear is that the Chinese gambit is not to replace the reserve currency of the world. They know that won’t happen.

China has no intention of replacing the US dollar with its RMB within the framework of the existing world banking system … the Big Tech/fintech revolution will make [the dollar] redundant. Instead, as Morgan Stanley analysts explained this week, “banks will lose their deposit base” as digital currencies replace their most basic functions.

This is the key play the Chinese are making with a central-bank digital currency (CBDC), according to author David P. Goldman (Sachs?).

A paragraph that really resonated in the article is this one:

What Western analysts fail to grasp is that China is not trying to take the place of the United States. Rather, China is creating a new system of world trade and finance that will – as a by-product – replace the methods of trade financing that have remained in place since the Venetian Republic introduced them in the 13th century.

Why does that resonate?

It is progression of my last few blogs and thinking: China has realised there is a new currency construct; most of Europe and America has not (yet). A new currency construct is needed for digital networking and it will replace the currency construct of physical networking.

Why do you think China is at the forefront of issuing a CBDC? It’s nothing to do with tech and tech experimentation; it is all to do with trade and trade experimentation.

Tech, trade and finance walk hand-in-hand into the future. Therefore, let’s forget the idea of a Chinese currency replacing the dollar; let’s instead consider the idea of a new trade construct.

Mr. Goldman postulates that: “the role of reserve currencies that began with the pound sterling under the Pax Britannica will atrophy over time”.

So, what does that mean? It means that a new currency will support digital world operations. Is it the Chinese CBDC or bitcoin or ETH or something else?

Maybe the answer lies in this research paper by Morgan Stanley: “Digital Disruption: The Inevitable Rise of CBDC”, where they note that:

“Even though central banks will try not to disrupt the banks, CBDC accounts will increase competition for customer deposits.

“Direct access to central banks will allow tech-enabled non-banks to offer payment services and digital wallets, capturing customer transaction data in the process.

“In combination with advances in AI, big tech will be able to use transaction data for credit assessment and cross selling.

“In the most disruptive case, banks lose deposit base, credit creation needs to be funded wholesale or by central bank.”

In fact, they underscore that the digital system will hollow out the deposit base of the banking system, most emphatically for international trade financing, and that reserve currencies won’t disappear, but they will become vestigial.

Vestigial?

Great word which translates into “a very small remnant of something that was once greater”.

Like the British Empire, the US dollar may be going the way of the last great empire of trade and commerce. It fuelled the Industrial Revolution but withers on the vine of the Digital Revolution, and it’s nothing to do with China versus America. It’s far more to do with what powers the trade and commerce structure of the new network. There’s the challenge and the question.

The question?

Is the future a Chinese CBDC or ETH or something else?

- SEC Commissioner admist that trying to ban bitcoin is like trying to shut down the internet ... it won't happen

- The European Investment Bank is reportedly preparing an inaugural 'digital bond' sale, offering $121 million of debt issued on the Ethereum blockchain network

Oh, this is fun to watch.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...