I was thinking about run the bank, change the bank, and the challenges therein. Part of it was down to a conversation that repeats quite often about it being easier to launch a new bank than change the old bank. Something I’ve argued against regularly. Reason being: what are you doing with the old bank, its customers and staff? Letting it rot? Similarly, almost every new bank gets beaten to death by the old bank management – just look at Bó and Finn.

As the conversation went on, the person I was debating with pushed back on each of these points and kept pointing at Marcus by Goldman Sachs. I said that’s not a good example. Marcus is not a bank that Goldman Sachs built to compete with Goldman Sachs. Marcus is a new bank they launched in a new market to attract new customers with new products and services. There is a huge difference between creating new companies for new markets than launching a new company to compete with your existing market.

Also noteworthy is that even as a new bank for a new market, even Marcus is apparently struggling.

And I guess that’s the critical point. Almost every new digital bank that has been launched by an old industrial bank has failed; but every bank launched by an old bank in new markets, new countries and new areas that attracts a new audience might succeed.

Such a simple message, but it makes me wonder why so many strategic directors of banks haven’t got it. In fact, take it one step further, many banks are seeing digital bank acquisitions as the way to go. National Australia Bank recently acquired 86400 in Australia. Good luck with that as, yet again, I have this feeling that even if you acquire a digital bank, if it overlaps too much with your core territories, customers and people, it will whither on the vine. Just look at BBVA and Simple (USA) or BPCE and Fidor Bank (Europe) if you want to see what I mean.

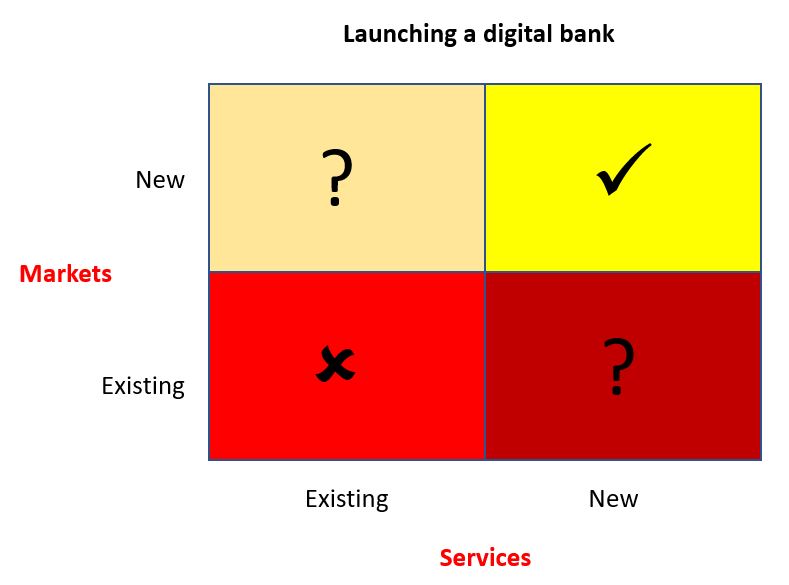

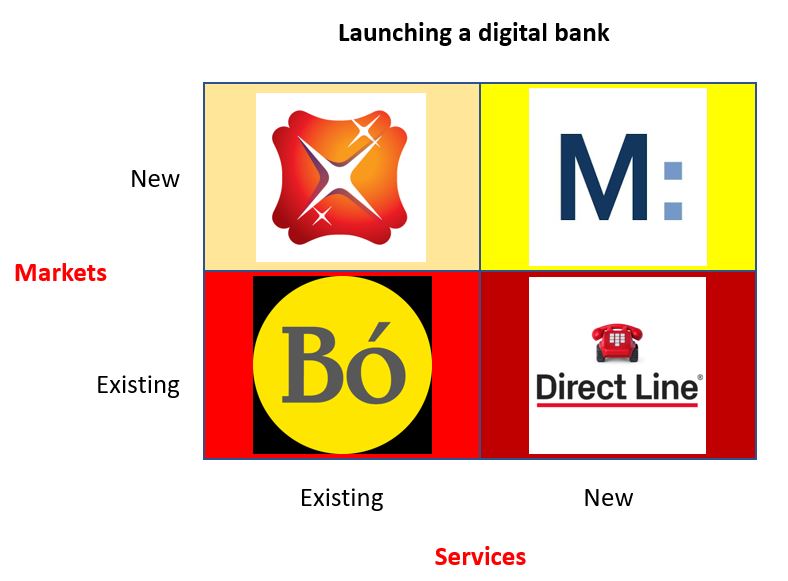

So, here’s a simple chart for banks looking at digital banking.

New markets with new services are likely the only area for success, although I don’t see many banks going there apart from Goldman Sachs with Marcus. Most banks tend to focus much more on existing markets with existing services, which invariably fails due to self-cannibalization. New markets with existing services can work, as illustrated by DBS’s Digibank launches in India and Indonesia, and existing markets with new services also, as shown by any bank that has extended into bancassurance, as many banks did in the last century, such as RBS with Direct Line in the UK.

What this says to me is that any bank launching a digital bank, to cannibalise itself, is likely to fail. Any bank that launches a digital bank into new markets and/or with new services is far more likely to succeed.

Meanwhile, yes, a bank does need to cannibalise. But it should cannibalise from within. Hence, the reason for a Chief Cannibal Officer (as I wrote way back in 2014).

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...