I had a bit of a twitter spat with my friend Peter Matza, who has a background in corporate treasury. You can follow the thread from here:

The gist of it is whether trickle-down economics works? I claim it does not; Peter claims it does.

First, what is trickle-down economics:

Trickle-down economics is the economic proposition that taxes on businesses and the wealthy in society should be reduced as a means to stimulate business investment in the short term and benefit society at large in the long term … the term "trickle-down" originated as a joke by humourist Will Rogers and today is often used to criticize economic policies that favour the wealthy or privileged while being framed as good for the average citizen.

It’s all part of supply-side economics. What’s that?

Supply-side economics is a macroeconomic theory that reckons economic growth can be most effectively fostered by lowering taxes, decreasing regulation, and allowing free trade. According to supply-side economics, consumers will benefit from greater supplies of goods and services at lower prices, and employment will increase.

Demand-side economics opposes this theory. What’s that?

Proponents of demand-side economics argue that tax breaks for the wealthy produce little, if any, economic benefit because most of the additional money is not spent on goods or services but is reinvested in an economy with low demand (which makes speculative bubbles likely). Instead, they argue increased governmental spending will help to grow the economy by spurring additional employment opportunities.

It's a complex discussion, as you’ve probably already just realised. The complexity is around supply and demand, free markets and government intervention. It’s also an important discussion, as there is a new model coming into play: the democratised market, where the network is the government.

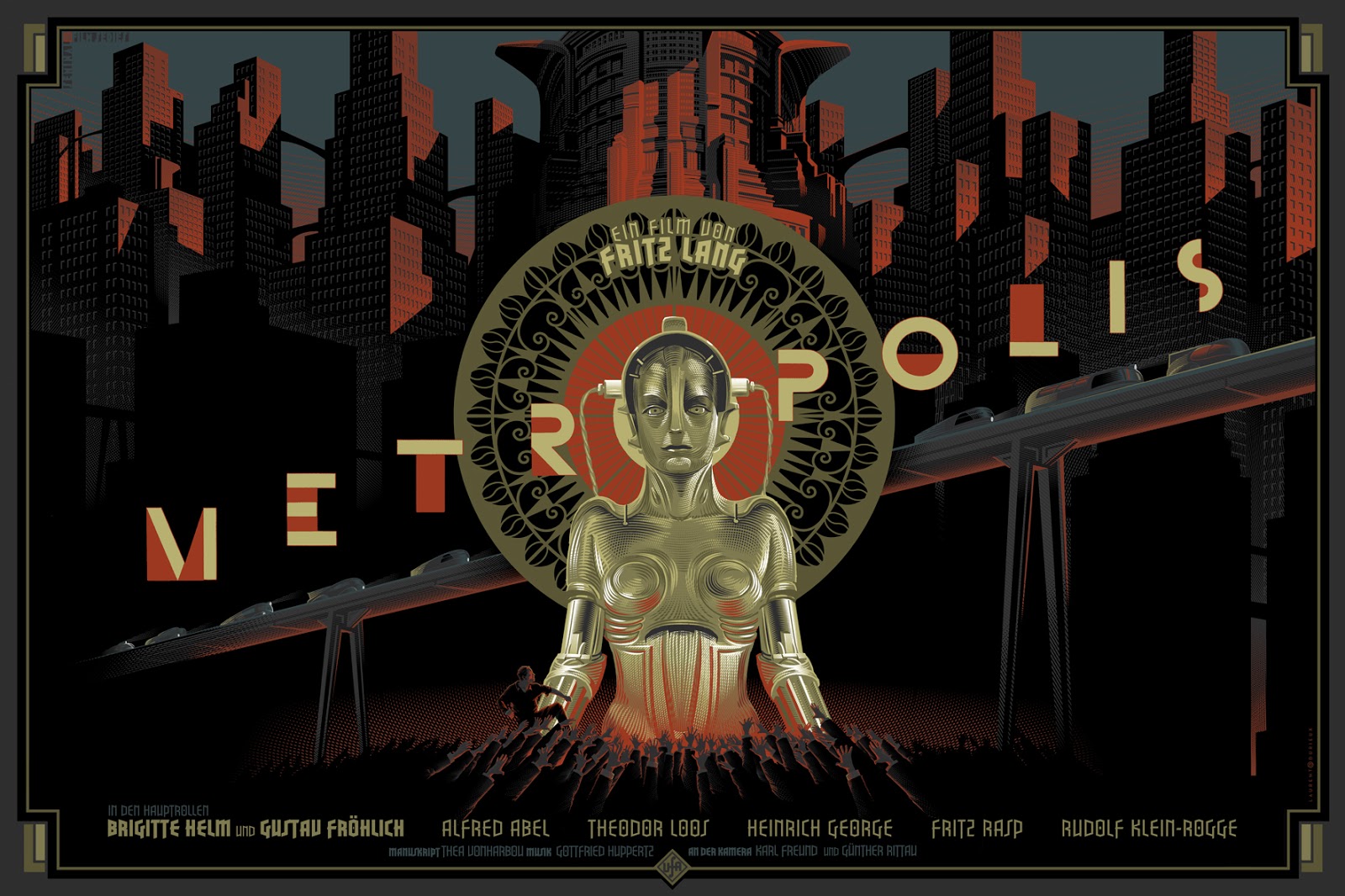

I’m having this debate often these days, and personally do not believe in trickle-down economics. It reminds me too much of Fritz Lang’s wonderful 1927 silent movie Metropolis. The movie is the story of a Utopian land where the wealthy enjoy the high life, whilst 1000’s work underground to support their high living. Equally, today, I often cite the fact that eight people with more wealth than the 4.6 billion poorest does not seem like a fair world.

Peter argued back that the world has always been unequal and that at least the poor have work.

Hmmm …

Along with my writing about using digital for good, climate change, financial inclusion and more, I worry that my political views seem to swing to the left. They don’t. They’re not left or right. I am purely an advocate that everyone should have opportunity, but when the opportunity swings too far in favour of the wealthy to control the poor, it has to be wrong.

This is where I’m a believer today that not only are trickle-down economics an unfair construct but that Milton Friedman’s free market economics is completely broken.

For me, the two go hand-in-hand and my loose interpretation of free market economics is that you can do whatever you need to do to make a profit, as long as it doesn’t break the rules. The result of that view is that you have billionaires, and some soon-to-be trillionaires, running all the way to the Mars Bank, whilst 1,000’s on Earth work for them 24*7 and get paid peanuts. Isn’t that the Amazon way?

In writing this, I found it interesting to discover a book I had missed: On the Clock by Emily Guendelsberger:

On the Clock examines the broken social safety net as well as an economy that has purposely had all the slack drained out and converted to profit. Until robots pack boxes, resolve billing issues, and make fast food, human beings supervised by AI will continue to get the job done. Guendelsberger shows us how workers went from being the most expensive element of production to the cheapest - and how low wage jobs have been remade to serve the ideals of efficiency, at the cost of humanity.

Now, I am not typifying the companies she covers in the book as squashing the workers at the expense of the management, but it is clear there is something disproportionately wrong when one person makes billions a year, whilst thousands of people walk tens of miles a day around their warehouses to pick merchandise off shelves to give them their dollars. Peter would say that at least the person walking the warehouse has work; I would say the system is too skewed to the wealthy versus the poor. Am I getting too political?

Each and every time governments have tested trickle-down [economic] theory, deficits balloon, rich folks hoard their wealth at the top, and average [people] suffer.

Maybe I am being too political but, for me, it always comes back to seeing people in extreme poverty who make the best of their lot. As I travel around the world, I often find the happiest people are the people who have the least. My worries for such folks is that it is also the poorest people who pay the most for financial access and service, and are the most exploited and vulnerable. That is not fair. After all, remember, you are ALL no better than the cleaner.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...