As someone who has set up a number of small businesses, there are three major tasks that I hate:

- Doing the accounts

- Tax returns

- Invoices

As the business owner, all I want to do is my job, to have fun, to get on with creating more customers and more business. However, the issue with accounts, tax and invoicing is letting go. Sure, I could hire a chief finance officer yet, when you’re just starting out, having one person dedicated to doing debits and credits record-keeping seems like a big overhead. Equally, you could give the record-keeping to a part-time helper, but how many small business owners are nervous about giving a temp access to their bank account?

In my case, I usually have my accountant do the record-keeping until the company gets to a size that it warrants having a CFO. But finance is a highly manual process on the accounting side – FX netting, pooling trade finance and other areas are different. This begs the question why do so many companies have armies of accounting people just doing record-keeping?

“In our bank we have people doing work like robots. Tomorrow we will have robots behaving like people” and accountants who “spend a lot of time basically being an abacus” will be replaced by machines. John Cryan, former CEO of Deutsche Bank

What is needed is automation of processes for business to eradicate the overhead of manual human checks. From receivables to payables, reconciliations and exceptions, corporate actions and accounting, every area of accounting and record-keeping that can be automated should be automated. And gradually it is.

The huge overhead of purely keeping debits and credits together is a pain that can be solved by software. Unfortunately, the first wave of software still required manual management. Everything from Sage to Excel spreadsheets were great for keeping records electronically, but the records had to be made by human hand.

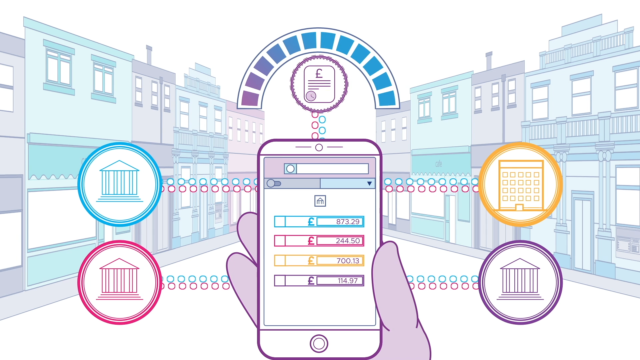

Now, we are moving into the world of pure automation. As money is spent through apps, the apps send details to accounting apps and the accounting apps keep the records automatically. As bank activities occur, the banking services via Open APIs updates the accounting apps. This is a move that is fantastic for the business, but threatening for the finance operations. Or is it?

Actually, it is a good thing for the financial side of the business. Automating manual processes makes them cheaper and more efficient, if done right. Specifically, as an example, I was impressed by a demo given to me by a company called Mesh, who provide a one-stop hub that includes a range of corporate services from virtual cards to subscription management and a digital platform to analyse, optimise and reconcile. The service happens to be completely free and they offer cashback for all transactions. There are many other firms that do this stuff like Ramp, Divvy and Airbase.

What surprises me is that banks are not offering these services as integrated offers to customers within their Open Banking services. This is where Open Banking could really stirk a low-hanging fruit hit. Proactively tell customers they can have free accounting software and automate the mundane, reduce overheads and become more efficient. Oh, some do.

This is the direction of the next decade. Banks will start to integrate more and more services for corporate clients, so that corporate clients don’t need to do their own mundane accounting. For small businesses, they do it already; for larger corporates, they will start to do it soon and some are already.

In fact, it’s been interesting seeing how banks are trying to add these value-added services, yet their corporate clients are resisting. I always remember how one banker said to me: we are always innovating but our corporate clients are not interested; they just want basic banking services.

Why would that be?

Well, just like banks, most corporations have evolved over time into complex structures and their accounting and financial systems are even more complex. If you think a bank is a mess of systems in the back office, you should look at any large corporation and see what they look like.

The thing is that this will also change as software eats the world. What we are going to see is Open Finance and Open Accounting evolve, in exactly the same way as we are seeing Open Banking today. In other words, the tightly integrated corporate financial system will become uncoupled and open to all the niche services we see out there today like the Mesh’s of this world.

Open Accounting offered by your Open Bank to your Open Corporation.

That sounds great.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...