I didn’t think about it until recently, but every generation is paying the debts of their parents and ancestors. When you say it, it’s obvious. It’s clear. Yet, why are we always thinking about the future whilst gorging on the past?

I can see this with the arguments over the climate emergency today, but I can see it more clearly brought to home when we discuss debt. The more debt passed to you, the harder your life.

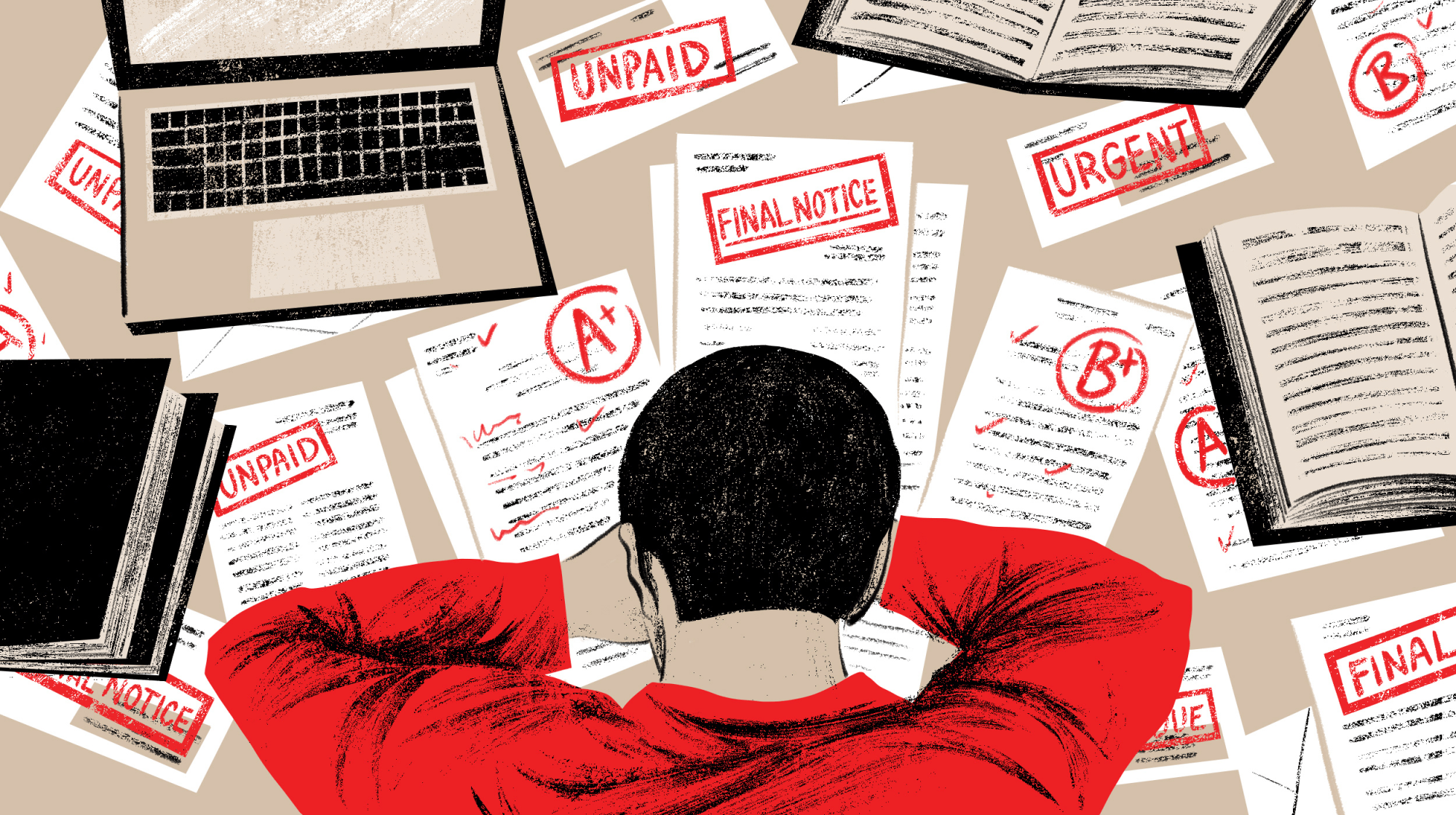

Today, we have built a society built on debt. Debt from education; debt from having a place to live; debt from travelling to work; debt from everything.

Debt is great for banks. As Walter Bagehot wrote in 1873:

“The distinctive function of the banker ‘begins as soon as he uses the money of others’; as long as he uses his own money, he is only a capitalist.”

The focus of banks is to create debt because then the banker is using the money of others. The money of others they may not own, but the very fact they took on the debt now means they have to pay back the debt.

Debt. Debt keeps people under your thumb. It’s the reason why the 1% succeed. They succeed by having everyone else in their debt.

The book Debt is a great work in this space. I was very struck by the opening. What particularly stayed with me is that if you can place a country or a person in debt, then they are forever indebted to you. It is the way to build empires and corporations. You make people subservient to you through money and debt.

There is an issue here today however which changes that equation somewhat. It is the issue of ownership. I grew up with the ability to own a home, but I worry that my kids will not. When my dad was growing up, he could buy a house and pay it back in around 15 years; due to inflation, when I grew up, I could buy a house and pay it back in around 20 years; due to inflation, as my kids grow up, they can buy a flat – houses are no longer affordable – and pay it back in around 30 years.

30 years?

That’s half their life!

And then what happens to their kids and their grandchildren?

It makes you think about human rights. We have a right to eat, a right to shelter, a right to Wi-Fi. OK, the last one is a joke … or is it?

But when we talk about rights and needs and debt, much of this is a false construct. The way we build our world today is that our children are born owing money. They owe for their birth, they owe for their future, they owe for this food, they owe for their education.

I was lucky to be born with free education and food at school, free access to my future. We seem to have shifted rapidly whereby our kids can only have food, education and a future if their parents can afford it.

Oh dear, I seem like I’m ranting. I’m not. I’m just thinking about the future, as always.

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...