I found the answer to What about maybe? and why HSBC, NatWest, Monzo and more are freezing customer accounts, closing them down and annoying customers left, right and centre.

Money.

Rather, it’s the money they’ll have to pay if the regulator catches them breaking the rules. From The Times:

Global fines for failures related to money laundering at banks and financial services firms were five times higher last year than in 2019 as regulators took a harder line over breaches. Total enforcement fines linked with efforts to combat money laundering reached $2.2 billion in 2020, up from $444 million in 2019, according to research by Kroll, the investigations, risk and regulatory consultancy.

Thing is that banks dealing with tightening regulations should focus upon how that impacts their externalities, not just their internalities. But they don’t. Whether challenger or incumbent, the reaction is that if there are millions of dollars of exposures to fines and regulations, we will just close accounts.

The problem with the latter approach is what does that mean for reputation risk?

It’s all about risk. Banks have risks from so many fronts, but they focus heavily on risk from regulatory enforcement more than perhaps risk from reputational loss? After all, how many people actually are stirred into action when a bank suffers a reputational loss?

Take Barclays as an example.

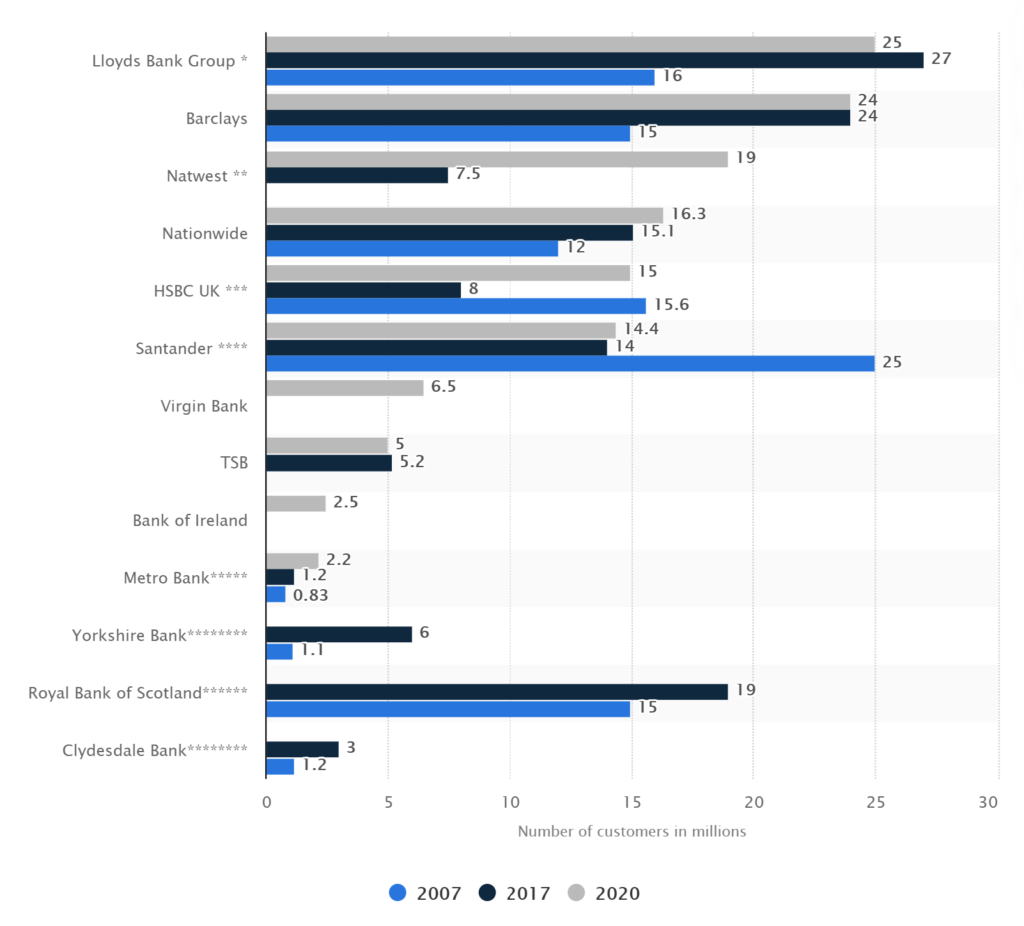

Barclays Bank suffered a huge reputational loss under Bob Diamond and the LIBOR scandal in 2012. To be honest, it was Barclays that was the whistleblower on the LIBOR scandal, but the ensuing media morass made out that it was Barclays who were rigging the markets. In other news, Barclays has been called out by Extinction Rebellion as the fracking king of Britain. After both incidents, there were regular chats on radio and TV about how disgusting and consumers saying they were going to close their accounts. Did customers leave? Looking at the UK market share of retail banking … urmm, no.

Source: Statista

In fact, after these scandals, Barclays gained more accounts. Barclays just got bigger. In fact, on a global scale, big banks are just getting bigger.

Americans are parking more money with the biggest banks than ever before, cementing the firms’ dominance of the financial industry less than a decade after the 2008 crisis. The three largest U.S. banks by assets have added more than $2.4 trillion in domestic deposits over the past 10 years, a 180% increase, according to a Wall Street Journal analysis of regulatory data. That amount exceeds what the top eight banks had in such deposits combined in 2007.

No matter what you feel about big bad banks, the big bad banks are getting bigger and bigger.

Why is this?

Because customers don’t give a flying truck. Customers just want a big bad bank with a big bad banking license to look after their small good money and not lose it. With all of our FinTech sword and sabre rattling, the big bad banks are still just that. Big and bad.

Meantime, what about maybe? Well, maybe not. Who cares?

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...