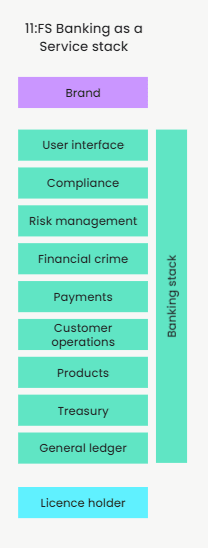

Simon Taylor posted an interesting dialogue about BaaS the other day. He used a couple of charts to illustrate the banking stack. The easiest and most basic one is this:

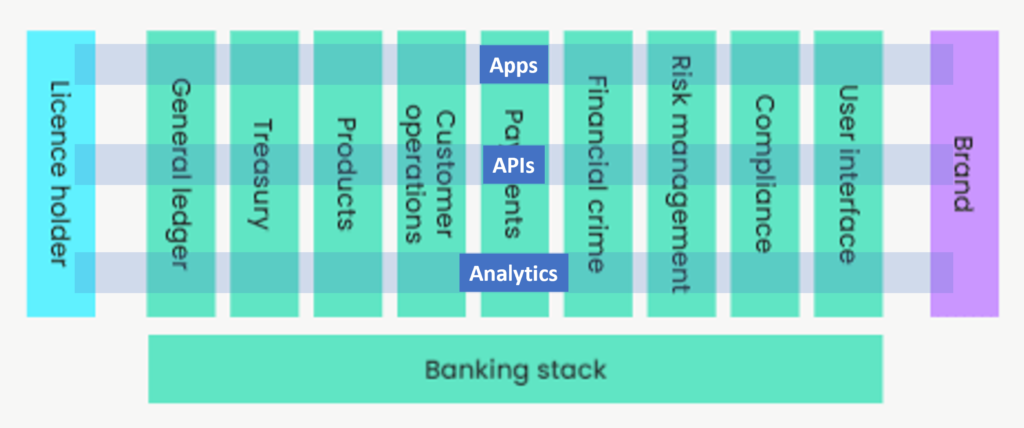

I quite like it but, as Simon himself notes, there’s lots of nuance missing here. So let me add my layer of nuance, and it’s the core of my digital discussions. The new world of banking and finance has a digital front, middle and back office. The digital office replaces the physical office, and it’s based upon front office apps that connect devices and the internet of things; the middle office provides an open banking ecosystem of APIs that connect the front and back office; and the back office is all about the data or, more importantly, the data analytics. You cannot be artificially intelligent if your data is dumb (I've been writing about this for years).

So, my overlay on Simon’s stack is the apps, APIs and analytics of the newly digital front, middle and back office:

A key caveat here is that the only company that can provide banking here is a bank, as in the bank licence holder. Everyone else in the stack is providing a piece of banking functionality and processing as part of the BaaS structure curated most likely by a bank, as they’re the only company that can do banking here (as I've also blogged regularly). By that, I mean that they’re the only company that can hold deposits and provide the guarantee that they will never be lost, within the limits of that country’s financial compensation schemes.

It also means a much higher level of capital and governance than the light-touch regulations that most FinTechs deal with.

However, as you look at the chart with this overlay, you can see why there is so much FinTech innovation in banking. First, most banks have never decoupled these layers – they are still tightly rather than loosely coupled; second, banks do not understand these layers – they believe they must do all of it, and missed opportunities to create specialist pieces; and third, they don’t know how to code these layers in the same way as millennial and GenZ visionaries.

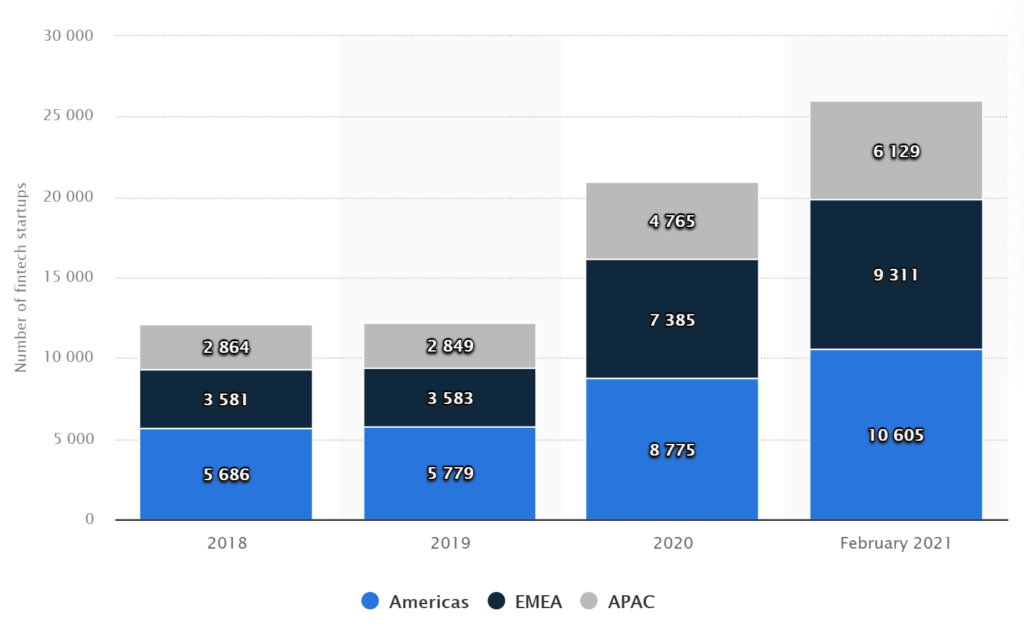

It's the reason why there are more than 25,000 FinTech start-ups around the world.

Source: Statista

In fact, when you think that 25,000 specialists can code one piece of the stack – the app, the API, or the analytics – you get a sense of the scale of change we are going through. Equally, when you think that some of those specialists are worth more than banks, you get another sense.

- This week, the market capitalization of FinTech payments firm Square exceeded that of Goldman Sachs, the 151-year-old investment bank, for the first time.

- Almost exactly two months earlier, PayPal surpassed Bank of America, the second biggest bank in the U.S., in market cap. That move made the online payments pioneer worth more than every American bank except for JPMorgan Chase.

As of September 8, 2021, PayPal is worth $345 billion, slightly less than Bank of America ($347bn); Square is worth $122 billion, also less than Goldman Sachs ($138bn). Markets move. Nevertheless, Stripe’s last valuation was $95 billion; Klarna $46 billion; and Ant Group … well, that all depends on President Xi ... but it did reach over $300 billion before the IPO was shut down.

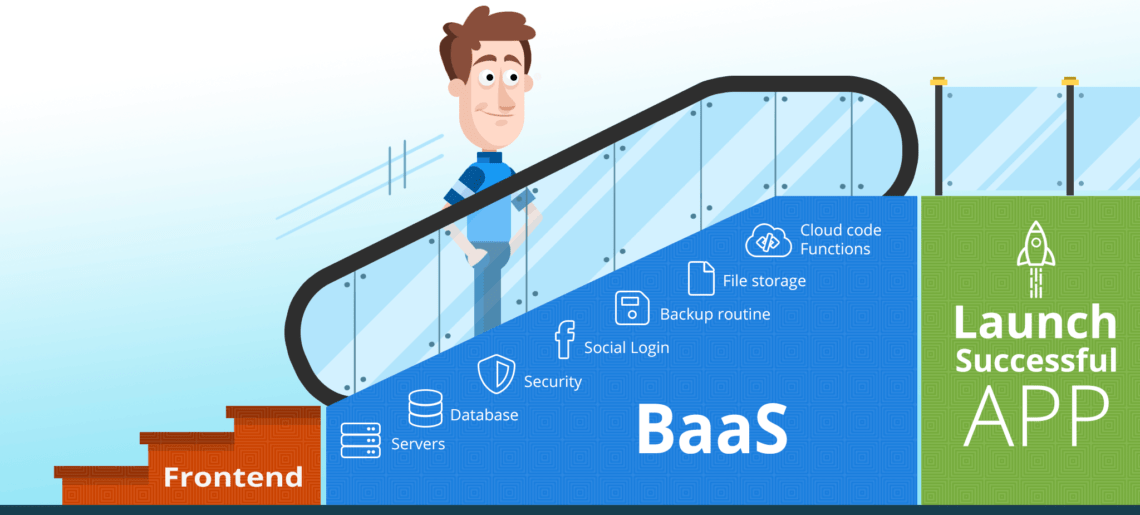

What’s happening here is that FinTech companies are building the new BaaS stack based upon coding the new apps, APIs and analytics required to run a digital front, middle and back office. What do banks need to do? Well, as the licence holders, they need to curate the partnerships with the specialists to run the new digital front, middle and back office. I’ve said this for so long now, I’m kind of getting boring, but banks need to conduct the digital orchestra (June 2017).

Thing is, when I say banks that does not mean good old banks. It could just as easily be a neobank or challenger bank, and that’s the thing that should concern the good old banks. There are plenty of challenger and neobanks rising who really understand curation of the ecosystem and orchestration of the BaaS stack.

Watch out good old banks. Life is not as comfortable as it was.

BaaS: Banking as a Service (February 2009)

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...