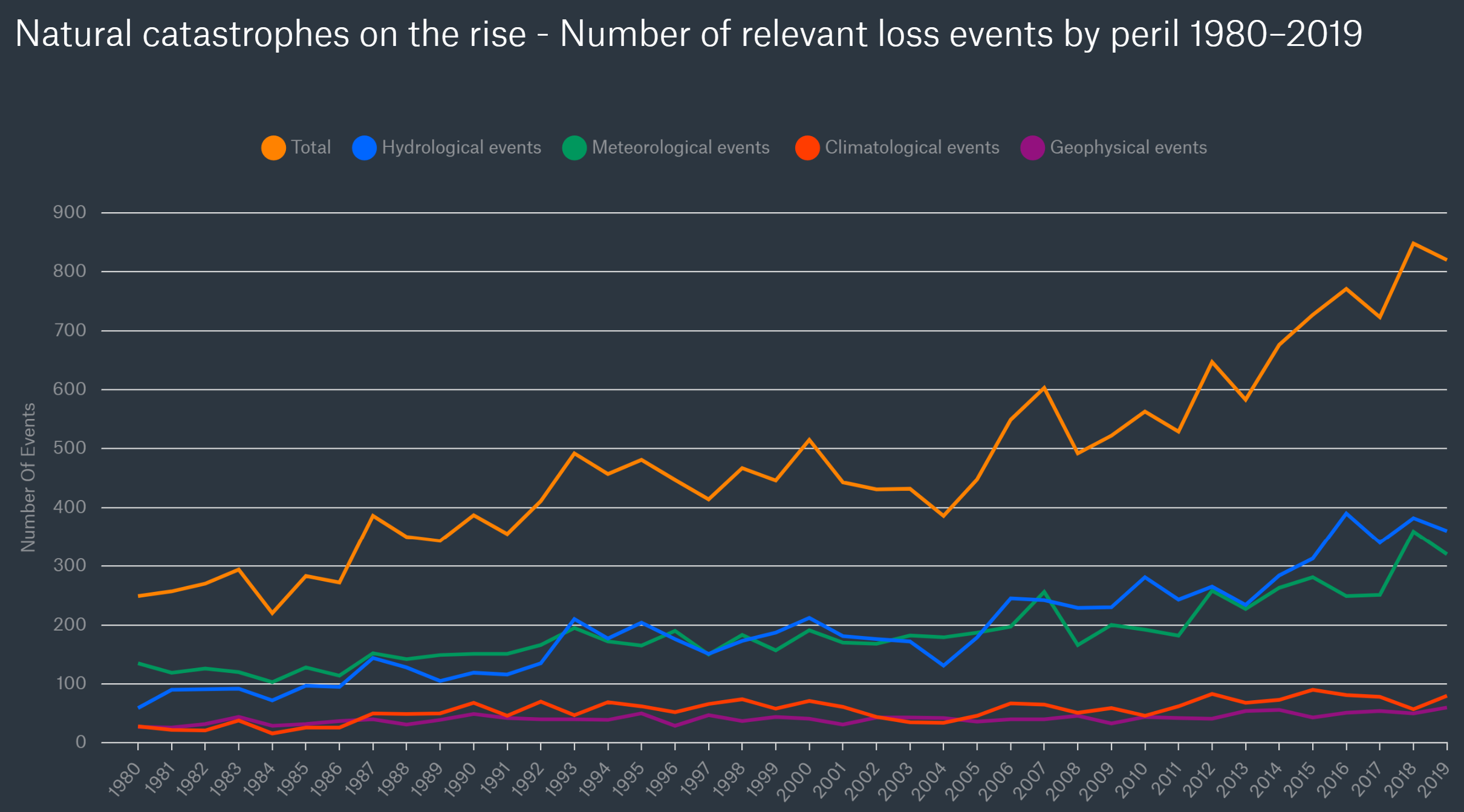

I heard a statistic on the BBC that natural disasters due to weather are costing the insurance industry seven times more today than in the 1970s. Is that because people insure against such issues more today? Partly, but it’s also because there are more natural weather disasters happening. For example, take this chart from Statista:

Source: Statista

The chart tracks the insurance losses of natural disasters between 1970 and 2017. Surprisingly, or maybe not, 16 of the 20 biggest insurance losses due to weather damage in the past half century happened between since 2000, and almost half in just the last seven years of that timeframe.

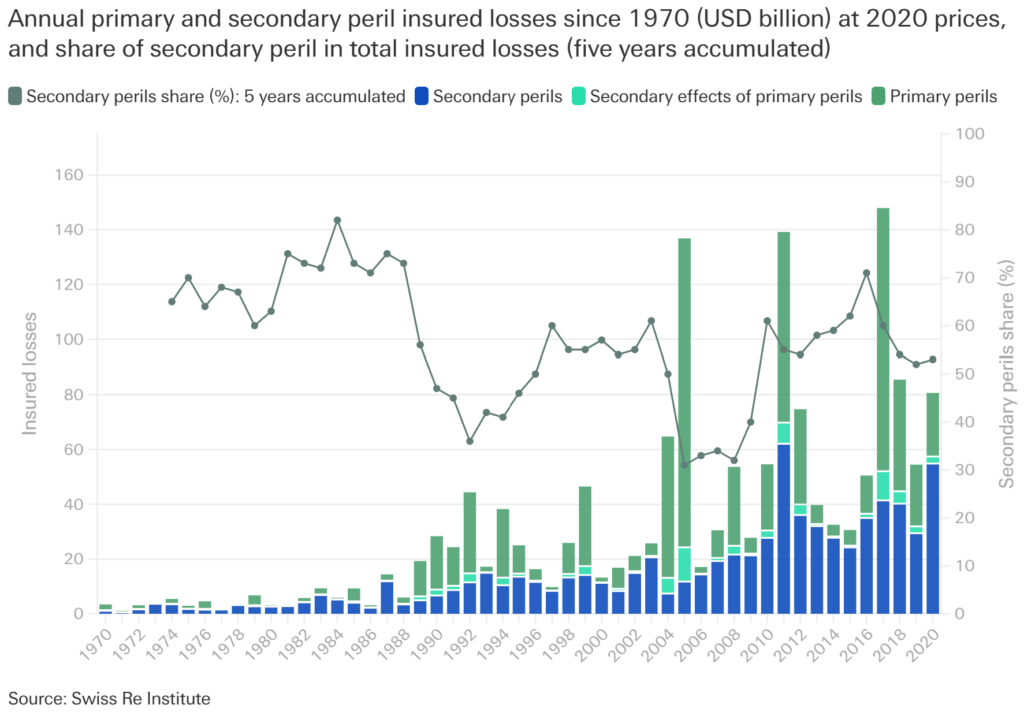

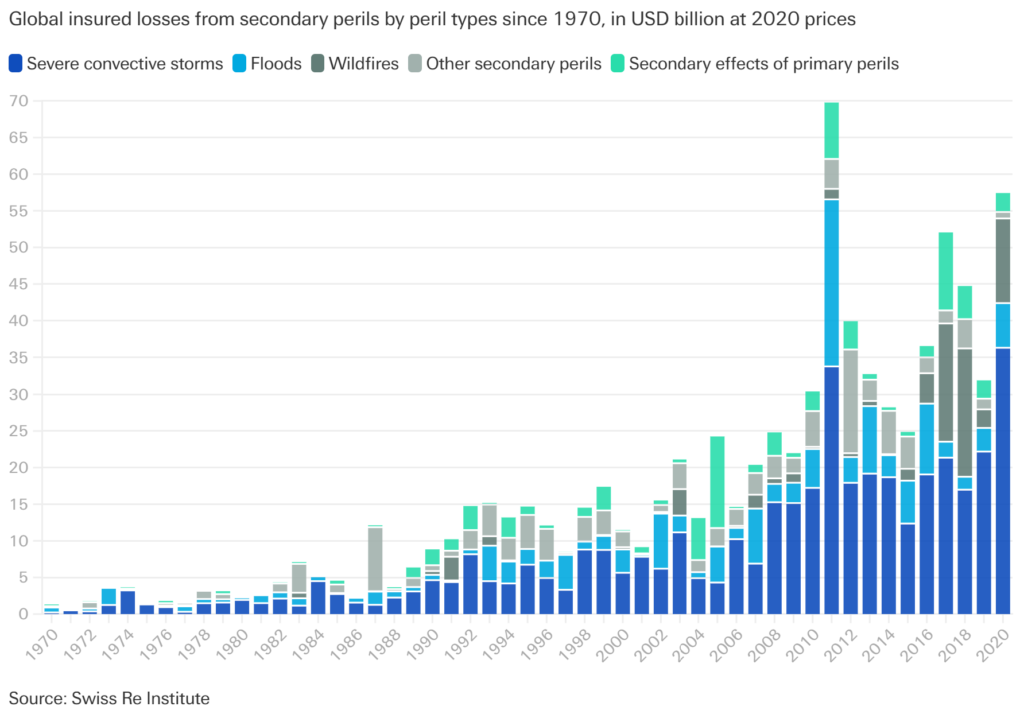

Swiss Re separate such issues into primary perils and secondary perils. Primary perils refers to large-scale catastrophes, typically tropical cyclones, earthquakes, and European winter storms. While those events tend to be less frequent, the losses they cause can be extreme. Meantime, secondary perils are high-frequency, low-to-medium-severity events such as thunderstorms, hail, wildfires, drought, flash floods and landslides. Insurnace losses tend to be split 30% to primary perils and 70% to secondary.

These three charts made me sit up:

Losses from weather-related secondary perils are on the rise. Climate change is a factor

Of all secondary perils, thunderstorms are responsible for most insurance losses

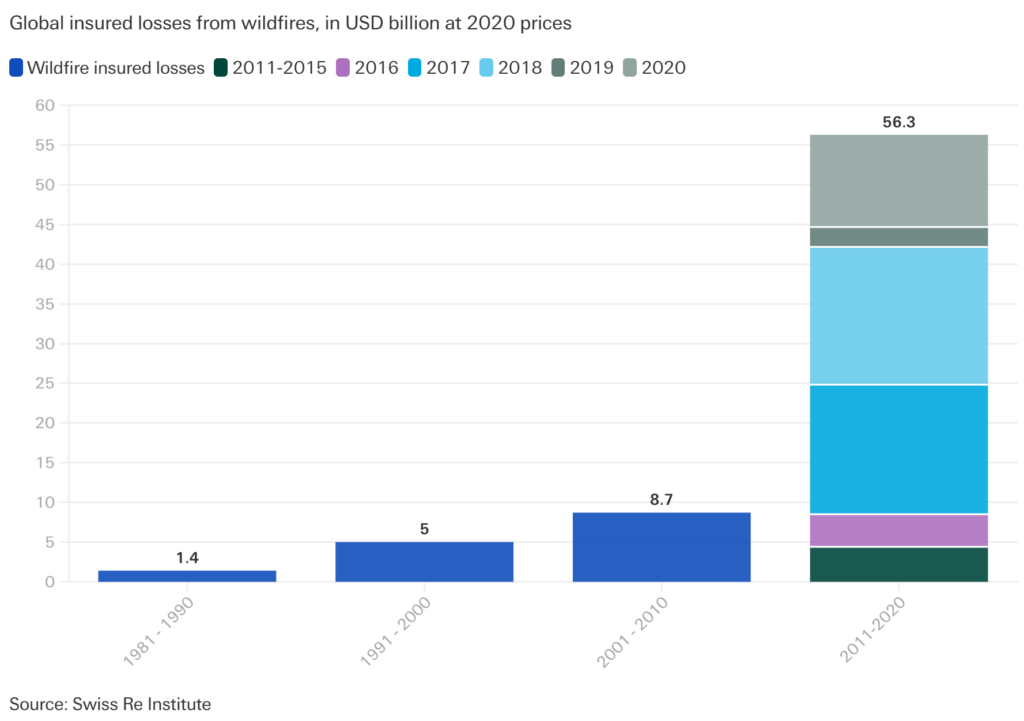

Damage from wildfires is rising faster than from any other secondary peril – a sign of hotter, drier weather in a changing climate

Equally interesting are these facts from Munich Re:

“Causing overall losses of US$ 210bn, the costliest natural disaster of all time is the Tohoku earthquake, which occurred in Japan on 11 March 2011. In terms of insured losses, the costliest natural disaster to date is Hurricane Katrina, which hit New Orleans in August 2005 and cost insurers a total of US$ 60.5bn (original values).”

Nevertheless, Munich Re note that most natural disasters are not insured. In the 1970s, only a quarter of such incidents were covered. Even now, over half of these disastrous events are uninsured. So yes, we have been insuring more against climate damage, which needs to be taken into account when looking at these figures. Even so, there is a trend where there are more serious and greater impacts on cities and populations due to natural disasters than ever before. This struck me as the New York subways were flooding whilst one of my favourite places, Lake Tahoe, was burning down.

Sometimes it literally does feel like the world is coming to an end.

But it’s not. To put things in perspective, insurance losses are massive but it’s because people can insure against natural disasters when, historically, they could not. In fact, a specific get-out clause in general insurance is that there’s no payment for losses due to an act of God. Today, you can insure against an act of God, but only if you take out a specific insurance against a specific act, for example, flooding. Equally, the number of people who die from these disasters is trending downwards.

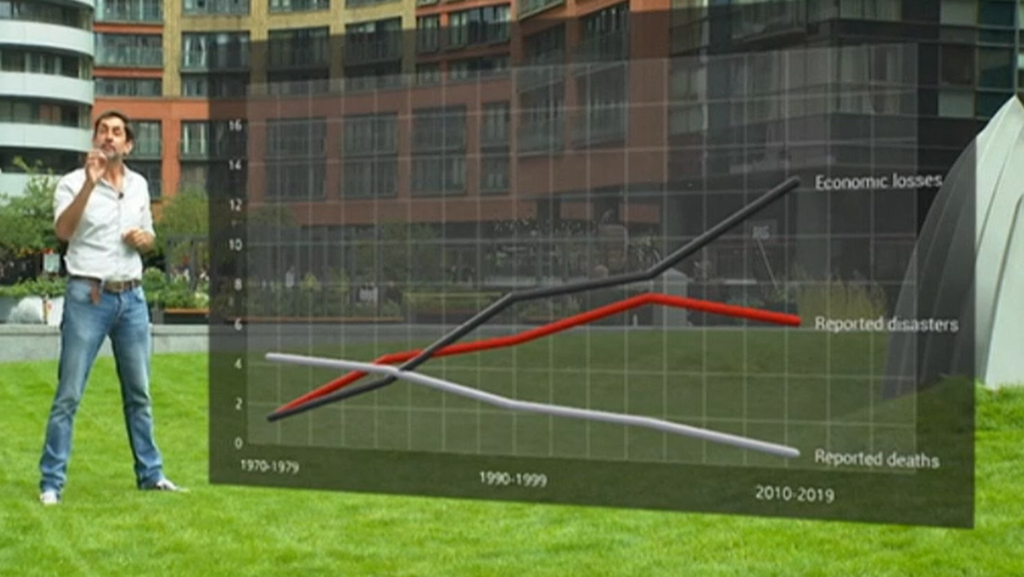

Source: BBC

According to the World Meteorological Organization, the number of weather-related disasters to hit the world has increased five-fold over the past 50 years but the number of deaths has fallen sharply. Scientists say that climate change, more extreme weather and better reporting are behind the rise in these extreme events, but improvements to warning systems have helped limit the number of deaths. So there you go. At least there's some good news ...

Chris M Skinner

Chris Skinner is best known as an independent commentator on the financial markets through his blog, TheFinanser.com, as author of the bestselling book Digital Bank, and Chair of the European networking forum the Financial Services Club. He has been voted one of the most influential people in banking by The Financial Brand (as well as one of the best blogs), a FinTech Titan (Next Bank), one of the Fintech Leaders you need to follow (City AM, Deluxe and Jax Finance), as well as one of the Top 40 most influential people in financial technology by the Wall Street Journal's Financial News. To learn more click here...